When I first started investing, I tried almost every investment portfolio management software out there. I had several brokerage accounts and it was a challenge to see my asset allocation and track my portfolio’s performance in one place.

And back then, the tools were fairly simple.

They used aggregators like Yodlee to scrape your accounts and showed your holdings in a simple dashboard. There was very little analysis of your portfolio because they were really just trying to sell you their wealth management and investment services.

Nowadays, the tools are much better. I don’t analyze my portfolio every day (that’s overkill) but these software packages can give you a quick peek very easily, whenever you want.

You might not be surprised to hear that I get asked all the time – “what is the best investment portfolio management software?”

The answer is the one that meets your needs. We are in set it and forget it mode right now, where I just track our net worth and make regular contributions. I check my investments once a month (or so) when I update our spreadsheet, and then I don’t look at it. I think of our investment money in time capsules so even if something were to happen, I don’t want to be tempted to respond emotionally.

I still read financial news from time to time. I like to be aware of what’s happening so if there is a big change, I’m not surprised. But that’s mostly for psychological reasons. I aim never to touch the investments outside of rebalancing and other basic housekeeping.

What’s the best tool for tracking investments? I’ll tell you what I liked about each of them and you can see which is the best one for you.

Table of Contents

🔃Updated February 2024 – Updated a few of the tools mentioned on this page, including Morningstar’s Portfolio Manager now only available to paid members.

What is a Stock Portfolio Tracker?

What is a stock portfolio tracker? It’s a tool that can collect all of your investments into one dashboard and give you an understanding of how it is performing.

Much like more general personal finance apps, the best portfolio trackers are seamless and give you the ability to quickly analyze your holdings quickly and in a variety of ways.

If you have several brokerage accounts, it can be difficult to get a full picture of your portfolio on one screen. Since you should think of your portfolio as a single asset allocation, regardless of where your investments are being held, then you’ll want one single of them all.

Stock trackers help you accomplish this. The best one integrate with the most brokerages so you can see your allocation and performance on a single screen.

As we list the best options below, we take into account the cost of the subscription (if there is one), as well as the speed and usability of the platform.

1. Empower Personal Dashboard

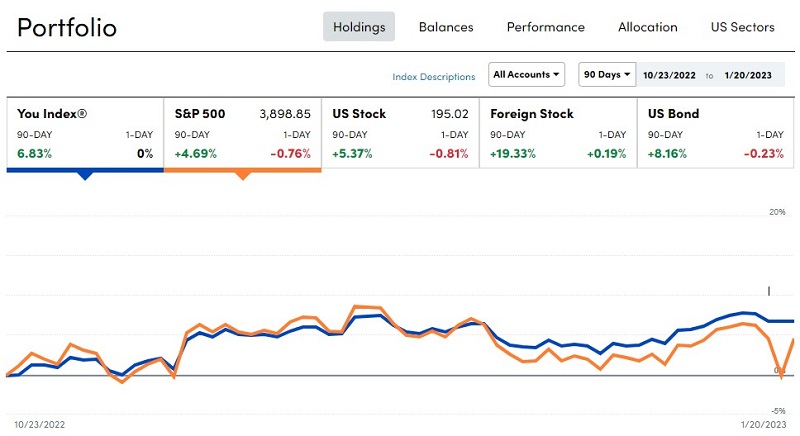

I’ve been using Personal Capital for years and it’s one of my favorite tools – they recently went through a rebranding and are now called Empower Personal Dashboard. Everything about the tool has remained the same, only the name has changed.

If you want a quick snapshot of your overall finances, this tool gives it to you pretty quickly once you connect all of your data sources via Plaid. While I would say you shouldn’t be checking your finances every minute of every day (because it’s a waste of time), Empower just makes it so that the waste of time takes a lot less actual time.

Empower Personal Dashboard is safe, it has an Investment Checkup tool to give you an idea if your investments are on track, and it has a pretty good retirement calculator too based on your data. If you need budgeting, it can track expenses as well but it’s not as good at that as dedicated budgeting tools.

With Empower Personal Dashboard, you get a lot of features for free. They will try to up-sell you on their wealth management services (politely decline and the calls will stop), so if you want to speak with a financial advisor, it’s an option.

Learn more about Empower Personal Dashboard

2. Morningstar Portfolio Manager

I haven’t been using it for a long time but Morningstar Portfolio Manager is a tool that has been around for ages.

It gives you the ability to track all of your investments in one place, monitor price changes, and pull in star ratings and other Morningstar data, while giving you insights and research from Morningstar. The portfolio manager does not link up your accounts so you have to enter your data manually (which may be a plus if you’re concerned about the security risk).

Unfortunately, they recently moved this to paid membership only. If you are a premium Morningstar Investor member, you get access to it and other tools too. I realize that’s all pretty vague but I wanted to include it in the list because they still offer it and there’s something to be said for longevity.

The Morningstar Investor service has a 7-day trial so you can check it out for free for a week to see if it works for you. Also, through our link, you get $50 off the Morningstar Investor subscription price if you decide to subscribe after the trial.

We have a more detailed review of Morningstar Premium here.

