If you are in financial media, you need to find your way to FinCon.

Before I get into my FinCon wrap up post, I want to thank PT, Nick, Jessica, Justin, Jay, Susan, Libby, and the rest of the FinCon staff and volunteers for putting on such a great event. FinCon had 2,500 attendees this year and no aspect of the conference felt big. It was top-notch and I never felt I waited for anything. Everything was smooth, professional, and most importantly, FUN.

Why I Go To FinCon

I've been to eight FinCons. The only one I missed was the first one and that's only because it was going on two weeks after the birth of our first kid.

Every year, I see a lot of my old blogging friends and meet many new faces.

A lot of first-time FinConners will ask me why I go year after year. Do I learn anything? Is it just a big social hang out? Am I there to meet new people and companies? The answer is yes. 🙂

I go because it's a big social hang out where I still learn things and meet people both new and old. The internet is constantly evolving and you need to continue learning or you risk falling behind. I tend not to attend many sessions, because I have the FinCon Virtual Pass and can watch it all online, but I try to make a few.

This year, I went to only two sessions. Colin Jones and Joseph Hogue's talk about YouTube and Harry Campbell's talk on growing his business. I still don't have plans to go into YouTube but I wanted to support Colin, who is a good friend, and I know he's had great success promoting Blackjack Apprentice on YouTube.

Harry's talk taught me some good strategies for outreach with journalists and I've known Harry for years, a must follow if you're at all involved in ridesharing (The Rideshare Guy). There are also several other talks that I wanted to attend but couldn't because of meetings, so I look forward to checking them out via the pass.

The rest of the time, I did the “hallway track.” That's when you wander the hallways and chat with your friends. 🙂

I also had the pleasure of being on a panel about collaboration with some of my best friends – Erin Chase, J.D. Roth, and Tom Drake. Erin and I work together on $5 Meal Plan and we had a chance to talk about how we came together to create it.

Learning is good but my primary goal at FinCon is to see old friends and meet a few new ones. Plus, what's nice is that I can watch everything on the virtual pass at home. With three small kids, I've scaled back my conference attendance but FinCon is always on the schedule.

I'm not going to do a day-by-day recap of the event for me or list everyone I met, it's simply too much and I risk forgetting folks, but at the end of this post there are recaps from other bloggers. They can give you a blow by blow account of their FinCon to give you a sense of what you may have missed. My experience will have been very similar.

For now, here are a few of the highlights of my FinCon:

Highlights of FinCon

The real highlights of FinCon for me are the impromptu meetings of people I've known online for years. Those don't fit into a “heading” per se but they're the most fun part about FinCon. I forget you have to budget a few extra minutes for where ever you're going because you'll run into someone. And if you don't talk to them when you see them, with 2500 attendees, you may never see them again.

The other fantastic thing about this particular FinCon was that it was being held in Washington D.C. This meant I could Uber to the hotel and then Uber home on Sunday. There was no way I was driving (and paying $62 a night to park my car) but being able to get home in 30 minutes was grand. I feel for folks like Michelle from Frugality and Freedom who have to fly back many many hours… (she lives in Australia!).

OK, to the highlights!

Keynotes

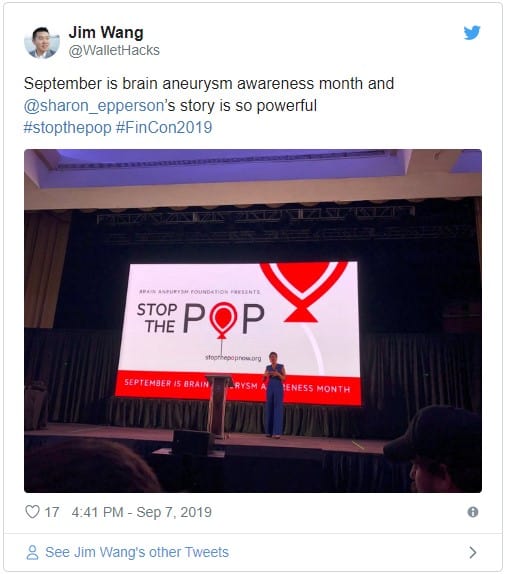

The keynotes this year were great – Tanja Hester and Ramit Sethi spoke about authenticity and being you. Cat Alford closed with a talk about fighting through adversity and Sharon Epperson shared her own adversity surviving a brain aneurysm.

I was too far to snap pictures of the first two but I got some of the closing Big Idea and keynote:

Karaoke!

After the Robinhood party, we were on the move to find a good place for some karaoke. It took a few tries but we finally settled on a place with a very generic name (like Italian Kitchen or something, but that wasn't it).

Whether you're a FinCon first-timer or a long-timer, karaoke is the best. If you want to sing, sing. If you don't want to sing, just have a good time. Either way, you'll meet some fun people in what normally would be a vulnerable moment and leave with plenty of memories.

