There are a ton of paid survey sites out there. Many of them look like they were made in 1990 and shady as all get out.

How do you know if a company is legitimate or a scam? How do avoid the ones that keep asking you qualification questions (that look like survey questions) and then disqualify you? It's hard.

You have to dig a little deeper and here at Wallet Hacks, we love digging.

So we're going to dig into 7 survey sites that are legit. They will pay you (they've paid me and countless others) and they're backed by major market research corporations you'll recognize.

🚩 Never pay to join a survey site. None of these companies will ask you to pay to join but there are hundreds of sites out there and some are scams. If they ask you to pay an application fee or membership fee, it's a scam. They should pay you!

| Best For | Learn More | |

|---|---|---|

| Straightforward points system | Learn More | |

| Variety of ways to earn | Learn More | |

| Earning cash directly | Learn More | |

| High earning rate | Learn More | |

| Variety of ways to cash out | Learn More | |

| Earning bonuses | Learn More | |

| Automatic payments | Learn More |

Want to make money sharing your internet anonymously for marketing purposes?

With the Pawns.app, you can make money in a variety of ways including filling out surveys and sharing your internet. You can install the app on a variety of devices, like your computer and phone, then use the Pawns.app to generate a little extra money.

When you share your internet, it's all anonymous and companies use it for marketing purposes. How much you earn is based on your IP addresses and internet speed.

This app is free, available worldwide, and the minimum payment is $5. When you sign up with the link below, you start with $1!

Survey Junkie

Best for: Straightforward points system

Payout options: PayPal, gift cards | Sign-up bonus: None

➕ Points translate directly to cash

➕ Get paid even if you don't qualify for a survey

➕ Phone surveys available if interested

➖ Only offers surveys (no videos, etc.)

➖ Some short surveys may pay 0 points

Minimum cashout: $5

SurveyJunkie is our favorite of the bunch and is the online survey division of ActiveMeasure.

SurveyJunkie is a survey company that only does surveys — no points for answering emails, watching videos, or fulfilling offers you have to cancel. It's just surveys.

They offer all kinds of market research surveys, from those you complete in a few minutes online to those that involve a journal, a phone call, or testing out a product. You get to choose what you're interested in, so if you want a phone survey, you can take a phone survey (if you qualify).

They have a huge supply of surveys at any one time and will pay you even if you do not qualify for a survey. However, some very short surveys may not pay you any points at all.

The points system translates directly to cash, with 100 points worth $1, and you can cash out at $5. You can receive your cash via PayPal or opt for an e-gift card.

Read our full Survey Junkie review for more info.

⭐ KashKick is a rewards and loyalty platform where you can earn money doing various tasks, including playing games. Companies partner with KashKick to gain exposure to their massive userbase and some of these companies include games. You can earn money playing various games (many of which are not on the list below), all for free.

KashKick is free to join and an easy way to earn extra money (some can make $200+ within their first week doing a lot of activities) while playing games.

Our KashKick review explains more, or click below to sign up:

Swagbucks

Best for: Variety of ways to earn

Payout options: PayPal, gift cards | Sign-up bonus: $10

➕ Several ways to earn points

➕ Low cashout threshold for gift cards

➕ Still earn points if you don't qualify

➖ High cashout minimum for cash

➖ Higher-paying surveys are tough to qualify for

Minimum cashout: $3 for gift cards, $25 for cash

Swagbucks is probably one of the most well-known reward sites today. Born out of an era of paid-to-surf sites and cashback portals, Swagbucks is different in that they have nearly every single way to earn money by interacting on the internet.

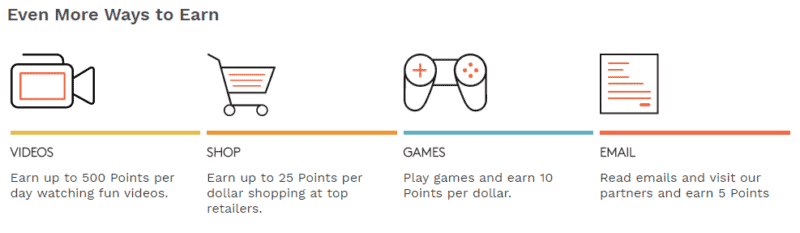

You can get cashback through their shopping portal, and earn points for searching the web (Yahoo search), answering surveys, watching videos, playing games, printing coupons, fulfilling offers, installing their toolbar/extensions — you name it.

