FamZoo

Product Name: FamZoo

Product Description: FamZoo is a pre-paid debit card for kids that includes chore management features as well parent controls and notifications.

Summary

FamZoo has one low price for unlimited debit cards. It is packed with features, including chore management and the ability to pay an automatic allowance. It also has an IOU feature, allowing you to track what is owed to a child, even if they are too young for a debit card.

Overall

Pros

- One monthly fee for the whole family

- Don’t need to link up a bank account

- Multiple free ways to add money to your account

- Loan tracking features

Cons

- No investing features

- Limited parental controls for kids’ spending

- Interest is “parent-paid”

FamZoo is a prepaid card that can help you teach your kids about managing money responsibly. Teaching children about money can get complicated. You don’t always have the cash to pay for chores when you need it, and having your kids walk around with cash isn’t always safe.

With FamZoo, you can give your children prepaid cards, completely control how they are used, and be able to monitor every transaction on the card.

Parents can send and receive money from each child’s card through prepaid cards. This lets parents teach good money habits by controlling the flow of money to and from their children.

At a Glance

- $5.99 a month (or less if you prepay) for unlimited debit cards

- You don’t have to link the parent card to a checking account.

- Automatically pay for completed chores or an allowance; or both

- Family loan tracking features, which can include interest

Who Should Use FamZoo

FamZoo is great for larger families since you can have unlimited debit cards on your account. You can create recurring or one-time chores and you can assign the chores to specific kids, or have them on a first-dibs basis. You can also set up recurring transfers to pay an automatic allowance.

This is a great way to give your kids money, without having to always have cash on hand. Plus it teaches kids about financial management in a modern way.

FamZoo Alternatives

| |||

| Price | $5.99 to $14.98 for up to five kids | $5 per month for one child, or $10 for up to five kids | $4 per month for up to five kids |

| Automatic allowance and chores | Yes | Yes | Yes |

| Investing | Yes | Yes | Yes |

| Learn more | Learn more | Learn more |

Table of Contents

About FamZoo

Founded in 2006 by Bill Dwight, FamZoo is a prepaid card company that teaches children the fundamental principles of good money management. The company’s team is made up of Bill and three others – a VP of Operations, a visual designer, and a cartoonist.

We asked Bill Dwight why he founded FamZoo and he said “Many years ago, I was looking for a hands-on way to teach our kids the fundamental life skill of personal finance. Schools communicated concepts, if they even offered money management at all, but couldn’t offer the day-to-day experience with real money. Financial institutions offered adult-centric products that lacked the educational component, weren’t designed for families, and relied on fees that penalized inexperienced consumers. I built FamZoo to fill those gaps for parents. Our offering has put family and youth financial literacy first from day one.”

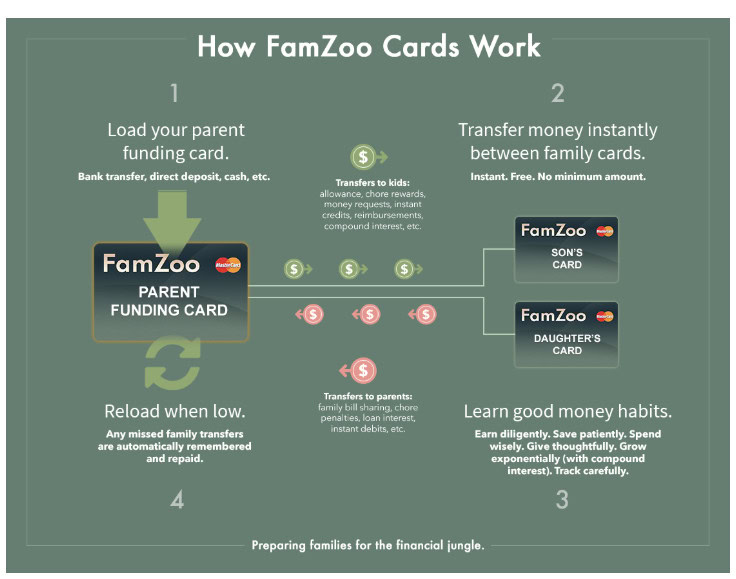

How FamZoo Works

FamZoo turns parents into bankers for their children. Each child gets a pre-paid debit card, which the parents fund via their own FamZoo card. Everyone in the family can access FamZoo via any device, so if your youngsters don’t have a phone yet, they can use a computer or tablet to see their FamZoo account.