Last year, in Orlando, karaoke became the late-night spot three of the nights. This year, it was only twice… it helps that the spot was open until 3 AM!

Plutus Awards

The Plutus Awards are the brainchild of Harlan Landes, one of the oldest and most respected bloggers in the community (and as a result, probably one of my oldest blogging friends), and each year it recognizes the best in financial media. This is all capped off with an awards ceremony and after-party that's become a fixture for Friday night at FinCon.

This year, the event was emceed by Jordon Cox and Sandy Smith and they did an AMAZING job. The show started with Jordon and Sandy doing a parody of My Shot from Hamilton. One of the funny storylines of the show was how Sandy had been nominated 19 (!!!) time for a Plutus but never won.

The show ended with a really fun surprise of Sandy winning Lifetime Achievement, Biggest Impact, and People's Choice! So well deserved and a long time coming.

Wallet Hacks was nominated for Best Investing Blog and Blog of the Year. Thank you! – that wouldn't have happened if you didn't nominate the site for these awards. Wallet Hacks was able to take home the Plutus Award for Best Investing Blog despite being up against some really strong bloggers. Much love to Just Start Investing, Investor Junkie, TelaHolcomb.com, and my good friend Robert at The College Investor.

Here's a list of all the award winners.

Paint the Town Red, White, and Blue Closing Party

The Saturday closing party was hosted by my friends at the Financial Freedom Summit – a partnership between Grant Sabatier, ChooseFI, FinCon.

The party was awesome with some great outfits. I don't know who the DJ was but he did a great job supplying great music, you couldn't even tell the venue was one of the hallways in the middle of the hotel. The transformation was pretty incredible.

Not only were the drinks flowing but there was a popcorn machine and ice cream! It doesn't get any better than that. It might surprise you to learn that after the party, we went to karaoke!

Some Companies I Met

It wasn't all just fun, there was a little bit of business. FinCon is a great way to meet a lot of new companies in a very short amount of time. If you get the Pro Networking pass, there's a Pro Networking morning on Thursday morning where you can schedule 10-minute meetings with a whole bunch of companies.

The Pro Networking sessions are great because it's a quick way to meet a company, briefly discuss what you each do, and see if there's a way to work together. If it's not a fit, it's not a problem because each meeting is just 10 minutes. If you don't fill up your schedule, you can just find an empty table during the 10 minutes and strike up a conversation.

This year, it ended with a nice lunch with a single brand and at night you had the Pro Networking mixer.

Capital Group hosted an amazing Saturday dinner at B Too, this fun Belgian and French restaurant by Bart Vandaele located in Logan Circle. Bart Vandaele, a contestant on Top Chef, was there cooking us great food paired with wonderful Belgian beers. There were so many delicious beers but the entree was a roasted leg of duck paired with a Leffe amber… mmmm so good.

Soapbox Financial Network, a Motley Fool company, hosted a lunch in which they explained how they were working to build a network of financial blogs, starting with the acquisition of one of the most respected and well-liked bloggers in the personal finance space – Budgets Are Sexy. With such a strong start, I look forward to seeing what they're able to put together.

I had the fun of playing in a Family Fued style game with Fidelity on J.D. Roth's team, along with Paula Pant, Miranda Marquit, and Ryan Guina. We were up against Erin Lowry's squad and won the team portion only to see me squander away the head to head against a much better competitor, Julien of rich & Regular (who, with Kiersten, also won BLOG OF THE YEAR! congrats!). It was all in good fun though!

Twine hosted a fun happy hour at McClellan's Retreat, a small little bar near the hotel, and if you're interested in a budgeting app designed by couples (and backed by John Hancock), give them a look.

I met with a few other notable companies and I want to run through them very quickly:

- FamZoo – I've known Bill Dwight for many years but I don't think I've ever talked about his company, FamZoo, before (boo on me!). To be fair, he rarely brings it up and is the least promotional person I know. FamZoo is a prepaid debit card designed for kids and until this year, I haven't even considered getting a debit card for our kids (oldest is 8). But, when I do, I know it'll be FamZoo.

- Tiller – Tiller has been a long time staple in the FinCon community and they build a tool that helps automate your budgeting spreadsheet. Peter and Edward was great guys and it was fun to catch up with them and learn what new projects Tiller has in store.

- AcreTrader – They're an investment platform where you buy shares in farmland. I've heard about them before, most notable as an advertiser on Money With Friends, a podcast that I guest co-hosted for their first season with the amazing Bobbi Rebell.

- Robinhood – They hosted the opening party and while I only briefly met their team at FinCon Central, I think many readers of Wallet Hacks are quite familiar with them. If you aren't, you can get a free share of stock from Robinhood to learn what they're all about!