Surveys are just a small piece of the puzzle. The best part about the surveys is that the qualification questions are typically short (they're there to confirm you're not breezing through it), and you can still earn points if you don't qualify. You will not answer 30 questions and then get denied, with zero to show for it.

As of May 2024, they've paid out over $584 million. They give out 7,000 free gift cards every single day.

Run by Prodege LLC, Swagbucks is a sister company to some other familiar names, like InboxDollars and MyPoints. Prodege has been in business since 2005.

Read our full Swagbucks review for more info.

Did I mention they give you a $10 bonus from the start?

InboxDollars

Best for: Earning cash directly

Payout options: Check, PayPal, gift cards | Sign-up bonus: $5

➕ Earn cash directly rather than points

➕ Wide variety of ways to earn (surveys, games, etc.)

➕ Upfront with payout amounts

➖ High cashout minimum

➖ Payments can take up to 10 business days

Minimum cashout: $30

The biggest difference with InboxDollars versus some other survey sites is that you earn cash directly — no need to wonder how many points turn into what.

You can earn cash by shopping online, watching videos, answering surveys, fulfilling offers, and clicking on links in emails (you don't have to sign up for anything, but you earn more if you do). They tell you how much you earn per task and then pay you that amount.

You won't get rich doing these things but it's legitimate and you'll get paid in the end. For example, you get a penny for each email you click. You get a penny for a video stream. You can earn dollars for fulfilling offers but those aren't nearly as quick as reading an email. They are upfront in what you get paid so you can decide if it's worth it.

Read our full review of InboxDollars for more info.

Pinecone Research

Best for: High earning rate

Payout options: Bank transfer, virtual cards | Sign-up bonus: None

➕ Low minimum cashout

➕ Earn $3 per survey

➕ Ability to earn even more with product tests

➖ Not all applicants are accepted

➖ Only one person per household can be a member

Minimum cashout: $3

Pinecone Research is one of the oldest market research firms and one I used to do nearly two decades ago. Back then, they would mail you a paper check before each survey so that you had the money in your pocket before you completed it!

Nowadays they've streamlined their process so you get an electronic payment of $3 for each survey. The surveys are pretty quick and can lead to larger product tests that pay even more. They're free to join, though they are only open for enrollment every so often, and one of the most straightforward in the business.

Here is our review of Pinecone Research if you'd like to learn more.

👉 Learn more about Pinecone Research

MyPoints

Best for: Variety of ways to cash out

Payout options: PayPal, Visa prepaid card, gift cards, United MileagePlus miles | Sign-up bonus: $5

➕ Many ways to earn and redeem

➕ Gift cards for 70 brands

➕ Long-standing reputation

➖ Vague about cashout minimums

➖ Gift cards can take up to 10 business days

Minimum cashout: Varies

MyPoints has been around for two decades. For years, they operated solely as a cashback portal and were one of the biggest in the industry. If you shopped at stores through their portal, you earned points. Those points could be converted into gift cards.

While they started as a cashback portal, they've added so many new ways to earn since being acquired by Prodege (which makes them sisters with Swagbucks and InboxDollars).

They currently have a welcome offer of $5 when you complete 5 surveys.

Here's our full review of MyPoints.

LifePoints

Best for: Earning bonuses

Payout options: PayPal, gift cards | Sign-up bonus: 10 bonus points

➕ Low redemption minimum

➕ Earn bonus points through giveaways

➕ Available outside of the U.S.

➖ Only surveys are available

➖ Need to prequalify for surveys

Minimum cashout: $5 (600 points)

It’s possible to take multiple surveys each day with LifePoints. As one of the largest online survey communities, there are many daily opportunities.

