Ask a lot of travel hackers for the best rewards program and they will likely all say the same – Chase Ultimate Rewards.

(for what it’s worth, I’m not a travel hacker, I just play a bad one on the internet)

I wanted to see what the hype was and I got the Chase Ink Preferred Card for my business. We do some online advertising and you get 3X rewards on online advertising spend on top of the ridiculous sign-up bonus. Right now, it’s 900,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening in the .

Up until now, my experience with travel rewards consisted of the Southwest Companion Pass and some Starwood points. Both are super easy to understand because they’re wholly contained in a program – Southwest Airlines and Starwood hotels.

Chase Ultimate Rewards are a whole different ballgame. The rewards points can be used for practically everything.

You do all of your business on the Chase Ultimate Rewards site and you can book your travel directly or transfer your points to 10+ hotel and airline partners.

Table of Contents

How to Use Your Chase Ultimate Rewards

Much like many other rewards programs, your Chase Ultimate Rewards points can be used a variety of ways.

In the most boring sense, it can be converted to gift cards and statement credits or spent like money on Amazon. I call these “cash equivalents.”

I chatted with Marco Pantoja, an Accredited Financial Counselor with the University of Missouri, about using cash equivalent rewards:

Saving money can generally be thought of in two ways: one, reducing the cost of goods purchased and two, setting aside unused money for financial goals. Rewards credit cards offer a route to both of those options if they are used effectively with the proper types of rewards.

Effective use of credit cards involves practicing good habits that prevent the payment of additional fees or interest charges. Without the additional charges for fees or interest, credit card borrowing is relatively free.

The most effective habit have when it comes to credit cards is to pay off the entire balance in full each month prior to the due date. Paying in full each month and never carrying a balance from one month to the next, allows a credit card user to take advantage of the grace period. The grace period is the time after the billing cycle ends, but before the bill due date, when, if the entire balance is paid in full, no interest will be charged on purchases. The habit of paying the full balance each month also promotes on time payment, avoiding late fees, and reduces the temptation to use more credit than can be paid in full.

Now, with this good habit in hand, as a credit card user goes about spending with a reward card, they earn points. These points are converted into different types of rewards such as cash back, airline miles, merchandise, and other monetary benefits. When thinking about the proper type of reward, I generally consider cash back the most versatile. Cash back can be applied to your credit card to help pay for things you’ve already purchased (saving type number one) or redeemed and deposited into a savings account (saving type number two). Use of other reward types are viable options. I would suggest though, that a user consider if the rewards are something they would normally use out of pocket money for anyway (saving type number one). If not, the reward may have no effect on the ability to save.

Converting Chase Ultimate Rewards to Cash Equivalents

There are three cash equivalents:

- Gift cards – $100 gift cards are 10,000 points, a classic conversion scenario where points are worth a penny each. What’s nice about Chase is they don’t play games, you can convert a $15 gift card for 1,500 points too so they don’t nickel and dime you on the smaller gift card amounts. Some gift cards go, like Starbucks, have gift cards as little as $5.

- Statement credit – listed as “Get cash back” in the menu, you can get a statement credit to your account or direct deposited to a linked account. The conversion rate is worth a 1¢ a point.

- Shop on Amazon – Amazon says the conversion rate you get on Amazon.com will vary but will generally be a little less than 0.8¢ per point. The advantage is you can pay fractionally, so not in $15 increments (smallest Amazon.com gift card available), but I don’t see the point. Just get a gift card and load your Amazon.com gift card balance so you aren’t giving up 20% of value.

What makes Chase Ultimate Rewards so amazing is that they don’t play the typical rewards games. They don’t change the conversion rate for gift cards based on the face value of the card. They don’t make “statement credits” expensive. They also don’t force you to a statement credit when a deposit to your account is all the same.

But, as you’ll see, 1¢ is just the beginning. You can get way more per point.