- Vaulted – It's an app where you can buy physical gold bullion stored at the Royal Canadian Mint. Read our Vaulted Review for full details.

- Breeze – Breeze does disability insurance, something that I'd completely forgotten about in my own financial systems.

- Countabout – Countabout is a budgeting application that is a great alternative to packages like Mint and Quicken. I had a chance to meet up with its founder, Joe, and catch up with what they're doing over there.

I'll add more of these as I remember them!

Other FinCon Recaps

FinCon has 2,500+ attendees and most of them are bloggers – so you can expect to see a lot more recaps if you want to relive (or live vicariously!) the fun.

Do you have a FinCon recap? If so, let me know and I'll add it to the list! (and many thanks to Liz from Chief Mom Officer for helping me with this list)

- FinCon 2019 – Washington, D.C, Friends and Inspiration – Adam's recap is very close to capturing the experience I had, just with different names of people.

- The Best Community Of Money Nerds: FinCon 2019 Recap – Angela from Tread Lightly Retire Early does a fun recap that includes her reaction to winning Best FIRE Blog – congratulations Angela!

- The Ultimate FinCon Bootcamp: Sleep, Sprint, Yell, Fast! – It was easy to meet “A Purple Life” because you can't miss her purple hair! She is also a Plutus Award winner for Best Personal Finance Article with her article “How To Negotiate With A Spendy Partner Or Family Member.” Her recap has a great list of things you need to do to prepare for FinCon, must read for next year!

- Everything you wanted to know about Fincon! – I did not get a chance to meet Kristen from The Frugal Girl but her recap showed the power of her mastermind.

- FinCon 2019 Recap (aka that time I spoke in front of 2,000 people) – One of the fun parts of reading recaps is being surprised and I was surprised to learn Tanja and Cat knew each from previous blogs in the home/DIY space!

- FinCon 2019 Recap: 7 Things I Did Right and Wrong This Year – Kyle at Money@30 shares his experiences as a 2nd year attendee.

- The Power of Human Connection (A FinCon 2019 Recap) – With an event as big as FinCon, it's easy to forget the power of conversation and connection. One Frugal Girl's recap focuses heavily less on the “what” of FinCon and more on the importance of “who.”

- FINCON 2019 – A Canadian’s Recap – Bob shares some of his key takeaways and how some of the best conversations happen in the hallways and at late night eateries. He went to bed at 11pm, 1am, 2:30am, and 3:40am… not an uncommon pattern!

- Stop Ironing Shirts' Fincon 2019 Recap – Another first timer's experience

- The Value of a Conference: Fincon 2019 Recap – A good overview of where to find value (and what it means to different people) at a conference as big as FinCon.

- How to Survive Your First FinCon – Another first timer shares advice to future first timers – including going to smaller events so you get to FinCon with a “base of friends,” knowing the reason why you're going and how much you'll spend, and much more!

- FinCon 2019 and the future of Get Rich Slowly – my good friend JD shares how various parts of FinCon changed the way he's thought about his blog, including the impact of Ramit's opening keynote talk.

- Five Personal Takeaways From FinCon19 – Dr. McFrugal shares another 2nd attendee experience including what he learned from the first that made #2 so much better.

- Attending Your First Fincon – Melanie shares advice for future attendees and starts with a powerful pro-tip: “If you are considering going to Fincon (or any conference for that matter) get on Twitter and start engaging with the community. You’ll make some amazing online friends who will eventually become real life friends, and you won’t feel as alone and overwhelmed as a first timer.” Do this!

- What is Financial Independence Really? – Less of a recap of the eveand more of a discussion about financial independence as told through the stories of two attendees.

- 5 FinCon 2019 Takeaways to Grow Your Biz – Pete isn't a personal finance blogger (anymore) but he shows how you don't have to be directly in the niche to find benefits. Congratulatulations on winning the best Entrepreneurship/Side Hustle Blog Plutus Award presented by Wallet Hacks! Can't think of a more deserving winner!

- FinCon 2019 Recap (aka that time I spoke in front of 2,000 people) – I mentioned her Big Idea talk earlier (and how she did a great job) but it was fun reading about it from her perspective… and now I know what she was listening to beforehand!

- Fear, Skydiving & The Search for Freedom and The Golden Mean – This is a “precap,” or a post about the event but before the event, in which he shares the importance of getting out of the echo chamber.

- 3 reasons you should be going to FinCon2020 – Three great reasons (some business, some fun) you should go to FinCon2020 as told through the experiences of FinCon2019.

- 10 Reasons Why You Need to Attend a FINCON – If those three weren't enough, here are TEN. (some overlap as you'd expect)

- 10 Things I Learned From FinCon 2019 Even Though I’m 14,000kms Away – and lastly but not leastly, a New Zealander who couldn't attend shares what he learned from reading all the recaps!

