moomoo

Product Name: moomoo

Product Description: Moomoo is a global investment trading platform offering no-commission trades, fractional shares, and an attractive yield on your uninvested cash.

Summary

Moomoo is a global investment trading platform offering no-commission trades, fractional shares, and an attractive yield on your uninvested cash. Moomoo is available to investors in the U.S., Canada, Singapore, Australia, Japan, and Malaysia

Overall

Pros

- Commission-free trading of stocks, options, and ETFs.

- Access to the Hong Kong and China A-shares markets.

- No account or trade minimum requirements.

- Level 2 Data is available free of charge with a minimum $100 balance.

Cons

- No mutual funds or cryptocurrencies.

- Limited account types – taxable brokerage accounts only.

- Does not support joint accounts.

Moomoo is a global investment trading platform offering no-commission trades, fractional shares, and an attractive yield on uninvested cash. It is available to investors in the U.S., Canada, Singapore, Australia, Japan, and Malaysia. However, its limitations mean it won’t suit all investors. We explore what moomoo offers, including key features, pricing, and pros and cons.

At a Glance

- Available to investors in the U.S., Canada, Singapore, Australia, Japan, and Malaysia

- Currently paying a bonus rate of 8.1% APY on uninvested cash

- Commission-free trading of U.S. stocks, options, and ETFs

- Invest in the Hong Kong and Chinese A-Shares markets

- No account or trade minimums are required

Who Should Use moomoo?

Moomoo is a highly specialized investment app with a focus on international investing.

Moomoo provides investors access to the U.S., Hong Kong, and Chinese A-Shares markets. It’s a perfect way to gain low-cost access to both Asian markets. Moomoo’s Cash Sweep Account pays one of the highest interest rates on uninvested cash.

However, moomoo isn’t for everyone. It doesn’t support mutual funds or fixed-income investments. Also, moomoo is only designed for individual taxable brokerage accounts. It’s not suitable if you want to open a joint investment account, or any type of tax-sheltered retirement account, trust account, custodial account, or education-related account.

Moomoo Alternatives

| |||

| Cash/Savings APY | 5.1% | 5.00% | 5.00% |

| Fractional Shares | Yes | Yes | Yes |

| Trading Fees | $0 | $0 | $0 |

| Learn More | Learn More | Learn More |

Table of Contents

What Is Moomoo?

Moomoo is a global stock trading platform that lets you invest in stocks, ADRs, exchange-traded funds (ETFs), and equity options without a commission (index options cost $0.50 per contract). Regulatory fees, such as SEC and FINRA pass-through fees, apply for sells only. There are currently no platform fees for the U.S. market.

Securities are offered through Moomoo Financial Inc, which is regulated by the U.S. Securities and Exchange Commission. You can review their records on FINRA’s BrokerCheck (CRD#: 283078/SEC#: 8-69739). They are headquartered at 550 S. California Ave, Suite 200, Palo Alto, CA 94306 and have been established since 2015 – which is far older than I thought since they are relatively new to me. They are licensed in 53 U.S. States and Territories.

Moomoo Financial Inc. is a member of the Securities Investor Protection Corporation (SIPC) which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). SIPC coverage does not protect against a loss in the market value of securities.

Types of Accounts

You can only open an individual, taxable brokerage account with moomoo. Joint accounts, retirement, custodial, trust, or business accounts are not supported.

The platform is available for both desktop and mobile users. There is no minimum initial investment required to open an account, nor are there any trade minimums.

Investments Offered

Moomoo offers U.S. stocks – including over-the-counter (OTC) stocks – American Depositary Receipts, or ADRs (for the purchase of foreign stocks), ETFs, options, and index options. Unfortunately, you can’t purchase mutual funds or fixed-income securities.

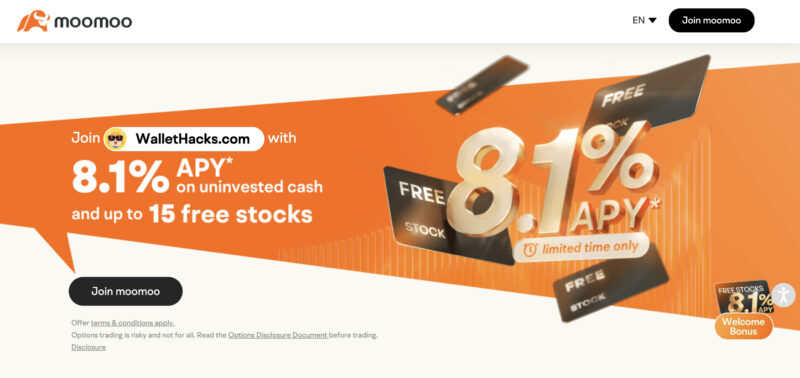

However, Moomoo does offer a high yield on its Cash Sweep Account. It has a regular rate of 5.1% APY on uninvested cash up to $1 million, but it is currently paying 8.1% APY on up to $20,000 for the first three months after the 3% boost coupon is activated.