Check out Morningstar Portfolio Manager

3. StockRover Portfolio Management

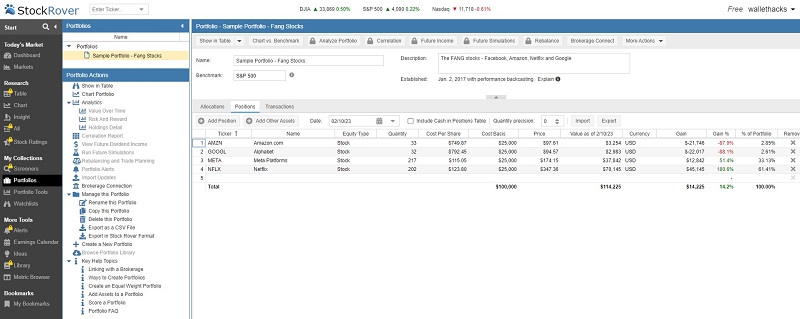

StockRover offers the ability to link up your brokerage account and use its powerful analysis tools using your specific brokerage data. You will be able to analyze your portfolio against benchmarks and make key decisions using data, rather than gut feel or guesstimates. If you don’t want to connect your brokerage, you can enter it manually or use a spreadsheet import too. They support thousands of accounts including Vanguard, Charles Schwab, Fidelity, Wells Fargo, E*Trade, Chase, and more.

Once you’ve set it up, you can get daily, weekly, or monthly reports showing performance as well as analyze it for a variety of metrics such as risk adjusted return, volatility, beta, IRR, Sharpe Ratio and more. It’s comprehensive and far more detailed than many others on this list. It really depends on how in-depth you wish to go.

StockRover has a free tier but you get more when you sign up for the paid services – read our review of Stock Rover for more information.

🗓️ StockRover Presidents Day Sale: 25% Off

StockRover is running a Presidents Day Sale where you can get 25% off all of their premium plans when you sign up for an annual subscription.

This makes it so that the plans are:

- Essentials – $59.99 (down from $79.99)

- Premium – $134.99 (down from $179.99)

- Premium Plus – $209.99 (down from $279.99)

The premium plans all have a 14-day free trial and you don’t have to enter payment information the start the trial.

👉 Try StockRover Premium for free for 14-days

Act fast, this offer expires February 18th!

4. Kubera Portfolio Tracker

Kubera is one of the newer entrants to the list and is a “modern” portfolio tracker in that it integrates well with brokerages as well as global banks, currencies, and crypto. The crypto component is what makes it modern, as compared to alternatives. If you want to keep track of your crypto alongside other familiar assets, Kubera is worth taking a look at.

It integrates with all of the major online brokerage accounts, it syncs with all the major banks, has the capability to track currencies, crypto assets (including DeFi on multiple chains), home value (uses Zillow), cars, metals, domain names, and, of course, your bank accounts.

One nice feature is that it has a “Life Beat Check” that checks for extended periods of inactivity and can send your portfolio to a designated beneficiary. If something happens to you, they will be notified – a nice little perk.

It has a one-dollar 14-day trial but then costs $15 a month or $150 a year.

Want to learn more? Our full review of Kubera goes into greater detail.

5. SigFig

SigFig was the first investment tracker I ever used. I signed up age ago because it was the only one that connected with E*Trade, TradeKing (now Ally Invest), and Vanguard; the three brokers I used at the time. The interface is very simple, connecting accounts is seamless, and they’ve expanded the tools they offer since I first used it.

Until I moved to Personal Capital, I was using SigFig because it had beautiful charts but it appears the charts are now gone.

I stopped using SigFig over ten years ago and since then they’ve added some new features I haven’t explored such as managed investing (roboadvisors). They’ve also added financial advisors who can help you manage existing investments, monitor your portfolio, and help you come up with a plan.

They’re not pushy though, I’ve never been called about a consultation.

6. Google Sheets with Functions

If you like complete customization and your data secure on Google servers, you can create your own Google Sheet and pull data using a function provided by Google. The drawback is that you need to customize it and it’ll be a very manual process, but you control it and it will always be free. You do run the risk of the GoogleFinance function changing underneath you but so far that hasn’t happened in many years.

The core function to pull stock prices is simple:

=GoogleFinance("TICKER", "price")

Where TICKER is the ticker symbol of the stock you’re tracking. This data can be delayed up to 20 minutes.

If you want to check Amazon, you put this into a cell and it’ll populate:

=GoogleFinance("AMZN", "price")

The syntax of the function is available here. There is a huge menu of things you can do with the function, including show historical data, tables, etc. It’s very solid and hasn’t changed much, despite Google Finance being more tightly integrated into Google Search.

Sadly, Microsoft Excel is not a good alternative because there are no good functions to automatically pull in data.

7. Google Finance

This was the first portfolio tracker I ever used.

I like Google Finance because the homepage gives you a handful of big stories (of which the headline alone gives you enough information) and then the portfolio tracking will pull in the major stories of your holdings.

I added my holdings as I acquired them, I removed them when I sold them, and I didn’t use any of the cash tracking for those purchases and sales. What’s nice about this set up is that it’s easy so simple.

