Do you like money? What about free money from sign up bonuses?

Of course, you like money. And of course, you like free money too. What kind of question is that!?

What if I told you that there are legitimate companies out there giving away free cash for you to sign up for their service?

So many companies want your business and will bend over backward to get it. So many startups have cash and need users, so they’ll pay. They want to be on the first page of apps on your phone, they want you to use them, talk about them, share it with your friends… and to get you to do it they will pay you.

This page will update the best sign up bonuses you can get today.

Table of Contents

- Bank Sign Up Bonuses

- Credit Card Sign Up Bonuses

- 🏆 Chase Sapphire Preferred Card – 60,000 Ultimate Rewards points

- TD Cash Visa® Credit Card – $150 cash back

- Chase Freedom Unlimited – Additional 1.5% cash back

- Southwest Airlines Rapid Rewards Plus Credit Card – Companion Pass through 2/28/26 + 30,000 points

- Stockbroker Sign Up Bonuses

- Acorns – $20

- Public – up to $10,000

- Webull – up to 20 fractional stocks

- Robinhood – free stock (valued $5 - $200)

- Rewards Sites Sign Up Bonuses

- RebatesMe – $45 cashback bonus

- TopCashBack – $15 cashback bonus

- InboxDollars – $5

- Swagbucks – $10

- MyPoints – $5

- Rakuten – $30 Cash Back

- Government Programs

- Other Sign Up Bonuses

- Why Are Companies Doing This?

Bank Sign Up Bonuses

Banks aren’t giving up toasters anymore for new accounts – get bonus cash now!

Bank of America – Cash Bonus Offer

Bank of America, N.A. Member FDIC

Bank of America Bonus Summary

- What you get: $300 Bonus Offer, See offer page for more details

- Who qualifies: New checking customers only

- Promotion code: AFC300CIS

- Where to open: Online only

- How to get it:

- Open a Bank of America Advantage Banking checking account through the promotional page.

- Set up and receive Qualifying Direct Deposits* totaling $2,000 or more into that new eligible account within 90 days of account opening. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Bank of America will attempt to pay bonus within 60 days.

- Additional Terms and Conditions apply. See the Bank of America offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- When does it expire: 5/31/2025

Chase Total Checking – $300

Chase Bank has a great $300 bonus for new Chase Total Checking accounts. All you have to do is open an account, set up and set up and receive direct deposits totaling $500 or more within 90 days. The direct deposits have to be an electronic deposit of your paycheck (payroll), pension or government benefits.

That’s it! (also, don’t close the account within 6 months of opening or they will reclaim the bonus)

There is a $12 monthly service fee that you can get waived (the easiest way is to maintain a minimum daily balance of $1,500 or more).

Available online nationwide. For branch locations, visit locator.chase.com.Credit Card Sign Up Bonuses

Credit card companies will also give you bonus points for signing up. There are a ton of credit card promotions so we can’t possibly list them here but I compiled a larger list of the best credit card promotion offers here.

Here are the highlights:

🏆 Chase Sapphire Preferred Card – 60,000 Ultimate Rewards points

This is a high offer in time for travel season and extremely valuable as it’s Chase Travel points, which are often considered quite versatile because you can use it in a variety of ways. You can convert to cash, gift cards, or get a bonus for booking travel through Chase Travel.

The annual fee is $95.

👉 Learn more about the Chase Sapphire Preferred Card

TD Cash Visa® Credit Card – $150 cash back

👉 Learn more about this card and others

Chase Freedom Unlimited – Additional 1.5% cash back

(here’s how the Unlimited compares to the Chase Freedom Flex card)

👉 Learn more about the Chase Freedom Unlimited Card

Southwest Airlines Rapid Rewards Plus Credit Card – Companion Pass through 2/28/26 + 30,000 points

If you value each point at around 1.66 cents so that’s quite a bit in airfare. That will get you also that much closer to Companion Pass, which means a friend can fly with you for free! $69 annual fee.