Spending Chase Ultimate Rewards on Travel

The Chase Ultimate Rewards program is about travel so it makes sense that the best use of your points is actually on travel.

There are two ways you can spend your points on travel:

- Transfer points to an airline or hotel partner with their own reward programs

- Book on Chase’s Ultimate Rewards travel portal directly for flights, hotels, cruises and car rentals

Transfering Points to Partners

Chase has partnered with 10+ airline and hotel reward programs and you can transfer your points over to them.

When you transfer your UR points over to the travel partner, book travel on that travel partner’s website/portal.

The current list of travel partners includes:

- Aer Lingus AerClub

- British Airways Executive Club

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- Korean Air SKYPASS (will be removed 8/25/2018)

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards

- World of Hyatt

The conversion rate is a simple 1:1 transfer with no fee involved and is one way (you can’t transfer back to Chase UR). The rules stipulate that the receiving party is owned by you or someone listed as an authorized user on the account. If you violate this (say, to sell points to someone else), you may be forced to forfeit the points and have your account closed. I do not recommend playing any games with this.

We fly Southwest a lot and we typically value Southwest Rapid Rewards points at about 1.6¢ per point. This is a solid 60% more per point than going with cash. Also, points transferred from Chase Ultimate Rewards to Southwest Airlines do not count towards Companion Pass.

Transfers can take up to a week but most are near-instant.

You can “daisy-chain” redemptions if you know the relationships. For example, you can transfer Chase UR points to Korean Air SKYPASS but you can’t transfer Chase UR points to Delta or KLM. Korean Air, Delta, and KLM are all part of the SkyTeam Alliance and you can redeem those SKYPASS miles on any SkyTeam Alliance airline… so you indirectly can transfer Chase UR points to Delta and KLM. 🙂

Booking Travel via Chase Travel℠ Portal

Depending on the card you have, you can get a bonus on your “spending.” A Chase Sapphire Reserve card offers 50% more, a Chase Sapphire Preferred Card and Ink Business Preferred card will get you 25% more. Everyone else will get regular pricing via the portal.

This bonus amount (in my case, 25%) is based on the only other “direct to value” redemption available – the cash equivalents I listed above. Those all convert at 1 penny per point. This means you are getting 1.25 cents per point when you book using the Chase travel portal. I’ll be showing you screens that I see, which is with the Chase Ink Business Preferred card.

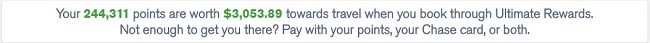

At the top of the search results of any screen, you’ll see your points total and how much they’re worth:

This is confirmed when you do any search.

For the hotel, we looked at a weekend in February in Washington D.C. and found this hotel:

$104.16 per night or 8,333 points, which values each point at 1.25¢.

The same goes for flights:

You do get better value per point that a gift card or statement credit but you’re limited by the travel tool itself. It does not include as many vendor options as some other travel search tools.

For example, the flight I looked up is one we take all the time. Baltimore International Airport (BWI) to Islip Airport (ISP) on Long Island is a frequent flight on Southwest. I looked up that exact flight and it’s $109 each way (total is $217.95 after taxes/fees). Southwest is rarely on the search aggregators but that’s an example of the limitations of Chase’s search functionality. You can only book what they have, which may not be the best price.

In my case, it is better to convert my points to Southwest Rapid Rewards points on a 1:1 basis and book the flight directly on Southwest using points. The flight is cheaper and I get more value per point.

Booking Chase Ultimate Rewards Experiences

Chase Ultimate Rewards Experiences are VIP experiences that include sports, entertainment, and culinary events.