- FinCon 2019 recap – Just your average run of the mill boring recap, oh by the way no big deal they just won BLOG OF THE YEAR. 🙂 Well deserved and congratulations!

- The DollarSprout Team Takes on FinCon 2019! Here’s Our Recap – Jeff shares his goals for FinCon and, despite his best intentions, failed to keep his voice intact.

- My Three Biggest Takeaways from FinCon 2019 – Read three huge takeaways (my favorite is #3, High-Flexibility Jobs > High-Status Jobs) from Zach.

- Taking a look back at FinCon 2019 – Lindsay of Gregory FCA captures the spirit of FinCon through a neat collection of tweets during the event.

- My First FinCon Experience : Thoughts and Emotions, So Many Emotions! – A great recap but most importantly, she talked about the importance of having support at home to be able to get away for 5 days. I'm in the same situation and am thankful my lovely wife held down the fort while I was away for so long.

- First timer FinCon 2019 recap including a delightful surprise – A fun recap of the keynotes, sessions and parties. It starts with a fun little surprise too!

- FinCon Volunteer Experience – Steven shares his experience as a volunteer/attendee.

- Fincon19 Fairy Tale – A fun recap of FinCon as told through the names of the bloggers they met.

- FinCon 2019 Recap: My Week as Mr. Burrito Bowl’s Publicist – Another recap that speaks about getting out of your comfort zone and ow impactful FinCon was.

- Taking Walks at Fincon19 – A recap by first time attendees who seemed to make the most of the FinCon despite not having plan or expectations!

- The Ultimate FinCon 2019 Recap Roundup – not itself a recap but it lives up to its title, includes every recap organized by number of years and Plutus Awards for the attendee!

- Lessons from Fincon 2019

- My Fincon 2019 Review

- FinCon 2019 and the Future

- Why FinCon Is “The Best Networking Event” For Personal Finance Bloggers

- Three Tips for Getting the Most out of a Conference: A Review of FinCon19

- FinCon19: A First-Timer’s Perspective

- Fincon 2019 was AMAZING

- Is FinCon Worth It?

- Key Take-Aways From FinCon 2019

- What I have learned at Fincon 2019 (or how to network like a pro)

- Pursuing a Triple Bottom Line at FinCon 2019

- The Bemused: Our #Fincon19 Experience [YouTube]

- Rachel Lyn: FinCon 2019 Vlog [YouTube]

- Pennies Not Perfection: What I Learned at FinCon [Youtube]

- MissBeHelpful: My Experience at FinCon 2019, Being an Official Speaker & Meeting Ramit Sethi [YouTube]

- Max Madill: FinCon 2019 Recap [YouTube]

- Kathleen Burns Kingsbury: FinCon 2019 Newbie! [YouTube]

- Well Behaved Wallet: Fincon Day 3 Warp Up [YouTube]

- City Girl Living on a Budget: FinCon Day 1 [YouTube]

- More to come…

This post will be a living document, updated with bits and pieces (and other recaps) as I remember/find them. If you have a great recap, email me and I'll make sure to add it. I'll be diligent for the first week but after that, I might slip a little.

OK, now that this post is done, I can empathize with Liz Eischen, of Kitchen Table Finances and someone I shared a harrowing 3+ hour drive from Winter Park to Denver this past winter, and her current status:

https://twitter.com/lizeischen/status/1171456774924197888

FinCon is going to Long Beach next year, hope to see you there!

FinCon sounds like a lot of fun but I’ve never been able to make it (my kids’ soccer teams always open the season that weekend, and it’d be weird to explain why coach is missing…). But it sounds like once you go, you can’t stop – hopefully in a few years I can join the bandwagon! Thanks for a great recap.

Great recap! I’m so sad that I missed it this year!

Thank you Jim. I thoroughly enjoyed your panel on collaboration

Thank you!

Awesome recap, Jim.

Congrats on your nomination and win. It’s well deserved!

Nice hanging out with you this year picking up some cool swag. 🙂

Hi Jim,

thanks for this awesome recap and sharing my article from Fincon as well. I regret not meeting in person in DC…Oh well maybe next year. One of my learnings this year was to prepare way more than I did so that I don’t end up missing as much 🙂

Hi Jim, Wow, can’t imagine a more complete Recap including what amounts to a catalog of other recaps! Brilliant. Everything you wanted or needed to know in one place. We missed 2019 and sadly 2021, but expect to be ‘tripping the light fantastic’ in 2022 where ever it is! I was searching for a 2021 recap, saw this one and couldn’t stop reading. Congratulations on the well deserved win! Hope to catch you next year. Right now we are busy launching our new Fintech site, App and blog! Whew. Take care and stay healthy! Wishing you all good things, Sharon… Read more »

Fincon 2019 was the last one we attended, couldn’t make it out to 2021 but hope to be there in 2022!