This post will cover the best 5-year CD rates that we know about but I want to add a caveat – I don’t think a 5 year CD at these rates makes a whole lot of sense.

We are currently in a (slightly) rising interest rate environment.

The Federal Reserve increased rates a few times last year and, as of this writing, are still expected to increase rates a couple times in 2025. This means you will be locking in a 60-month CD at a time when rates are going up – which is generally not a great idea.

But sometimes we want certainty and to maximize rates. And locking in a rate today that you know will last for five years might make sense in your financial situation.

So, if that’s you – we hope this will help solve that problem for you.

Table of Contents

💡 If you’re looking for the highest absolute yield, current 5-year CDs yields are attractive but not as high as some shorter terms. With interest rates rising, but market sentiment is that they won’t be rising for long, banks are not eager to lock in high rates for five years. The best rates are in the 12-month to 24-month range or with a no-penalty CD as many banks are using that as a differentiator.

BMO – 3.90% APY

BMO has a 60-Month CD with a strong interest rate of 3.90% APY. There is a $1,000 minimum deposit required for this and that rate is effective as of .

They have a lot of special weird CD terms – 13 months, 25 months, 35 months, 45 months, and 59 months – in addition to the standard terms.

- Interest compounds daily

- No monthly fees

- $1,000 minimum balance

BMO also has a great new account promotion where you can get a $350 bonus when you open a BMO Smart Advantage Checking or BMO Smart Money Checking account.

So you can open a new account, get the bonus, and then take advantage of the high interest of the 60-Month CD.

Barclays – 3.25% APY

Barclays is one of the oldest banks in the world, having been founded over three centuries ago, and they offer a 60-month CD that offers a yield of 3.25% APY. They have a pretty common variety of term lengths on their CDs, from 12-months up to five years (60-months).

- Interest compounds daily

- No monthly fees

- No minimum balance

What’s really nice about Barclays is that they are like a brick and mortar bank in their age and size but they offer all the trappings of an online bank, including a savings account that yields up to 4.50% APY with minimum balance requirements.

Quontic Bank – 3.00% APY

Quontic Bank is a relatively new online bank that has collected a series of awards and high ratings from experts because of their approach to banking. They are a digital bank and a CDFI (Community Development Financial Institution, a US Department of Treasury certification), which means they look to use private and public funds to help economically disadvantaged communities.

They offer a 60-month CD with a 3.00% APY, which is a great rate especially when you couple it with their savings account that offers 3.85% APY.

- Interest compounds daily

- No monthly fees

- $500 minimum balance

Here’s our full Quontic Bank review for more information.

Ally Bank – 3.40% APY

Ally Bank is my main bank and they offer a variety of certificates of deposit including a 60-month CD currently yielding 3.40% APY. What’s nice about Ally is that they have high interest rates across many of their deposit products and includes ATM reimbursement of up to $10 each statement cycle.

- Interest compounds daily

- No monthly fees

- No minimum balance

- Low than average early withdrawal penalty

Ally bank also offers no penalty CDs – their current offer is a 11-Month CD that yields 4.00% APY. It’s not the best one out there right now but a nice little benefit if you open an account there.

Discover Bank – 3.50% APY

Discover® Bank has some very attractive CD rates right now, especially as you look towards the shorter terms, but their 60-month CD is offering a yield of 3.50% APY. They have a lot of CD terms so you can find one that fits your finances.

- Interest compounds daily

- No monthly fees

- No minimum balance

Discover Bank sometimes runs promotions on their online savings account so you’ll want to check those out too.

Member FDIC.

👉 Learn about Discover Bank CDs

What To Consider with 5-Year CDs

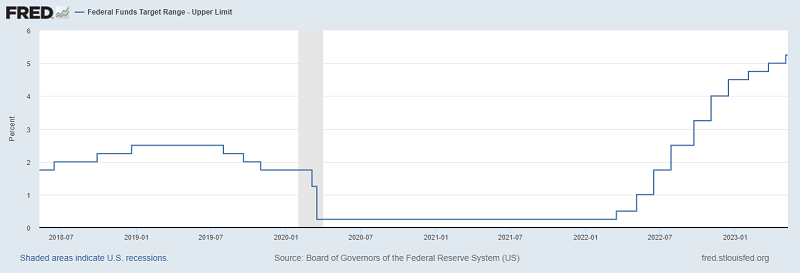

Five years is a very long time. Five years ago, the Federal Reserve had target interest rates at around 2%. Then, in late 2019 they started lowering rates until they reached 0.00%-0.25% in early 2020 for over two years. It wasn’t until 2022 that they starting increasing them again to combat inflation.

Check out this graph of the last five years:

The point of this chart is to show you that interest rates change and five years is no time at all.

Early withdrawal penalties are very expensive. On a 5-year CD, the standard early withdrawal penalty is 180-days of interest. That’s six months worth of interest. The easy solution to this is to open up several small CDs rather than one big one. In the event you need that money, you can close a small CD and take the penalty on a smaller balance.

Pay attention to Series I Bond interest rates. Series I bonds are a similar savings vehicle to a 5-year CD because of how it is structured (you can’t withdraw within a year and if you do it before five years, you lose the last 3 months of interest). For about a year, they offered very competitive rates but they’ve since come down. Always peek at those because the interest from Series I Bonds is not taxable at the state or local level (or when used for higher education).

Five year bonds have a place in financial planning, just make sure you’re using it for the right reasons.