👉Learn more about the Southwest Airlines Rapid Rewards Plus Card

Stockbroker Sign Up Bonuses

The days of giving you a toaster are over. Now, banks are giving cash for new accounts and the bigger the deposit, usually the bigger the bonus. Sometimes you’ll need a direct deposit too, but you can set that up with a job, to avoid fees.

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 20 fractional stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 25 Free Stocks | Learn more |

| free stock (valued $5 - $200) | Learn more | |

| Up to $500 cash | Learn more | |

| up to $700 | Learn more |

Acorns – $20

Acorns is a microsaving and investing app that will let you invest your spare change. You can set up round ups on your purchases, regular contributions (daily, weekly, monthly), or one-time deposits into a selection of portfolios customized to your goals.

Get $20 to start and invest with as little as $5.

Public – up to $10,000

Public is a brokerage that will let you purchase fractional shares (and whole shares!) of publicly traded companies for free in most cases. You don’t pay anything to open an account, you don’t pay maintenance fees, and most of the fees that do exist have to do with paper statements or brokerage-assisted trades (where you call in).

Plus, you can get a bonus that depends on the amount you deposit and your asset mix. You are able to see your exact bonus before you commit to signing up.

Get a custom bonus from Public

Webull – up to 20 fractional stocks

Webull is a stock brokerage that offers free trades and free stock when you sign up. The account is free, there are no minimums, and you can get up to 20 fractional stocks. (more details on the Webull offer)

- Get 20 free fractional shares when you open an account and deposit $500 – $1,999.99,

- Get 40 free fractional shares when you deposit more than $2,000

Get Your Free Stock from Webull

Robinhood – free stock (valued $5 - $200)

Robinhood is a stock trading app that has zero transaction fees. Buy and sell shares of stock in real-time, pay absolutely nothing in transaction fees. Robinhood makes money on their premium Gold accounts and rebates they get from the exchanges for helping fulfill transactions.

They recently raised $110 million at a $1.3 billion valuation and are giving away a free share of stock when you sign up. You can read more details about the Robinhood free stock promotion here but it’s pretty straightforward – download the app, fund it, then get your free stock. No activity or maintenance fees to worry about. You can sell it after 2 business days.

Get Your Free Stock from Robinhood

Rewards Sites Sign Up Bonuses

Rewards Sites are those that pay you to do the things you already do on the internet – like taking surveys, watching videos, reading emails, and shopping online. Many will entice you to join them by giving you a little extra just to sign up.

InboxDollars – $5

InboxDollars is one of several sites that will reward you for all of those things and more. They one of the few that will pay you to read emails and click on a button inside. We go into much greater detail in our review of Inbox Dollars so check that out if you want to dig deeper.

When you sign up, they will give you $5 to start your account. It’s free to join.

Swagbucks – $10

A lot like InboxDollars, Swagbucks rewards you for all the same activities online plus gives you $10 to start. With Swagbucks you earn Swagbucks (SB) which you can convert 300 SB to $3 on Amazon – a pretty low threshold compared to many other places. It’s about as low as you can get so you don’t need to go weeks between awards. (read our Swagbucks review)

MyPoints – $5

MyPoints is a cashback site where you earn points whenever you shop at a partner store like Groupon, eBay, etc. When you sign up, you will get a $5 reward when you confirm your email.

Rakuten – $30 Cash Back

Much like MyPoints, Rakuten is a shopping portal that offers rebates on purchases.

If you don’t have an account already, they’ll give you $30 extra cash back for the first 7 days after you sign up and make a purchase.

They used to be called eBates and was started in 1998, which makes it very old in internet years, and is now owned by and named after Rakuten, a massive e-commerce comment based in Japan.

If you want to learn more, our Rakuten review goes into great detail.

Get 10% extra cash back from Rakuten

Government Programs

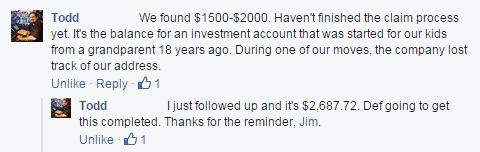

MissingMoney.com & Unclaimed.org

When a company or state government owes you money but can’t get it to you, they often turn it over to your state’s unclaimed property division. They try for a few years but if they can’t find you, eventually they leave it there until you dig it up yourself.