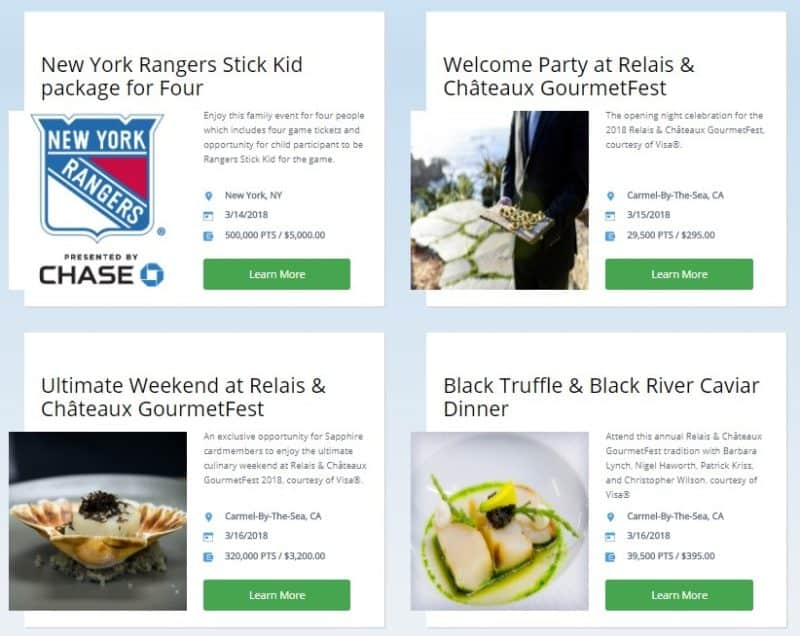

A sampling of the events available when I looked:

Some of the events are specific to certain cardmembers. For example, one of the vents listed (Ultimate Weekend at Relais & Châteaux GourmetFest) was only for Chase Sapphire Preferred cardmembers. Others are only for Chase Ink Preferred cardmembers. They fall into a category known as Chase Preferred Experiences. These are the higher end ones that include Relais & Château GourmetFest 2018, Andrea Bocelli at Amalie Arena, VIP experiences at the New York Knicks, etc.

What are the best cards to earn Chase Ultimate Rewards?

There are a variety of Chase cards that accumulate Chase Ultimate Rewards points:

Chase Freedom Unlimited – 5% on travel purchases through Chase Travel, 3% at drug stores and dining in restaurants, including takeout and eligible delivery services, plus 1.5% on all other purchases

Chase Sapphire Preferred – 5x points on travel purchased through Chase Ultimate Rewards, 3x points on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on everything else (plus a $50 annual Ultimate Rewards Hotel Credit)

Chase Sapphire Reserve – 5x points on air travel and 10x on hotels and car rentals purchased through Chase Travel℠, 3x points on other travel, 1x on everything else

Chase Ink Business Preferred – 3X points on the first $150,000 spent in Travel, Shipping purchases, Internet, cable and phone services, advertising purchases on social media and search engine optimization, 1X points on everything else

Chase Ink Plus Business – 5X points on the first $50,000 spent in Office supply stores, Phone, internet and cable TV services, 2X points on the first $50,000 spent in Gas stations, Hotel accommodations when purchased directly with the hotel, and 1X points on everything else

Each one is different and for different types of spenders. I personally use the Chase Ink Business Preferred card because it gives me 3X points on the first $150,000 spent in categories that include advertising purchases on social media and search engines. It also has an 100,000 Chase Ultimate Rewards point bonus for new signups after you spend $15,000 on purchases in the first 3 months.

What are the active Chase Ultimate Rewards Sign-Up Bonus Promotions?

The Chase UR program has some of the richest and most generous sign-up bonus point promotions for a new account. You can often see tens of thousands of points (upwards of 100,000 Chase Ultimate Rewards points), with very reasonable annual fees (especially given the rich bonus). For example, the Chase Sapphire Preferred card will give you 80,000 Chase UR points and its annual fee is just $95.