Most successful survey completions earn between 50 and 150 points and take up to 25 minutes. Gift card redemptions start at $5 (550 points) for digital Amazon gift cards. Cash via PayPal costs a bit more — $5 via PayPal costs 600 points.

You will need to prequalify for the full survey by answering a handful of screener questions. LifePoints awards two reward points as compensation if you don’t pass the initial interview.

Survey topics mostly ask your opinion on certain consumer brands and online retailers. It’s also possible to watch and review commercials, share your shopping habits, and rate your cellphone provider.

Some surveys award more points if you’re willing to participate in an extended focus study. You may keep a daily diary of your eating habits for 30 days, for instance.

Another example is using your webcam or phone camera to record your facial responses as you watch a TV ad.

It’s possible to win bonus points by entering giveaways. Some examples include guessing a winning soccer game score, a nation’s flag, or commenting on a LifePoints social media post.

You only need to be 14 years old to join LifePoints and receive 10 bonus points. Membership is open to many nations if you live outside the USA.

Clickworker

Best for: Automatic payments

Payout options: ACH, Payoneer | Sign-up bonus: None

➕ Variety of ways to earn

➕ Cash payouts are automatic

➕ No points system

➖ PayPal not available

➖ Higher-paying tasks may require specific skills

Minimum cashout: $10 – $20

Clickworker is a microtask site that pays you for doing small tasks on the web, such as completing surveys and testing websites. The tasks are usually short and easy to complete, and the surveys are entirely anonymous.

How much you'll earn with Clickworker depends on the task you choose and how long it takes to complete. Fees are calculated based on the estimated processing time, the difficulty level, and whether any special skills are required.

Payments are made weekly via Payoneer or ACH. You don't need to request a payout — you'll just automatically be paid in the next bill run, once you've reached the minimum payable amount for your chosen payment method. (Payoneer requires at least $20; ACH requires a minimum of $10.) PayPal payments are currently not available for U.S.-based users.

While Clickworker offers the potential for more regular and higher payouts than what you'd get doing just surveys, they say on their website that you shouldn't use it as a substitute for full-time work or self-employment.

What Is a Survey Site?

Survey sites are a way for brands to do market research.

In exchange for collecting your insights on their products or services, you get to earn a bit of pocket money. The survey website is just the go-between, providing the platform for the brand to collect its data (and for you to earn your rewards!).

You've probably heard about focus groups, where brands hold a seminar for people to learn about and respond to a product. But these can cost a company a lot of money. Online surveys are the cheaper, easier option — especially when a third-party survey site manages the data collection.

How to Choose a Legit Survey Site

When you're choosing a survey site to participate in, you'll want to look for factors like:

- Clear cashout minimums

- Easy ways to redeem your points or get your cash

- Transparent terms and conditions

- Easy-to-use website or mobile app

- Tasks you're actually interested in doing (e.g., don't sign up for game testing if you don't love games!)

There are plenty of scammy survey sites out there, so it's important to sort out the good from the bad.

Before signing up for any survey site, make sure that there's no fee to join and that they don't ask for your credit card or Social Security number. Also avoid any sites that make you jump through hoops like watching a ton of paid promos before actually getting into the surveys themselves.

How Much Can You Earn With Survey Sites?

The payments that survey sites offer can vary from a few cents to a few dollars per survey. Generally, you'll see payments in the range of $0.50 to $3 for short, 20-minute surveys, and higher amounts for longer, more in-depth surveys.

Each survey site has a minimum cashout amount (meaning you can't withdraw until you reach that threshold), which typically ranges from $5 to $30.

When it comes to survey sites, keep in mind that if it sounds too good to be true, it probably is. You won't get rich on survey sites — you won't even earn enough to make up for a full-time job. These sites are really just for earning a bit of extra cash in your spare time.

Even Clickworker, the most “job-like” of all our sites listed above, says right on their website that it shouldn't replace full-time employment.

Summary

Survey sites can be a fun and easy way to earn a bit of extra cash. Since most legit sites are seeking specific demographics from their users, you'll be answering surveys about things that actually interest you — rather than trudging through questions about something you don't understand or don't care about.