Moomoo Cash Sweep Account

Moomoo’s Cash Sweep Account pays a base rate of 5.10% APY on uninvested cash. There is no minimum balance requirement or fees connected with the account. Meanwhile, Cash Sweep account balances are FDIC-insured for up to $1 million at partner banks.

BONUS RATE: The Cash Sweep Account is currently paying a booster rate of 3% above the regular APY of 5.1%. That means depositors can earn an incredible 8.1% on their uninvested cash. The enhanced rate is good for three months after account activation.

“The competitive rates moomoo customers can earn on idle cash enable them to earn a competitive interest rate when they are not trading and to have funds readily available when they want to trade US stocks, options, ETFs or other securities available on moomoo,” said Justin Zacks, VP of Strategy at Moomoo Technologies.

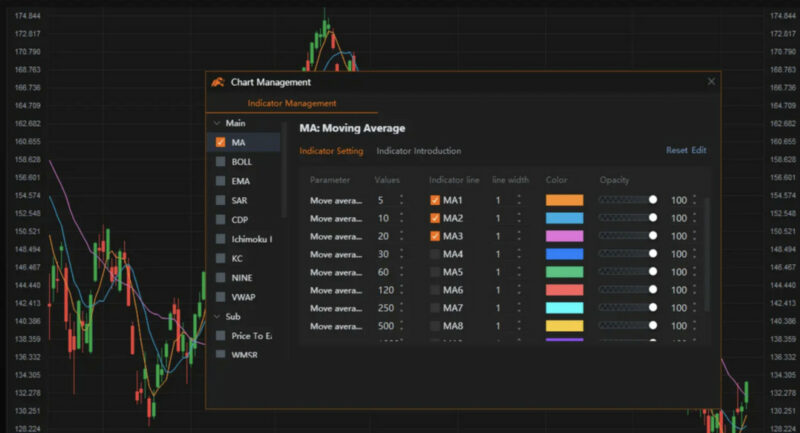

Investment Research and Tools

Moomoo accountholders have 24/7 access to financial news from more than 200 news sources. As an investor on the platform, you’ll also enjoy social media access to millions of Moomoo users worldwide.

Moomoo’s investment tools include:

- Up to six multi-monitors to monitor stocks in multiple time frames with multiple screeners

- Over 63 technical indicators

- 38 drawing tools to help investors spot patterns moving the market

- Customized technical indicators with over 190 preset functions to help you build your own technical indicators

- Paper trading feature where you can trade stocks and options with $1 million in virtual money, and $10 million for futures. Test strategies before risking your own money.

Level 2 Data

Moomoo offers Level 2 data, which helps to evaluate support and resistance levels, measure stocks’ liquidity, better understand bid-ask spreads, and enhance overall trading timing capabilities.

Level 2 data is available for all U.S.-listed securities, and is free for Moomoo customers for 30 days. After the initial offer expires, access to Level 2 data will continue to be available free of charge with a minimum 30-day average account value of $100.

U.S. Pricing

Moomoo charges the following trading fees:

- U.S. Stocks and ETFs: $0 per trade

- ADRs: $0 per trade, plus $0.01 to $0.05 per share

- U.S. Equity Options: $0 per trade + $0 per-contract fee (see additional fees below)

- Index Options: $0 per trade, plus $0.50 per-contract fee

- Margin Rates: 6.80%

Moomoo Promotions

How to Get up to 25 Free Stocks from Moomoo

Moomoo is currently running a promotion where you can get free stock for opening an account, and more stock when you deposit money into your account.

| Total Net Deposit | Total Stocks You’ll Get | Eligibility |

|---|---|---|

| $100 – $1,999.99 | 5 free stocks | New client |

| $2,000 or more | 25 extra free stocks | New client |

To qualify, you must maintain the average asset balance for 60 days. Click the link below for more information on the offer, including the terms and conditions.

You can also receive stock for referring others to the platform. After your referral deposits $100, you’ll receive a fractional share worth $5 for the first five successful referrals.

What Stocks Can You Get?

Due to fluctuations, the stock price may vary depending on the marketing conditions. The free stocks you will receive are worth between $2 and $2,000 as of May 14, 2024, 16:00 ET.

Your free stock is chosen randomly according to a specific probability distribution, so you may not receive the same stock as others. There is approximately a 99.559% chance of getting a share of stock worth $2-$9.99, a 0.4% chance of getting a share of stock worth $10-$99.99, and a 0.041% chance of getting a share of stock worth $100 or more. Moomoo Financial Inc. reserves the right to adjust the incentive program parameters at its discretion.

