A mutual fund can be one of the easiest ways to invest, as it gives you exposure to hundreds or even thousands of underlying stocks and bonds, even if you only have small amounts to invest.

Most people can invest in mutual funds through a workplace retirement plan such as a 401k or a Thrift Savings Plan(TSP). It’s also possible to buy fund shares through individual accounts, although you’re more likely to encounter fees, commissions, and high investment minimums.

This guide will help you understand mutual funds and how to utilize them in your investment plan.

Table of Contents

What Is a Mutual Fund?

A mutual fund is a professionally managed investment fund holding stocks, bonds, and other funds. Mutual funds pool money from thousands of investors, which makes it possible for a person to invest in large numbers of securities with small sums of money.

The first mutual fund was launched in the Netherlands in 1774, and the first fund to trade within the United States began trading in 1924. The Massachusetts Investors Trust (MITTX) is still open to investors today.

Instead of having to pick and choose which stocks you invest in, you can buy fund shares and get exposure to every holding within the fund portfolio. For example, with a mutual fund, you can invest in the S&P 500 instead of buying individual shares of each member.

Mutual fund shares are held by multiple individual and professional investors. You can buy them through many online brokerages in taxable and IRA accounts and employer-sponsored plans.

Legacy brokers such as Charles Schwab, Fidelity, or Vanguard have the widest selection of no-load, no-transaction-free funds if you buy mutual funds in a self-managed account. The investment minimum can also be as low as $1. In fact, here is a list of the best Vanguard mutual funds, for you reference.

How Mutual Funds Work

Thousands of mutual funds are available, making choosing the right funds challenging. Many investors will seek the assistance of an investment advisor, but if you’re doing it on your own, there are ways to narrow down your options.

If you have an account with an online brokerage, you should be able to use their mutual fund screener. But here is some additional information on the various categories most mutual funds fall into.

Types of Mutual Funds

There is a mutual fund for nearly every domestic and international investment sector. Reading the fund prospectus is the best way to see how the fund managers will balance the asset allocation. Most funds fall into these categories:

- Equity: Invests in individual companies of a specific market cap (large cap, mid cap) and may emphasize a growth, balanced, or value strategy.

- Fixed Income: Holds government and corporate bonds with investment-grade and “junk” credit ratings. These are sometimes called income-focused mutual funds.

- Money Market: Invests in short-term debt, cash, and cash-like equivalents to earn interest. These funds are not risk-free and are different from FDIC-insured money market accounts.

- Index: Passive mutual funds that match the performance of a specific stock or bond benchmark.

- Commodity: Get exposure to commodity spot prices or the performance of commodity producers and mining stocks. You may add these funds to your All-Weather Portfolio.

- Asset Allocation Funds: These funds hold equities and bonds with an aggressive, balanced, or conservative risk tolerance, similar to robo-advisors. One example is a 60/40 portfolio comprising 60% stocks and 40% bonds.

- Target Date: Funds that adopt a more conservative asset allocation as you near your estimated retirement year.

- Hybrid/Multi-Asset: Can invest in a variety of assets. They can be a “fund of funds” by holding several mutual funds.

Investment Strategy

Each fund is managed by at least one manager and can have one of two investment strategies:

- Actively managed: Tries to outperform its benchmark index (i.e., beat the stock market)

- Passive index fund: Matches the annual performance of the underlying index. These are called index funds.

Most mutual funds are actively managed and try to outperform the market. As a result, most funds have relatively high investment fees. However, it’s easy to find passively managed mutual funds and pursue the Three Fund Portfolio that many investors (including early retirees) follow.

Investment Minimum

Mutual funds operate differently than individual stocks and ETFs, where the investment minimum is a single share’s price (or as little as $1 if your broker offers fractional investing).

Instead, mutual funds typically have different initial and subsequent minimums.

For example, you may need to invest $1,000 initially (which is higher than stocks and ETFs), but your future investments can require as little as $1 at a time.

