For years, Google Finance was one of the best portfolio trackers available.

You could put in a list of stocks, including transaction information, and it would give you a snapshot in moments. It even kept a cash balance so that transactions could reflect an actual portfolio. It was one of the go-to platforms for investment information and tracking stocks.

That all changed in 2017 when they completely revamped the platform. They made it much simpler and got rid of a lot of the core reporting that users look for in a service like that. People were not happy and they started to look for alternatives. Sure they didn’t shut down their services, but it opened the door to be replaced by users.

Fortunately, there are plenty of options in this space that will give investors a much deeper look into their portfolios. I’ve identified at least six free Google Finance replacements (they have premium versions) and each is worth investigating.

Table of Contents

- Google Finance

- Morningstar Portfolio Manager: For The Committed Investor

- Personal Capital: For the Personal Financer

- Kubera: For All-In-One Net Worth Tracking

- Yahoo Finance: For Those Who Want a Little More

- SigFig: For the Investing Junkie

- MSN Money: For Those on a Budget

- Investing.com: For Those Seeking More Detailed Analysis

- Finviz: For the Financial Whiz

- Final Thoughts

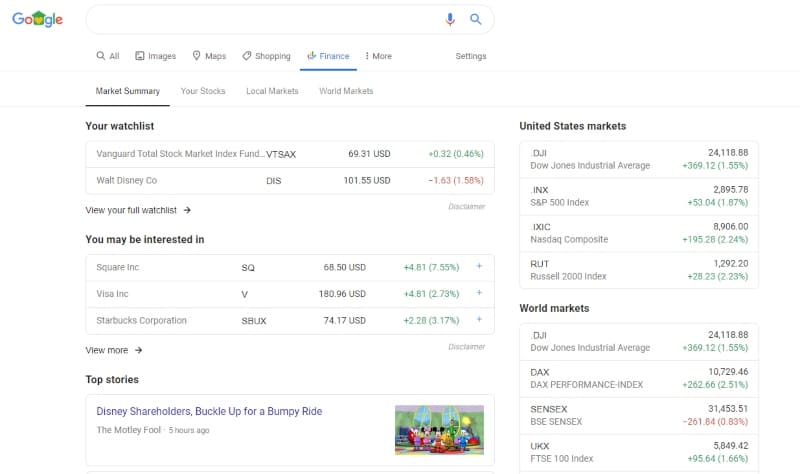

Google Finance

First, let’s take a quick look at Google Finance. Launched in 2006, Google Finance became a primary platform for investors to monitor the markets and their own portfolios. It provided real-time stock charts, as well as news about individual companies. But in 2018 it underwent some significant changes that reduced the amount of information provided. One big change was reducing the number of publicly traded companies it tracked on a regular basis.

It still provided company information, like stock charts, but today it contains far less information than it once did. It is now best suited for new and casual investors.

Today, you can create a “watch list” under the “your stocks” tab where you can have quick access to information on the companies or mutual funds you are most interested in. You can see the historical price over 1 day, 5 days, 1 month, 6 months, year to date, 1 year, 5 years, and max.

You will also see the previous day’s close price and today’s open price as well as it’s high and low for the day and the 52-week high and low. It gives you the dividend yield, market cap, and P/E ratio all at a glance.

Then Google does what it does best and pulls in articles from the web about current news for both the company and the industry as a whole. But as far as investment tools go, this is fairly limited information. It gives no analysis or screening, it’s a news site with some stock information attached.