Your kids’ cards can also be funded from the outside world, which is handy for kids who hold down summer or part-time jobs. Each card has its routing and account number, which you can use to set up direct deposits or bank transfers.

Different rules can be set to get money onto a child’s card. Parents can move money manually or set up automatic payments to a child’s card. Manual payment from the bank might be an incentive for completing a task, whereas an automatic payment may be similar to a payroll (i.e., allowance).

Children can receive several cards each. This is similar to having several piggy banks, in which the child uses different piggy banks for different spending goals. The custom label embossed beneath the cardholder name can be used to identify the goal – like “Suzy’s Saving.” [NOTE: See here about how cardholder and label work for pre-teens]

As parents, you can also set notifications so you can see exactly when transactions occur.

IOU Accounts

If your child isn’t ready for a debit card, FamZoo allows for IOU accounts instead. It’s basically just a tracking feature, so when your child does chores or gets an allowance, you can add it to their IOU account. When you spend money on their behalf, you can subtract from what you owe them.

For example, Ben has done $10 worth of chores, creating a $10 IOU. When you are at the store, Ben sees a toy he wants for $6. After some discussion, he decided he would like to buy it with his own money. You purchase the toy and subtract $6 from his total owed, so now you only owe him $4.

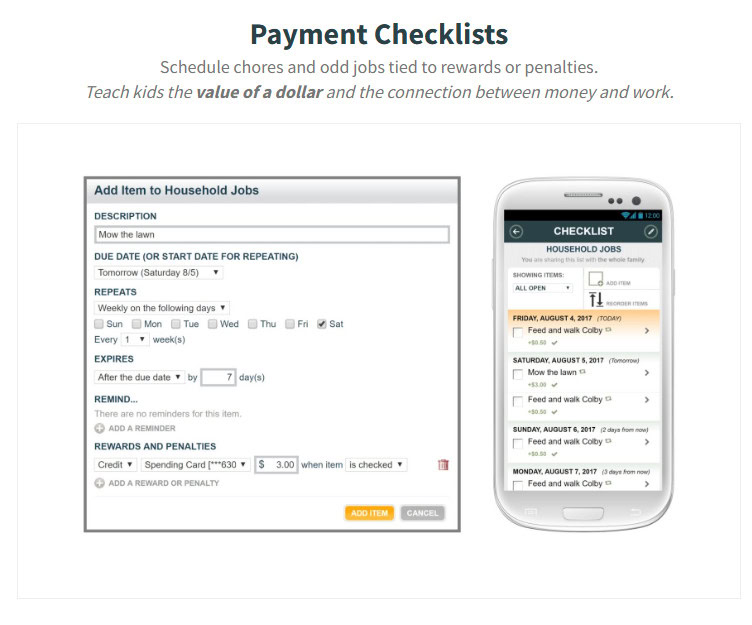

Chores and Allowance

Within the FamZoo app, you can set recurring or one-time chores that will automatically pay your child when the item is complete — or you can set it up that you must approve the payment first. You can set the individual chore to a specific child, or have it be on a “first-dibs” basis, where the first child to complete the chore gets the money.

There is also a “chore fail” penalty option. This is where a child is docked if the chore is not completed. For example, a $2 fee for not making the bed.

You can also set up recurring allowances to automatically transfer periodically.

If there are not enough funds in the parent account to fund the automatic transfers, FamZoo will keep track of these and complete them as soon as more money is loaded onto the parent card.