Chase Freedom Unlimited – Additional 1.5% cash back on everything you buy (on up to $20,000 spend in the first year) - worth up to $300 cash back

Chase Sapphire Preferred – 60,000 Ultimate Rewards points after you spend $4,000 in purchases within the first three months

Chase Sapphire Reserve – 60,000 Ultimate Rewards points after you spend $4,000 in purchases within the first three months

Chase Ink Business Preferred – 900,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening in the

If you plan on making a big purchase, you want to get a rewards card for it so you can maximize your rewards.

Now that you know how the Chase Ultimate Rewards program works, what will you be doing next?

We started credit reward hacking a little after Chase put a limit on those who opened too many cards within two years. To play it safe, we never applied for Sapphire (which was the one everyone raved about) because I assumed we would be booted for opening up more than 5 cards within 2 years. I’m wondering if this rule Chase imposed applies to the Ink/Sapphire business credit cards. We’ve been itching to get back on the saddle 🙂 You can’t say no to free money!

It’s hard to say no, especially if you’re not too concerned with a little ding each time (for the hard inquiry).

I’m pretty sure you can call to find out if you’re past the window.

Hey Lily, We wrote a couple of different articles to answer the questions you talked about. First, you can absolutely figure out how many cards you’ve opened in the past 24 months and you can do so with a free account over at Credit Karma. We explain how to do so with 4 easy steps: (https://millionmilesecrets.com/2017/09/24/count-how-many-open-credit-cards/) Additionally, we wrote another article about if you’re new to miles and points what you need to know about Chase’s 5/24 rule: (https://millionmilesecrets.com/2018/02/04/new-to-the-miles-points-world-heres-what-you-need-to-know-about-the-chase-5-24-rule/) If you’re over, it’s not the end of the world, you can still apply for the following Chase cards which do… Read more »

Unfortunately, you have to be below 5/24 to get approved for a Business card, as well. Which makes absolutely no sense… I can have 5+ personal cards and it shouldn’t impact my business’ ability to get a credit card.

Hey Jim, Couple of things to keep in mind when it comes to Chase Ultimate Reward points. 1) In order to redeem your points for travel, and not for cash back or gift cards, you have to have one of the premium Chase cards. Either one of the business card’s (Ink Business Preferred, Ink Cash, ect.) or the Chase Sapphire Preferred or Chase Sapphire Reserve. The easiest way to look at it is you have to have a card with an annual fee. Otherwise, if you just get the Chase Freedom or Chase Freedom Unlimited, which are both great cards,… Read more »

Thanks for the tips Jesse!

One thing to keep in mind with using the points directly on the Chase UR travel portal, is that as far as an airline is concerned, it is a cash booking through an online travel agent — it is treated exactly the same as if you booked with cash on, say, Expedia. This means you earn redeemable miles for your flight just as if you had paid cash and you earn status (premier qualifying miles / premier qualifying dollars). It also means, if you have status already, you are eligible for things like complimentary upgrades and the like that you… Read more »

Thanks for sharing your experiences!

Hello,

You wrote:

“Chase Ink Business Cash Card – 5X points on the first $25,000 spent in travel, shipping purchases, Internet, cable and phone service,”. Is that true about travel points earning on this card? I did not think TRAVEL gives 5x points on CBC. Can you please clarify?

Thank you,

Ania

Hi Ania – you are correct, they updated the categories and travel and shipping are no longer included.

After your post about this being their best offer ever, I was considering it as I work on scheduling an upcoming large purchase (to help with the initial 4K spending as that is a lot to spend in 3 months.) But in trying to understand how to use the rewards, I see that you can not transfer miles to Alaska and I saw some indications that booking through their portal does not always bring up the best/cheapest flights. So I’m wondering if you have any experience with these rewards and Alaska flights.

Alaska is not one of the transfer partners for Chase Ultimate Rewards and booking through their portal isn’t always the cheapest, so it sounds like it wouldn’t be a great card for you because you can’t transfer with Alaska.

There is one option, you can transfer Chase points to British Airways Executive Club and then use the Avios points to book flights on Alaska. That might be too many hoops but that’s up to you.