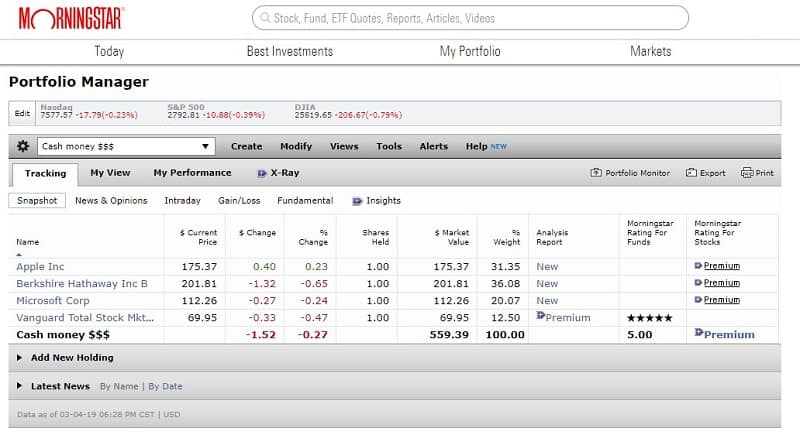

Morningstar Portfolio Manager: For The Committed Investor

How it works. Morningstar is one of the most respected names in the investment industry and commonly used as a source of information by other services. The company is perhaps best known for providing investment research and management services. As a management firm, it has $295 billion in assets under management as of 2023.

The company also offers a variety of premium services, including StockInvestor, DividendInvestor, FundInvestor, and ETFInvestor, for investors looking for more specific information and guidance.

The homepage has a simpler format than other platforms, which is interesting considering the diversity of services the company provides. Basic market information is at the top of the page, then followed by a limited amount of commentary. The basic market information seems to be more limited than other sites — however, you do have the capability to drill down into specific investments and tools within the site.

Unfortunately, the more valuable content of the platform is for paid members only, under the Morningstar Investor plan.

Strengths:

- Morningstar is one of THE sources of investment information and ratings for other platforms and investment services.

- You can access as much or as little investment information and services as you choose.

- The platform has concentrations for specific investments, that are often more extensive than what is available on competing sites.

- The homepage is simple and extremely easy to navigate.

- Ads on the site are very limited, probably because of the premium services Morningstar provides.

Weaknesses:

- Much of the most valuable tools and information require a paid subscription.

- It can be annoying to engage with the platform, only to be stopped by a subscription-required notification.

- The platform seems to be set up to whet your appetite, then draw you into a subscription.

How it compares with Google Finance. Morningstar is a platform for the more committed investor, who is willing to spend some money getting access to the tools and information desired. Google Finance is at the opposite end of the spectrum, in that the information and services, while free to use, are much more limited. Here is a full review of Morningstar Investor.

Morningstar Investor costs $34.95 per month when you pay monthly, or $16.58 per month if you pay upfront for the full year. (And you can get a discount of $50 if you use our link).

Check out Morningstar Portfolio Manager

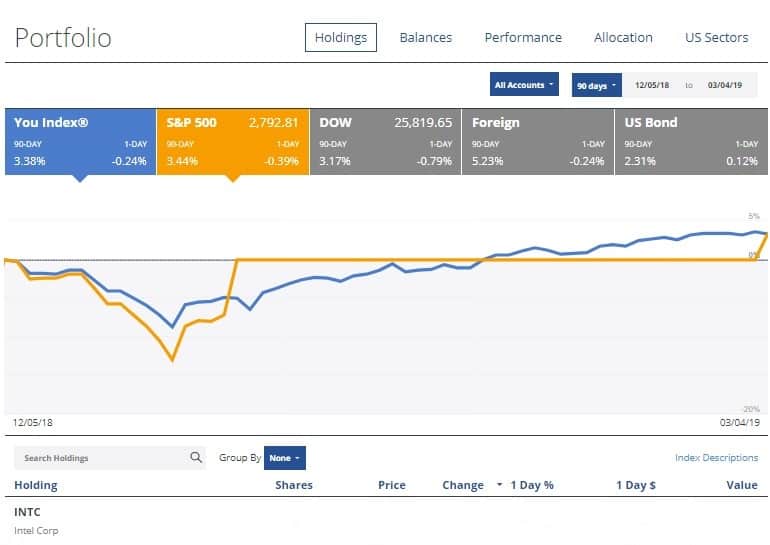

Personal Capital: For the Personal Financer

How it works. Personal Capital is one of the most popular personal finance platforms and it’s different from the other platforms on this list in that it’s a specific application, rather than an information source for the general public.

