Robinhood is a popular stock trading app that charges absolutely no commissions. You can read our full review of Robinhood to get a better idea of what they do.

They recently went public and so they’re under even more pressure to increase accounts and revenue.

The most exciting of which is a free share of stock for new accounts when you have a referral. (and once you have an account, then you can refer your friends!)

Want even more free stock? Webull will give up to 20 fractional stocks. They have no account minimums and fees, so enjoy your free stock!

The two brokers are similar, here is a comparison between the two!

Table of Contents

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 20 fractional stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 25 Free Stocks | Learn more |

| free stock (valued $5 - $200) | Learn more | |

| Up to $500 cash | Learn more | |

| up to $700 | Learn more |

Open Account, Get free stock (valued $5 - $200)

Robinhood recently improved their new account promotion to include free stock (valued $5 - $200).

For a short time, they offered a bonus that included cash based on what you deposited. That has expired and there’s just the free stock bonus now.

Free Stock Promotion Details

When you join Robinhood with a referral, you get a chance of getting a share of stock valued between $5 – $200. The stock is awarded when you link a bank account.

When you refer a friend, you also get a share of stock too – you can receive up to $500 in free stocks per year.

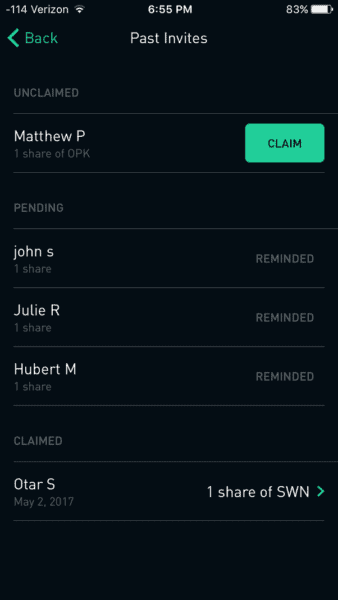

The stock is not automatically deposited into your account. You will get a notification (or look in your history/past invites screen) and you have 60 days to claim the stock.

You can sell the stock after 3 trading days but you have to keep the cash value of the stock in your account for 30 days. That value will be reported on a 1099-MISC.

According to Robinhood, here are the probabilities (based on when they acquired the shares, the market fluctuates so award could be different) – 1-in-100 get a value of at least $20; 1-in-1000 get at least $50.

Once they open an account and transfer, you’ll see a notification on your phone. Click through to the person and claim your stock:

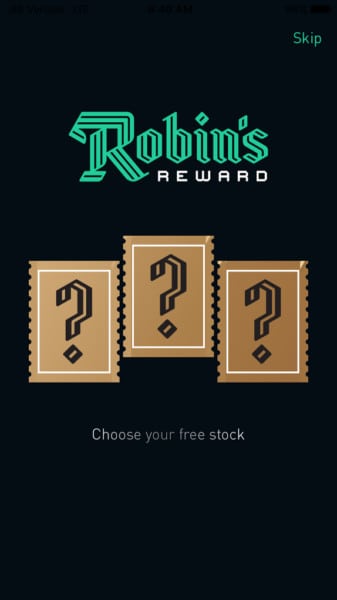

Then you get to a screen where you “pick” three stocks (part of Robinhood’s gamification):

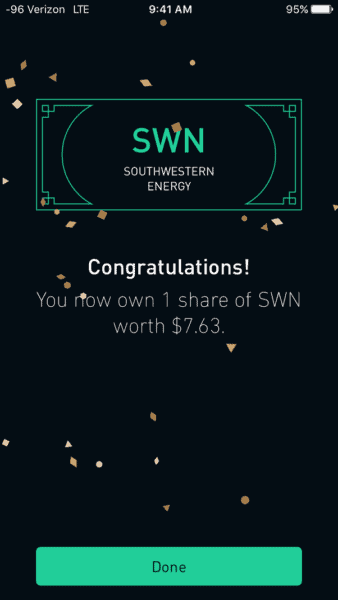

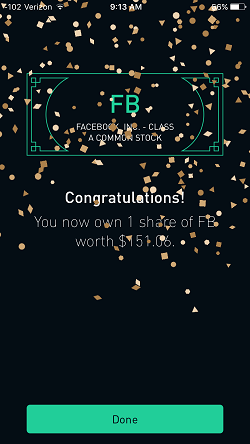

There’s some intermediate “scratcher” screen but then you see this:

Fun! Now I can sell in 2 business days (how long it probably takes to settle).

Here are a few high stock amounts I’ve seen:

How Robinhood Promotions Work

A great part about Robinhood promotions is that your referral link never changes. It’s the same invite link you’ve always been using.

The only difference is the incentive you get, the incentive your friend gets, and the rules regarding withdrawals. So what you will see above is a listing of all the different promotions they’re actively running. As a startup, they mix it up all the time so what you see will vary based on your account.

No commission trades, referral sign-up money, this is what disruption looks like — if you get a free share of stock through this, let us know what you got! 🙂

Interesting app. I’ll give it more thought before trying. Thanks for sharing!

i got sprint

I just got at&t NYSE:T and my friend got the sought after Apple NASDAQ:APPL :0

Whaaaaat??? T and AAPL!? Nice. ~$150 for AAPL is great but ~$38 for AT&T is a solid get too.

So far I’ve only gotten the $3-10 stocks (usually around $7-8).

The first one I got was brk-b (Berkshire b) and I’ve also gotten 2 groupons, 2 zegna, 1 sunpower, and another I can’t think of. I love this app. I started with 0 dollars and have already made over 300 in a month. Thank you for reading.

I got Sprint! $7 is better than nothing. 🙂 Thanks!

Yeaaaah! $7 is better than nothing! 🙂

Does Robinhood allow accounts for minors yet? I really want to get nieces and nephews to learn about investing using this, but I can’t until they allow some sort of custodial accounts.

They don’t have custodial accounts yet, right now it’s just straight up cash accounts.

Hi Jim, can we tap into this outside the US?

As far as I know, to open an account you must be a U.S. citizen, U.S. permanent resident, or have a valid U.S. visa – and have a U.S. residential address.

Australia now…

Hey Jim, it sounded like a great deal so I signed up as soon as you posted this. However, I am still waiting. It keeps saying Pending Application Approval. Should it take more than a couple weeks for the account to set up?

You need to go to email and verify your email. Then go to your home page of robinhood and there will be a notification saying claim your free stock.

I am already signed up with Robinhood. I don’t see the option for me to get stock for referring people. Did you have to do something special?

Go to personal info on robinhood. Then friend invites. As soon as your friends sign up properly, you’ll get a notification saying claim your free stock.

I already signed up for Robinhood. Is there a way I can still get the free stock that you would get for signing up?

You’d have to check with them.

Just got FB for $170… seems too good to be true?

It’s true! 🙂

I have referred 2 people. They both got Zynga & I got a Zynga and a Groupon (~$4 a pop).