Plus, many sites now offer more than just surveys, like website and game testing — so when you're bored of surveys, you've got other options.

While you won't get rich with these sites, they can offer a nice little boost to your wallet.

Best of luck!

well the article was really useful for me as it really saved me from scammers because of you

You’re welcome!

I do not think MySurvey is a legitimate survey site anymore. I used to think so but lately you need to “beg” for the points awarded for surveys taken. If you ask for help looking into these, you get a standard reply message that basically tells you, “they are looking into this and if you don’t hear back from them in six weeks, you will not being receiving the points.” This has happened multiple times to me. I also know someone who questioned why they were no longer receiving survey invitations, only to be told that their account was found… Read more »

I agree. Have been with MySurveys for several years. Last 6 months have had problem receiving credit for surveys completed. Most recent was 1 hour 30 minutes for 300 points. When finished, got a blank page and no points. I now have three inquiries for missing points. 1 is 3 months old, 1 is 2 months old and 1 is 1 month old. All show status as open, have not received any type of reply, or points, on any of them.

Are there any surveys that pay more than $1-$2.00 per survey? I need to make $300-$500 a month to supplement my Social Security. But most of the surveys only pay $1.00 or less for a 20 minute survey. At that rate I’ll spend all my time taking surveys and not making any real money.

Unfortunately survey companies don’t pay out too much per survey and these should be seen as supplemental ways to earn a little extra money with downtime, say if you’re watching TV or waiting for something.

Another company that might be of interest, but you won’t get a ton of surveys, is Respondent.io.

I’ve been doing i-Say surveys for a long time. I use Chrome as my browser.Lately, when I get a survey invitaton from i-Say, i’m told there are no current surveys at the moment for me to do. But when Ii clicck on “next”, i bring up surveys for be done. When I click on one of the survey links, I bring up the phrase”there are no current surveys at the moment for me to do!” Whey does i-Say survey have them out if there are no current surveys for me to do?

Hmmm… I didn’t personally experience that but perhaps it’s because the survey was filled?

I agree! Never ever pay to join any survey sites or it’s definitely a scam. Swagbucks is one of my favorites. Haven’t joined SurveyJunkie yet so will definitely give it a go! Thanks!

You missed one, Cashcrate, they pay cash directly and it’s pretty easy to earn up to $50 per month with just a little time invested.

I am not a big fan of CashCrate – you can read my review to see why.

I just recently started doing surveys. I like doing them. One issue i have is what I think is age discrimination. Surveys that start with age and sex usually get me cut off 80% of the time. I feel that they are geared toward an younger group. Seniors buy groceries, alcohol, TV’s, kitchen appliances, phones, all kinds of electronics, etc. And what is this bull about the survey is full? You do the start up and in 3 or 4 questions it is suddenly full. For further information Swagbucks is a rip off. They never have surveys but always have… Read more »

Hi Jim,just a quick one.l just had a call from Liberating Research. My son had responded to an earlier advert. They sounded very nice,and we’ve both booked interviews for next Thursday,1 hour each. They’ve offered £50 Amazon vouchers. Which we accepted. It was only later l read they expect 10% of your earnings. They didn’t mention this on the phone. You can donate to a registered charity. Which l don’t mind,of they told me. Please don’t get me wrong,l do what l can,when l can. But l’m a pensioner on a very basic pension with a disabled son,so l do… Read more »

The 10% thing seems a little weird – I don’t understand why that’s necessary. If they want to donate, they can just pay you less and donate.

As for Liberating Research, the site looks legitimate but I don’t know much more about them.

I recently received and completed a survey from Simmons National Consumer Survey. There was $5 in the initial letter and $10 in the thank you letter asking me to do more. Do you have an opinion about them?

If there’s one survey site I’d say to keep away from it’s Productreportcard.com. The problem is you’ll rarely qualify for surveys on that site. And when it does happen the survey is very long and all you’ll walk away with is maybe $1 or $2