Personal Capital comes in two versions, its Free Tools and Wealth Management. Free Tools is the one most comparable to the other platforms. It enables you to aggregate your entire financial life on the platform, providing limited budgeting capabilities. But it does provide extensive investment tools, such as the Free Analyzer that exposes hidden fees in mutual funds, and the Retirement Planner that helps you prepare for retirement. It also does a great job of portfolio analysis too.

It offers a dashboard where you can sync all your financial accounts, including bank accounts, investments, and loans. It can even provide recommended portfolio allocations, though it doesn’t manage them.

If you do want direct investment management, Personal Capital provides that through its Wealth Management service. Not to be confused with a robo-advisor, this is more of a technology-assisted investment management service, but at a much lower fee than traditional investment advisors. (here’s how to find a fee only financial advisor)

Strengths:

- It’s a financial aggregator where you sync your accounts and it loads your portfolio holdings automatically.

- The free version can be used to stay on top of your entire financial situation, including your investments.

- The free version also offers valuable tools, that can provide portfolio allocation recommendations, analysis of mutual fund fees, and retirement planning tools.

- Unlike the competition, the Personal Capital platform isn’t crowded with third-party ads.

- Personal Capital is purely financial and investment management platform, that avoids the news and commentary typical of other platforms.

- You have the option to go with a professionally managed investment service (if that’s what you choose to do).

- The Wealth Management service will even make recommendations for the management of your employer-sponsored retirement plan, though it won’t manage it directly.

Weaknesses:

- Personal Capital is radically different from other platforms on this list. If you’re looking for the typical news and commentary format, it isn’t here.

- Though the free version offers substantial investment management tools, the best service level is provided by the premium Wealth Management version.

How it compares with Google Finance. It doesn’t. While Google Finance is a general application platform, Personal Capital is tailored to the individual’s complete financial situation, which includes investing.

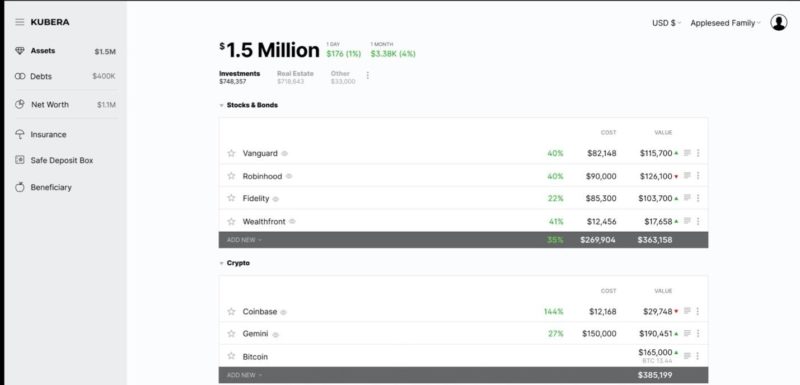

Kubera: For All-In-One Net Worth Tracking

How it works. Kubera is a relative newcomer to the portfolio tracking party and as a result, they bring a few new tools to the table that the incumbents haven’t picked up on. Kubera’s main goal is to be an all-in-one net worth tracker and a document store that includes your assets and liabilities.

One of the big differentiators is that you can track your cryptocurrencies as well. Do you own art? Yep, you can include that. Do you own [insert anything you want]? Yep, you can track it. It won’t update automatically since there isn’t market data (for others it uses Yodlee or Plaid) but it’s still in there.

With cryptos, it connects to your crypto exchange so you get live data.

As a document store, you can include account-specific documents and add your notes. This includes contracts, titles, tax receipts, etc.

After a 14-day trial, it’s $15 a month or $150 for a full year if you pay annually. Our Kubera review goes into greater detail about the service.