The best way for you to do that is to check MissingMoney.com or Unclaimed.org, the only two sites you should use (besides your state’s unclaimed property department) to search for your money. Billions of dollars are locked away in these unclaimed property vaults and it just takes a few seconds to search for them.

This is technically not “free money” – it’s really your own money back. 🙂

We share more details of how it works plus some of the best unclaimed property success stories here.

Rental Assistance

Rental assistance is part of the Emergency Rental Assistance (ERA) program and the Treasury Department has collected a list of websites that can help you find programs that help both tenants and landlords.

For example, in my home state of Maryland, you can go to the Maryland Emergency Rental Assistance Program to find out if you are eligible for assistance. If you are, you can also find out how to apply and get help with your application.

Low Income Home Energy Assistance Program (LIHEAP)

The Low Income Home Energy Assistance Program (LIHEAP) has been around since 1981 and offers financial assistance for energy bills, weatherization, and energy-related minor home repairs. It’s based on financial need (income and household size) and if you qualify for SNAP, SSI, or TANF, you may be automatically eligible. A household of four making $39,750 (before taxes) is eligible.

We share a few other government assistance programs here.

Other Sign Up Bonuses

Startups are always looking to gain users and willing to pay you just to sign up. These are the ones that don’t quite fit any of the other categories.

Cash.app – $5

The Cash App is a payment wallet that will give you $5 when you sign up with the promotion code JKJDBWT and complete a transaction of $5 or more in the first 14 days. You can pay for something or just send money to another Cash App user for it to qualify.

Just download the app (Android, iOS) and then go to Personal Settings. At the bottom, you’ll see Enter Referral Code where you can put in JKJDBWT. Then transfer $5 to a friend and boom, you get $5.

Our Cash App review explains more about how it works.

Easy!

HoneyGain – $3

HoneyGain is an application you install that uses your “unused internet” to run business tasks for other companies. They give you $3 to start and you install an app on your phone and/or computer. They don’t sell your browsing behavior or anything personal about you, they simply run internet searches and other browsing-type activity from your internet connection to collect market research for their clients.

Read our HoneyGain review for more details.

Netspend – $20 Cash

Netspend is a prepaid debit card that will give you $20 if you sign up through a referral. You will receive a debit card in the mail and while there are no maintenance fees, there is a small $1.50 per transaction fee. I turned it into an Amazon gift card and added the credits to my account for use later.

It’s a pretty easy way to earn twenty bucks, plus you can then start referring people to earn more.

What free money offer will you snatch up?

Why Are Companies Doing This?

When a company is trying to get customers, what does it do? Advertise right? They buy television commercials, pay for Facebook and Instagram ads, or maybe they get a spread in the magazine or on a billboard. It’s all the same.

They are paying to reach new customers.

Why not cut out the middleman and pay you to try them? Robinhood doesn’t want to give you free stock because they’re generous. They know switching your stock broker is a pain in the butt so they want to give you a free share of stock to give them a try. It’s more direct and probably cheaper than buying an ad anywhere else… plus they can keep track of it. They’ve been doing the promotion for so long that if it wasn’t profitable, they would’ve cut it a long time ago.

Recently, Robinhood scored a $323 million Series E funding round valuing their company at $7.6 billion. BILLION. And they’re looking to raise even more money in 2020. Flush with all that cash, they need even more customers so it’s time for you to get on top of their free stock promotion!

Jim is truly one of the best financial bloggers in today’s environment. His website offers an array of accurate information explained in a fashion that can help anyone.

Thanks to his dedication and hard work others can benefit from these simple tactics, ideas and offers and educate themselves along the way! Keeping up with wallethacks on a daily basis is a win/win! Thanks

Thanks for the kind words Alex!

I’m 62 and try to get by on my disability check, $1130 a month. As you can imagine, there is always more month than money! Any suggestions or advice would be greatly appreciated.

You should give some of these banks a try! https://wallethacks.com/best-bank-promotions-bonus-offers/