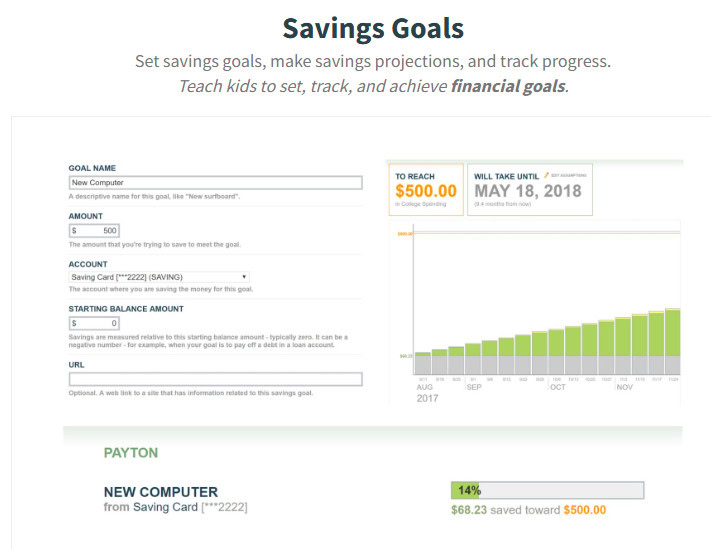

Goals

Kids can create and track financial goals. You can use separate cards for separate goals, think of each card as it’s own account. So, if the child is saving for a specific purpose, they could have a card just for that goal. For example, if they want to save up for a new video game, they could have a card for this purchase and transfer funds to the card when they want to save towards it.

Each additional card is free, with just a one-time $3 shipping fee after the fourth card.

Family Loan Tracking

If you make a loan to a family member, you can track the loan within FamZoo. You can keep track of the amount owed and charge interest if desired.

FamZoo Pricing

Here are the per-card numbers for a family of four, each with one card:

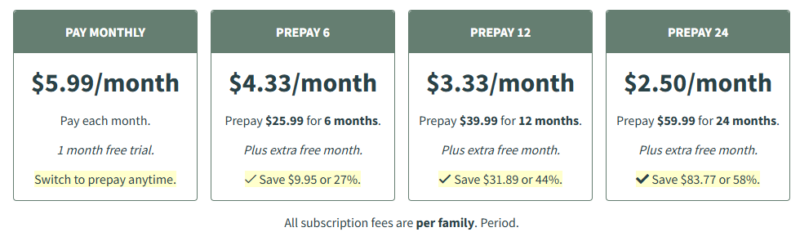

- $5.99/month per family paid monthly. ~$1.50 per month per card.

- $4.33/month per family billed at $25.99 in advance for 6 months—$1.0825/month per card.

- $3.33/month per family billed at $39.99 in advance for 12 months—$0.8325/month per card.

- $2.50/month per family billed at $59.99 in advance for 24 months—$0.625/month per card.

The bigger your family, the bigger the savings. The first four cards are shipped for free, after that there is a one-time fee of $3.00 per card.

Reloading your card directly from your employer or government agency is free. If that is not an option, there are several other ways to get money onto your card, but at a cost.

- Bank Transfers: $0 – takes 1-3 business days.

- MasterCard rePower, GreenDot @ the Register, GreenDot MoneyPak: $4.95 – takes minutes

- Apple Pay: $0 – takes one business day in most cases

- PayPal, Square Cash App, Venmo: $0 – takes 1-3 business days

- Direct Deposit: $ – takes 1-5 business days

FamZoo Customer Service

FamZoo provides customer service through its mobile app, a contact form on its website, and a phone number: 1-412-FamZoo1 (1-412-326-9661). If you need to call after hours, there is a 24/7 800 number on the back of the card.

FamZoo Alternatives

Greenlight

Greenlight has many of the same features of FamZoo, including chore management and allowance. It’s a little more expensive, between at $5.99 per month and $14.98 per month for up to five kids.

However, Greenlight has a few additional features, including earning interest on savings, cash back on debit card purchases, and access to investing features.

Here’s our full Greenlight review for more information.

Acorns Early

Acorns Early is a debit card for kids from the investment app Acorns. It comes free if you have an Acorns Gold account. Otherwise, it’s $5 per month for one kid or $10 per month for up to four kids. Like FamZoo, it includes chore management and allowance features, as well as a savings account and parental control features.

Here’s our full Acorns Early review for more information.

BusyKid

BusyKid costs $4 per month for up to five kids. It has all the chore management and parental control features you’d expect, as well a robust investing and giving options. You can invest in over 4,000 companies and ETFs within the app and donate to over 60 charities.

Final Thoughts

FamZoo has built out an ecosystem through prepaid cards, allowing parents to monitor and control how their children spend money. This parental oversight, coupled with education, teaches children how to develop good money habits.

It’s also a very modern method. Rather than using piggy banks and cash, children use prepaid cards. Unless there is a big change in how we pay in the near future, children using prepaid cards will be more prepared to handle financial transactions daily in the real world.

For a small monthly fee, FamZoo provides great value for those who want to instill good money habits in their children.