However, Fidelity Investments has no minimum investment on many Fidelity-managed mutual funds, and Schwab only requires a $100 initial commitment for most of its offerings.

Typically, the investment minimums are lower for funds the brokerage manages than similar funds offered by independent fund families (think of it as a loyalty benefit). Many discount brokerages don’t provide in-house funds but have a list of curated funds with reduced fees and minimums.

Share Classes

Most mutual funds offer different share classes that impact upfront and ongoing fund fees.

There are three different mutual fund share classes:

- A: Are more likely to have higher initial fees (front load) but fewer ongoing fees. These shares are usually better for long-term holdings.

- B: Less likely to have upfront fees and commissions but can charge a redemption load when selling. It’s possible to waive the back-end fees by eventually converting into Class A shares.

- C: Tend to have fewer front-end and back-end fees but may charge a higher expense ratio. However, it’s usually not possible to waive these fees.

Typically, Class A shares have the lowest annual expense ratio of the three share classes. The fund prospectus describes the costs for each share class.

Morningstar Rating

Mutual funds have been around for nearly a century, so plenty of research and rating tools exist. The Morningstar ratings are the most respected as it compares the fund’s recent performance to its peers over a 1-, 5-, and 10-year period.

As always, past performance doesn’t predict future results, but it’s one metric to analyze the track record of a particular fund manager or investment strategy.

Trading Hours

Mutual funds only trade once a day after the stock market closes. After adjusting the fund’s net asset value (NAV) with the portfolio holdings closing prices, the investors can see how many funds they sell or buy.

In comparison, stocks and ETFs trade on demand during your broker’s trading hours. For most investors, that’s from 9:30 AM to 4:00 PM EST.

Availability

Brokers may not let you buy certain funds, or the investment minimum may be extremely high if they do. For example, try buying a Vanguard fund on Schwab.

Additionally, fund managers may close a fund to new investors when they have too many assets under management. Funds that are too big can be challenging to rebalance properly and invest the new cash to provide the best returns to investors.

Mutual Fund Fees

There is a price for convenience as the mutual fund manager and the fund provider charge fees to pay operating expenses and draw a salary. Actively traded mutual funds charge significantly higher management fees than ETFs due to the higher operating costs. Here are some of the fees and other costs you can expect when you invest in mutual funds.

- Annual expense ratio: Covers fund management fees charged as a percentage. This fee is usually 0.10% or less for index funds versus 0.50% to 1.00% for actively managed funds. Some mutual fund MERs are well above 1.00%.

- 12b-1: Covers marketing and distribution expenses and is percentage-based and capped at 1%. Not every fund charges this expense, but it’s relatively common.

- Sales loads: Funds may charge a front load (at the time of purchase) or a back load (when selling shares). Some brokers waive these fees on select funds.

- Transaction fees: Your trading platform may charge a commission to buy or sell shares. Brokers charge from $0 to $75 per buy or sell order.

- Early redemption fees: Some funds charge an early redemption fee, usually when selling shares 30 days after the purchase date.

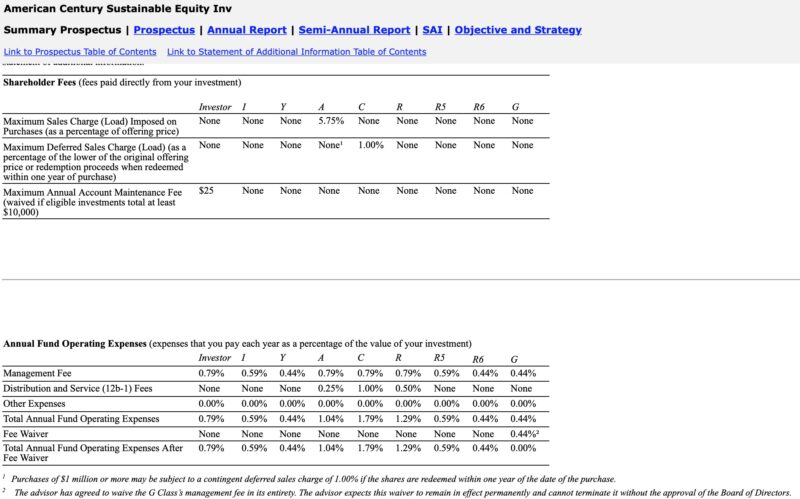

The screenshot above illustrates the various fees a typical equity mutual fund charges. See if your broker offers no-load, no transaction fee mutual funds to pay minimal fees. In addition, it’s possible to find funds that only charge an expense ratio.