How Does moomoo’s Bonus Compare?

Moomoo isn’t the only brokerage offering free stock promotions. The following table lists the current promotions from several online brokers, including moomoo.

| Brokerage | Bonus Promotion | Link |

|---|---|---|

| 🏆 up to $5,000 | Learn more | |

| up to 20 fractional stocks from the Brokerage+ up to $3,000 from Cash Management | Learn more |

| up to 25 Free Stocks | Learn more |

| free stock (valued $5 - $200) | Learn more | |

| Up to $500 cash | Learn more | |

| up to $700 | Learn more |

Robinhood offers just a single share of stock, while Webull will give you a few shares based on deposits too. Moomoo’s offer is better than Robinhood, and comparable to Webull. Regardless of which broker you choose, it’s hard to see a downside to opening an account and getting free stock.

Moomoo Mobile App

Moomoo’s mobile app is available for Android users through Google Play and for iOS devices on The App Store. It provides identical capabilities to the web-based version.

The app has received 4.6 out of five stars among over 20,000 iOS users and 4.5 out of five stars among over 20,000 Android users.

Customer Service

Moomoo provides 24/7 customer support by email and chatbot. Phone support is available on trading days from 8:30 AM to 4:30 PM Eastern time. The customer service phone line is 1-888-721-0610.

Account Security

Investments held with moomoo are covered by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. This coverage protects against broker failure and will not apply if losses are attributable to market conditions.

Moomoo also employs multifactor authentication to provide extra protection for your account

Alternatives vs. Moomoo

Public

Public offers a wider selection of investments than moomoo. For example, while both allow you to invest in stocks, ETFs, and options, Public supports over 25 cryptocurrencies.

Public also offers a limited number of opportunities to participate in collectibles. However, you cannot access stocks on either the Hong Kong or the Chinese A-Shares markets. And while Moomoo can accommodate high-frequency trading, like day trading, Public is not set up for that activity.

Like moomoo, Public is currently offering 5.1% APY through its high-yield cash account. It also offers commission-free trades.

Learn more in our full review of Public.

Webull

Webull provides up to 12 free stocks when you open a new account, and will also reimburse up to $100 in transfer fees if you transfer at least $2,000 from a competing broker.

The two platforms are similar in other ways. Webull offers commission-free trading of stocks, options, and ETFs, and doesn’t offer mutual funds or fixed-income investments.

While Webull does offer a high-interest cash option – currently paying 5.0% APY – it does not offer the 3.0% rate enhancement for the first three months like Moomoo does.

Learn more in our full Webull review.

Robinhood

Robinhood provides fast-paced, commission-free trading and a high-yield cash option, currently paying 5.00% APY on uninvested cash. Robinhood doesn’t offer an enhanced APY like Moomoo, but it does provide a cash card with similar benefits to a checking account.

You can’t access the Hong Kong or Chinese A-Shares markets through Robinhood. However, it has other advantages over Moomoo, including commission-free cryptocurrency trades and participation in a limited number of pre-IPO stocks.

Robinhood stands with its IRA offering. Robinhood provides a matching contribution of between 1% and 3% of the investor’s contribution to a traditional or a Roth IRA account. Moomoo doesn’t support IRA accounts.

Learn more in our full Robinhood app review.

FAQs

Yes. Moomoo is a registered member of the Financial Industry Regulatory Authority (FINRA) and a member of SIPC. Cash deposits held on the platform are FDIC-insured through participating banks. The company is also highly regarded by thousands of mobile app participants.

No. Moomoo is a subsidiary of Futu, a financial services company based in Palo Alto, California. However, the app allows users to trade stocks listed on several Asian markets, including China. The company has multiple international offices, including Shenzhen and Hong Kong.

There is no cost to open an account with Moomoo and no minimum opening deposit. However, you must deposit a minimum of $100 to be eligible for the free stock offer.

Moomoo is a limited trading platform that allows you to make commission-free trades in U.S. stocks, options, and ETFs. The platform also gives you access to stocks on both the Hong Kong and the Chinese A-Shares markets.

Summary

Moomoo is worth considering if you are a non-U.S. resident who wants access to U.S. stock markets, or any investor also wants access to either the Hong Kong or the Chinese A-Shares stock markets. The cash option is also attractive, with its standard rate of 5.1% APY, and the 3% enhancement for the first three months.

However, if you want to trade mutual funds, fixed-income, or cryptocurrencies, or invest in tax-advantaged accounts, you’ll want to look elsewhere.

Disclosures: Moomoo is a financial information and trading app offered by Moomoo Techonologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided by the influencer are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any trading strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation to engage in any investment or financial strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should always be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results.