Strengths:

- Robust net worth tracker that can capture all of your assets, including cryptocurrencies

- For assets with a market price (stocks, cryptos, funds, ETFs, forex), it is updated automatically

- Document storage for important documents if you wish to use it

Weaknesses:

- It is a net worth tracker and does not have other features like wealth management (which can be a strength, depending on what you want!) or portfolio analysis

- It is not free, though as a result it does not have ads, but $150 a year may be a lot

- No mobile app

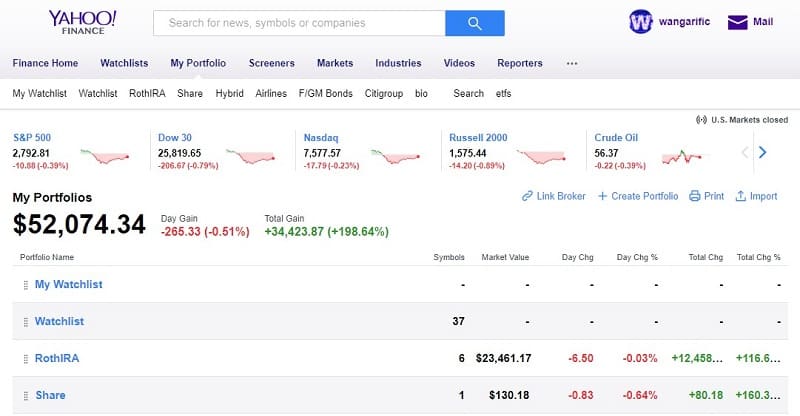

Yahoo Finance: For Those Who Want a Little More

How it works. Yahoo! Finance is a much more mature platform than Google Finance, having been launched all way back in 1994. It’s available for mobile devices and tablets, as well as the web version. The homepage might be the best organized in the space. Major market indices are across the top of the page, followed by breaking news stories. The remaining content appears in a neat column below, allowing you to scroll down.

From an investment standpoint, the primary information is in the right-hand column. That’s where they list the most active and biggest performing stocks, as well as mutual funds, ETFs, currencies, commodities, and even options.

From the drop-down menu, you can take advantage of My Portfolio to zero in on your investments. There are also screening tools for stocks, mutual funds, ETFs, futures, and even indexes. Meanwhile, you can easily drill down on industry sectors.

Strengths:

- The homepage is very well organized, making it easy to go exactly where you want.

- There are fewer drop-down tabs at the top of the page, making it less confusing, and easier to get to where you want to go.

- The site has extensive financial news and personal investing tools.

- The simplicity of the site makes it perfect for new and inexperienced investors, and anyone who prefers less complication with their investment tracking.

Weaknesses:

- Much of the editorial content is made up of sponsored posts. It can be hard to determine the difference between legitimate content and ad posts.

- Much of the sponsored content has a definite “clickbait” orientation.

- The site is heavy on ads, including pop-ups, which can be more than a little bit distracting.

- Limited stock charting capabilities.

How it compares with Google Finance. Like most of the other personal finance websites on this list, Yahoo! Finance has substantially more content and tools than Google Finance. It also has a more comprehensive feel to it. Where it underperforms Google Finance is in stock charting capabilities. The differences aren’t dramatic, but it’s there.

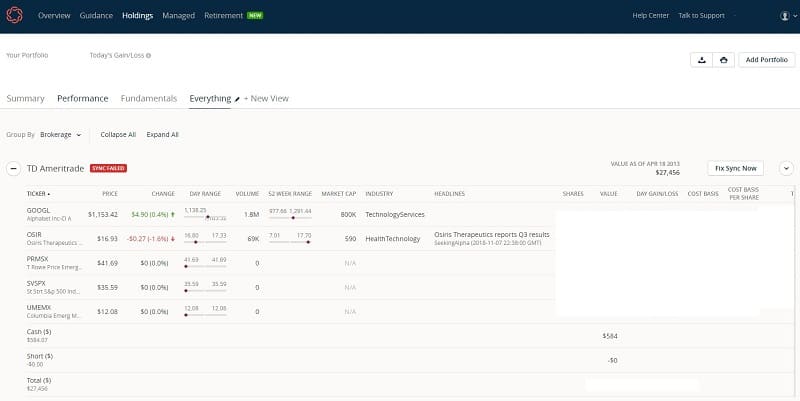

SigFig: For the Investing Junkie

How it works. Much like Personal Capital, SigFig has little in common with the other platforms on this list, especially Google Finance. It’s actually an online portfolio manager, or put another way, a robo-advisor. It works specifically with accounts held at either Fidelity or Charles Schwab. It analyzes and manages your portfolio, providing balanced asset allocations, and minimizing fees.