Mutual Funds vs. ETFs

You can invest in mutual funds and ETFs (exchange-traded funds) and have similar investing results. Most longstanding brokerages that initially launched mutual funds offer an ETF equivalent with lower investment minimums and expense ratios.

Here are some of the key differences between both products:

| Mutual Funds | ETFs | |

|---|---|---|

| Expense Ratio | Are usually higher than ETFs, from 0.50% to 1.00% | Almost always lower from 0.01% to 0.25% |

| Other Fees | May pay load fees, transaction fees, and 12b-1 | Some brokers charge sales commissions to buy or sell (up to $5 per trade), although most are commission-free |

| Minimum Investment | Varies by fund and broker. The initial investment is usually from $100 to $5,000, but subsequent investments can be as low as $1 | Cost of a single share. Some brokers offer fractional investing. |

| Trading Hours | Trades settle at the end of the trading day | Can buy or sell at any time during market hours |

Typically, you will need to decide between a 401k or an IRA. However, many employer-provided plans only offer mutual funds as they trade once daily and are easier to manage for a group.

Additionally, most investing apps make it easier to trade ETFs and stocks as they either don’t offer mutual funds or only have a few without loads and commissions.

Mutual Fund Pros and Cons

Pros:

- Offer instant diversification

- Can handle many investment strategies (active and passive)

- Potentially low investment minimums

- Plenty of no-load, no-fee funds are available

Cons:

- Higher fees than similar ETFs

- Only trade once a day

- Not available at every brokerage

- Can have multiple share classes

Glossary of Mutual Fund Terms

There are several components to mutual funds that you may not come across with other investment options. Here are several important definitions.

Management Expense Ratio (MER): All shareholders pay an annual asset management fee, or MER, as long as they hold the fund. The fund prospectus will list the gross expense ratio and net expense ratio (the total expense after fee waivers).

Fund Family: Refers to the investment company providing the mutual fund. Some of the leading fund families include:

- American Funds

- Charles Schwab

- Fidelity

- Franklin Templeton

- Thrivent

- WisdomTree

- Vanguard

Load Fee: Commission fee the fund family charges when you buy or sell shares. There are many no-load funds, which don’t charge a load fee.

Net Asset Value (NAV): The share price isn’t necessarily as important with mutual funds as you can buy partial shares. However, you can calculate the value of each share and your investment balance by dividing the fund’s portfolio value (minus liabilities) by the number of outstanding shares.

No-Load: Brokerages waive all sales loads and transaction fees on select funds and fund families. These funds are known as no-loan funds. Investors will only pay the annual expense ratio and potentially a 12b-1 fee.

Portfolio Turnover: The percentage of portfolio holdings sold during the past year. A high turnover rate usually indicates a higher expense ratio as there are more trading fees to rebalance the portfolio.

Transaction Fee: The commission an online brokerage charges to buy or sell mutual fund shares. The fee is usually as low as $0 for online trades but can be as much as $75 for phone-based and broker-assisted transactions.

Final Thoughts

A mutual fund might be the best (and only) way to build a diversified workplace retirement plan. They can also be helpful for self-directed accounts if you want low ongoing investment minimums and to avoid the volatility of constantly fluctuating share prices that ETFs encounter.

However, many actively managed funds carry relatively high fees that erode your investment returns, which is why ETFs are often a better solution. Finding a brokerage that offers your desired funds without loads and commissions can also be challenging if you want to use a third-party fund provider.