But they recently got rid of the Portfolio tracking features. You can still track companies, it just looks weird, you just won’t be able to keep track of your basis.

I never used it to track my portfolio entirely, such as tracking cash inflows and outflows. I only used it to see how particular holdings were performing on a daily and overall level. Many of my individual stock holdings are now nearing their 10-year mark (acquired during the Great Recession) so it’s all green across the board (and thus not particularly useful).

Final Verdict

You will be able to find a stock portfolio tracker from one of the options above.

If you want something relatively light and hands-off, Personal Capital can analyze your portfolio and help you understand whether you’re on track to retire with the assets you need. Morningstar and Stock Rover exist for those who want more information and greater detail into their investment holdings.

And for the spreadsheet junkies, you always have Google Sheets or your own spreadsheets that you can customize to exactly what you want. It’s all about what you hope to achieve and how much tinkering you need to do to get to it.

How do you track your investments?

I love Personal Capital. So far it’s the only one I use to track my finances (partially, since the main tracking goes on my AceMoney installation. As soon as I’ll get into investing, I should look into the other tools, since they’d make my life easier.

I’m fully vested in Vanguard ETFs which makes my tracking “easy as pie”, I go to the Vanguard site 1st thing in the morning and at market closing later in the day (takes only about 15 minutes a day). BTW, I’ve been hearing a lot talk lately on some of the investing info sites like Zacks and The Motely Fool about the “Next Big Thing” being AI (artificial intelligence) so I’m keeping an eye on the Vanguard Technology sector VGT 🙂

I have Morningstar Premium. It emails me daily reports on the gains, and losses of the portfolio. It does so with each fund listed, and the change in the value of the fund. It takes less than 10 seconds to view. Once or twice a month I call the toll free automated number for my 401K, and it gives me the total, and how much is in each fund. It even tells me my investment return for the last 12 months. Being less than a year from retirement, I watch them a little more closely. Periodically, I call the automated… Read more »

We don’t have Personal Capital in Canada but it looks amazing from the screenshots I see. I use Google Sheets too to track my dividend income.

I use Personal Capital as well (I have an investment account with them). I have had many issues lately (all of 2018) using the Dashboard with USAA bank accounts. I have reported it to Personal Capital tech support and they say they are working on it but the problems have been ongoing for several months. Have other people had problems with Personal Capital and USAA or is mine an isolated case?

When it works the Dashboard is great! I just hope I can get it working again soon.

I haven’t tried Personal Capital but it seems, that it might be worth taking a closer look. It is a shame that Google killed the portfolios. I was thinking about tracking my portfolio using google sheets but it seems like too much work. After some research, I decided to try Wallmine and I can say that I don’t regret choosing it as the alternative portfolio tracker. Morningstar is also a very good tool for analysis and news but I find Wallmine more user-friendly and the free version offers everything needed with the stock and crypto screener, insider tradings, heatmaps visualizations… Read more »

I miss Google Portfolios. I like simple solutions to simple problems and it was just that.

I’ve never heard of Wallmine though.

Personal Captital is not “safe”. The fact it doesn’t use OAuth to get your data from the various banks and brokers leaves YOU vulnerable. Because they store your account creds for all these data points. If PC ever gets hacked if it hasn’t already, all you bank and broker credentials are out in the world. And I checked some terms of the banks and brokers and this may void your right to recoup any money stolen since you technically gave out your account credentials.

This is nonsense. Personal Capital does NOT store your credentials as you suggest. They use the same third party (Yodlee) used by over 1000 banks and brokerages to store your login credentials. So even if you never use Personal Capital your data is likely at the same risk if you consider Yodlee a risk. it’s also read only access so even if someone does gain access, they can just see your balances and holdings. They can’t do anything with them. The same is true for any aggregator on this list and many more. If you don’t want to share your… Read more »

Jim Wang,

How safe is it divulging my investment account & banking information to Personal Capital, i am concerned after reading the post from Mente Gee on November 5, 2019

Thank you

Joseph – which post?

I think there’s always a little risk whenever you reveal your login credentials but they’ve had a good track record and I’m not personally worried. It’s up to you to decide if the tools are worth that risk.

I recommend i3DIY Portfolio Tracker. Because it has the following features • Free to use: Single trading account tracking. • Account sync: Help you automatically synchronize trading accounts. Or you can manually enter of your transaction. • Calculate Time-Weighted Return: Showing the real performance for your account. • Benchmark Comparison: The performance of an investment is not only the absolute value of the return, but the result of comparison with a benchmark or a target portfolio at your specific periods. If you have any asset allocation plans, i3DIY Portfolio Tracker can integrate with i3DIY Portfolio Rebalance, so that your investment… Read more »

Hi Jim,

Thanks for the article. What portfolio tool would you recommend if you don’t want a web-based one (I don’t want my information exposed on the web), and would prefer a tool I can download and run locally on my Windows laptop?

Thanks!

JS

Unfortunately, I’m not aware of any free portfolio management software packages that download to your computer. There are a few that are paid and get good reviews online but I don’t have first hand experience with these so buyer beware:

http://www.owlsoftware.com/mi2k.htm

https://www.investmentaccountmanager.com/