The platform requires a minimum initial investment of $2,000 and charges a fee of 0.25% per year. However, the first $10,000 is managed free. It can accommodate both taxable investment accounts as well as retirement accounts. In addition to the web version, it’s also available for iOS and Android mobile devices.

Strengths:

- Like Personal Capital, you sync your accounts and it loads up your portfolios automatically.

- The first $10,000 is managed free, which means virtually anyone can get the benefit of direct investment management cost-free.

- You’ll have unlimited access to SigFig investment advisors.

- Since it’s not an information source, the platform has no ads.

- Manages both taxable investment accounts and retirement accounts.

- SigFig is an inexpensive way to manage your investments. A $100,000 portfolio can be professionally managed for just $225.

Weaknesses:

- If you’re looking for free news and information, you won’t find it on this platform.

- Unlike the other platforms on this list, there are no free tools to help you with self-directed investing.

How it compares with Google Finance. Like Personal Capital, SigFig has nothing in common with Google Finance. It’s an investment management platform, rather than a general news source, with tools for self-directed investing.

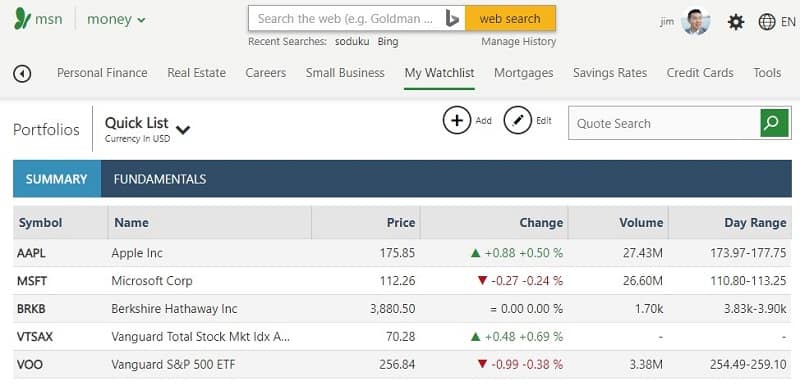

MSN Money: For Those on a Budget

How it works. MSN Money has rapidly developed into one of the most popular investment tracking platforms. It can be used to set up watchlists of companies to follow while providing stock updates, real-time trading figures, and the latest financial headlines. You can also track personal finances, and get information on investments other than stocks, including bonds, currencies, and commodities.

It provides extensive news from around the financial world, as well as investment tools and calculators.

Like most of the other platforms on this list, MSN Money is free to use. It’s available on the web, as well as on iOS and Android mobile devices.

Strengths:

- Investing tab provides general market news, as well as news on specific companies, and especially on the top stocks.

- Real-time tracking of markets and stocks.

- Provides content on related topics, like real estate, careers, and small business.

- The main pages of the platform are relatively ad-free, especially when it comes to those annoying pop-up ads.

- Valuable tools, like a mortgage calculator, retirement planner, and savings calculator.

- Excellent analysis of market sectors, such as high dividend yields, price-earnings ratios, and market capitalization.

Weaknesses:

- Many of the drop-down menus offer duplicate content, mainly articles, and commentary.

- Personal Finance content is aggregated from around the web, including blocks. There’s little in the way of original content.

How it compares with Google Finance. MSN Money Outshines it on the sheer volume of information and tools it provides. This is particularly true of the ability to track individual stocks, as well as to get news and comprehensive information.

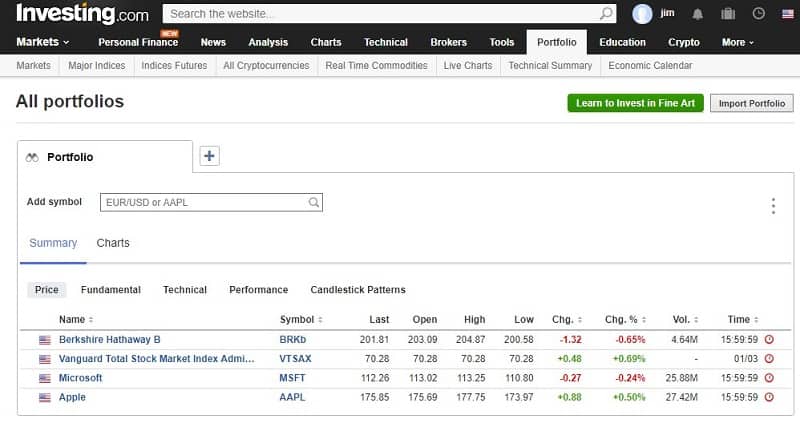

Investing.com: For Those Seeking More Detailed Analysis

How it works. Investing.com is internationally based, with locations in Spain, Cyprus, and Israel. It was launched in 2007, just one year behind Google Finance. It’s available for Android and iOS mobile devices, as well as the web version. It was originally designed to be a FOREX platform, but later expanded into other investment categories, including stocks, bonds, futures, options, currencies, cryptocurrencies and commodities.

The platform provides streaming quotes, technical data, extensive chart capabilities, and financial news and analysis. It differs from other investment platforms on this list in that the homepage is dedicated primarily to market results and financial data. To get financial news, you need to access the News drop-down tab. You can set personal portfolio preferences on the Portfolio tab.

Strengths:

- The homepage gets directly to the point, with the important financial information. There’s little guesswork with this platform.

- Investing.com departs from the typical investing website format of centering around news stories, which may be of little interest to individual investors.

- The level of detail in both information and tools is impressive compared to other platforms.

- Ads on the website are relatively limited, compared to the competition.

Weaknesses:

- Like Yahoo! Finance, the platform contains a significant amount of sponsored content on the homepage.

- The site, when we accessed it, seemed a little sluggish.

How it compares with Google Finance. Where Google Finance has become a limited platform, Investing.com is at the opposite end of the spectrum. The platform offers considerable detail, including information and tools. It’s an excellent website for more advanced investors.

Finviz: For the Financial Whiz

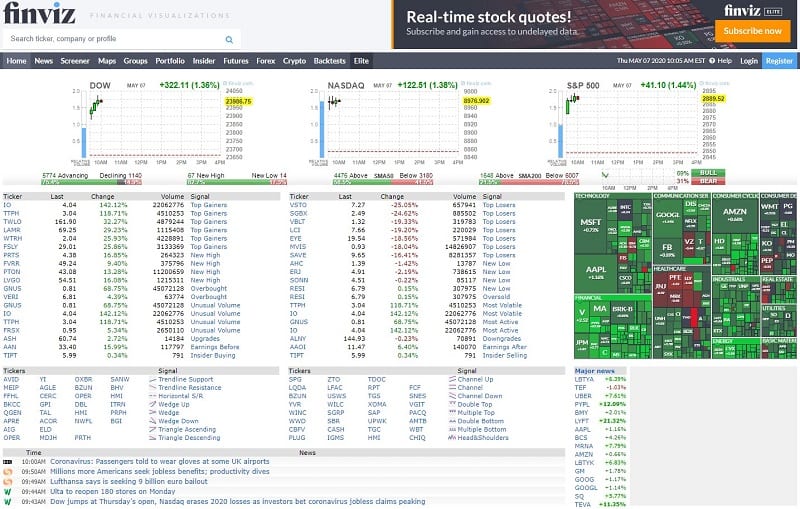

If you want something super hardcore, Finviz offers up some portfolio management tools that are going to be a lot more technical and detailed than you are probably ready for – especially if you’re just scratching the service of portfolio management with Google Finance’s previously available portfolio tools. I haven’t used it myself, and the homepage is already quite intimidating, but I wanted to offer this because I’ve seen this mentioned a few times on Q&A sites like Quora.

The strength of Finviz isn’t in the portfolio tool but its filters and stock screeners. It has a portfolio but what it’s good at the research and analysis. They have a free tier as well as a paid service, though I haven’t tried either. You can play around with some of the tools without registering (but you can’t set up a portfolio, obviously).

If you want to learn more, our review of Finviz has more.

Final Thoughts

In today’s technology-driven investment world, there are all kinds of personal finance platforms available.

There are free sites with news, information, and tools, primarily for self-directed investors. This is the niche that Google Finance once filled to a greater degree than it does now. But it’s been eclipsed by the competition.

And there are now services, like Personal Capital and SigFig, that go beyond providing information and tools. They offer direct investment management as a premium service. Also, if you’re looking for stock screeners, here’s a list of the top ones.

It’s always good to have options, especially when it comes to investing.

charles simkins says

The problem I have with Yahoo Finance, which I have been using for many years, is that there is no support . I have tried in vain to delete a portfolio I no longer use. And tried to revise one that needed significant revisions, and created a new version by downloading to a CVS file and then imported that and now have two copies of exactly the same information. Yes, I can just delete all the stocks and have empty portfolios. But these are simple things that a good software designer would catch early on, and while the UI is not bad, a bit awkward to remember when adding to existing stocks, this lack of support is disturbing. As I have searched online and found others with the same issue, I would recommend adding the warning that Yahoo Finance has no support available. I hate to redo my portfolios in Yahoo Finance, over 40 stocks, but may need to do so.

That would be a pain in the butt but given that it’s a free service, I’m not surprised it’s not supported as well as a paid service would be. Sadly, not much we can do about it.

Blake says

Bro, it’s YAHOO not TD Ameritrade. When a website is completely free, like Yahoo is, it means YOU are the product (they sell ads to make money, and the more of you there are – people spending time on the Yahoo portal – the more they make from selling ads). OF COURSE there is no support…ITS FREE! You think they’re going to hire a large staff and pay all the related expenses that comes with that in order to provide support for a simple free investment tool that they are not making any money off of directly? They would be in even worse shape as a business than they already are if they were doing something like that.

Nobody offers free tools for the public that is used by millions of people and provides free comprehensive support. Yahoo essentially only has free tools like the portfolio tracker at all because it’s a way to entice people to use their site more often and to spend more time on it, which, again, means they are then able to make more money from selling ads. It’s just something to get people onto the Yahoo platform – It provides basic stock tracking, charting, and market information / news and that is acceptable for 99% of the people who use it, which is all Yahoo needs for it to do to keep a large number of people repeatedly coming onto Yahoo so they can sell more ads.

Go look at the other option that were listed on here to find something better…Finviz is the most informative, detailed, professional tool on this list and it does have some services / products you can pay a monthly fee to use. Their free tools are still very useful as well. It looks like the MSN Finance site had a good and free portfolio tracking tool as well.

***LASTLY AND PROBABLY YOUR BEST OPTION*** – Go here: https://www.tdameritrade.com/tools-and-platforms/thinkorswim/desktop.page and download this trading platform from TD Ameritrade called ‘Think or Swim’. It’s totally free and they will even give you live data if you just message customer service through the platform and ask nicely instead of the delayed data feed that comes with the platform – just create a free account with TD Ameritrade, which doesn’t require any deposit or anything else – and you can trade with their fake money account and you can recreate your whole portfolio there as well as have access to full advanced charting, market info, news, trading education, etc. as well.

Petr says

Unfortunately Personal Capital looks like it cannot be used by non-US customers. On the landing page where it asks for a registration it requires “valid US phone number”. Bummer 🙁

Maxwell says

Finwiz does not offer Canadian stocks, and is not real time.

schultzter says

Thanks for the round-up. Is there a Portfolio tracker that supports Canadian stocks and mutual funds AND will allow me to track income (dividends, interest, etc)? Most trackers seem to concentrate on day-to-day gains/losses in price. If you switch GFinance to portfolio mode you can see your gains/losses over a longer time, but you still don’t get any idea how much income you are getting from the stock.