Ally Bank

Product Name: Ally Bank

Product Description: Ally Bank is an FDIC insured online bank. It offers a checking account, savings account, money market and CDs. In addition to Ally Bank, their parent company also operates Ally Invest.

Summary

Ally Bank is an online bank that offers checking, savings, money market, and certificates of deposit. It’s my primary bank because there’s an easy mobile deposit feature, bank-to-bank transfers, $10/month ATM reimbursement, and an app that is easy to use. They don’t often have the highest interest rates available, but they’re usually close enough that I’m satisfied.

Overall

Pros

- No minimum balance requirements

- No maintenance or overdraft fees

- Competitive interest rates

- $10 per statement ATM reimbursement (automatic)

- Mobile deposit of paper checks

Cons

- Competitive interest rates but not highest

- No business accounts

- Can’t deposit cash

Ally Bank is an online bank that offers checking and savings accounts that pay competitive interest rates and have practically no fees.

Years ago, I made Ally Bank my main online bank. I still keep a Bank of America account for quick ATM access, despite Ally’s ATM reimbursement program, but I keep that around because of inertia more than any other reason. It’s the center of my financial map and one of my favorite savings accounts available.

At a Glance

- Checking, savings, money markets, and CDs available

- Competitive interest rates

- Low fees

Who Should Use Ally Bank

Ally Bank is great for someone who wants a no-nonsense online bank. There are no hoops to jump through to avoid fees or earn higher rates. It also pays competitive rates on all its accounts, although they are not usually the highest rates you can find.

Ally has everything you need for everyday banking without any hassle.

Ally Bank Alternatives

| Savings APY | 3.75% APY | 3.70% APY | |

| Monthly fee | $0 | $0 | $0 |

| Bank account types | Checking, savings, CDs, money market | Checking, savings, CDs | Checking, savings |

| Learn more | Learn more | Learn more |

Table of Contents

About Ally Bank

Ally Bank started as GMAC, the financing division of General Motors, and got into banking services in 2000 with the creation of GMAC Bank. They have almost $200B in assets and about 11 million customers.

Ally is an online-only bank with competitive interest rates and low fees. Their interest rates aren’t typically the highest you can find, but they are always competitive. You’ll likely be satisfied if you aren’t one to chase interest rates from one bank to another in search of the absolute top rates.

They were founded all the way back in 1919 and expanded their financing operations in the 1940s to include trains, then household appliances (1951), and financed their 75th millionth vehicle in 1977. In 2009, they rebranded from GMAC Bank into Ally Bank.

Ally Bank Accounts

Ally Bank offers a full suite of deposit accounts – savings, checking, and certificates of deposit.

Checking Account

The Ally checking account has no minimum balance requirements and no monthly or overdraft fees. It also earns a bit of interest. Balances under $15,000 earn 0.10% APY.

You’ll get a debit card and free standard checks. Ally is partnered with both MoneyPass and Allpoint ATMs, so you can use over 75,000 ATMs for no fees. Ally will also reimburse you for ATM fees, up to $10 per statement. You’ll also have access to bill pay and Zelle.

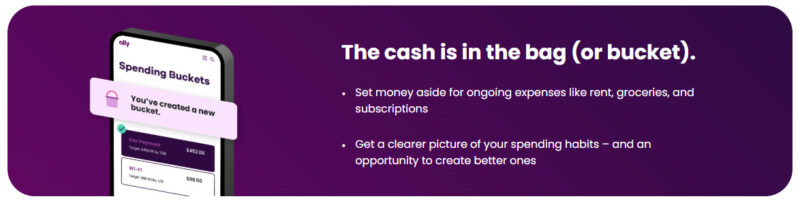

One feature that you don’t see often is “buckets.” Buckets allow you to section off a portion of your balance so you can stay organized. For example, maybe you have a “bills” bucket, and you can move money into that bucket so you don’t accidentally spend it. You can also get your direct deposit up to two days early.

Savings Account

The savings account has no minimum balance requirements, no maintenance fees, and earns 3.80% APY. They don’t charge a fee for excessive transactions, but if you regularly make over 10 transactions per month, Ally reserves the right to close the account. So it’s something to keep an eye on.

Like the checking account, you can also create buckets in the savings account. They also have other features to help you save more, such as round-ups and surprise savings.

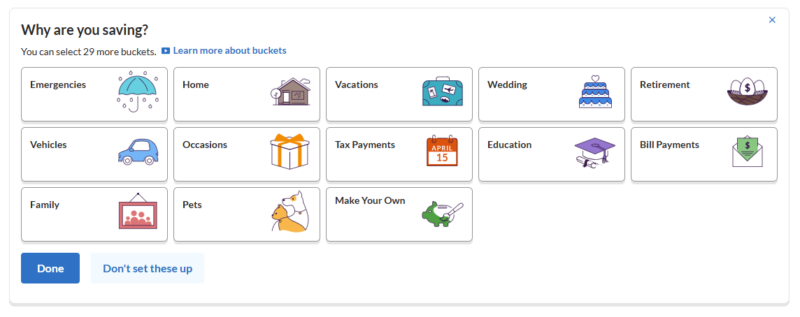

Savings Buckets Feature

Buckets are ways to organize your savings without creating separate savings accounts. There are 12 pre-made buckets (Emergencies, Home, Vacations, Wedding, Retirement, Vehicles, Occasions, Tax Payments, Education, Bill Payments, Family, Pets) and a “Make Your Own.” When you pick the ones you want, you’ll get those plus one called “Core Savings.”

You can have up to 30 different buckets.

Afterward, you can distribute the amount in your savings across the various buckets to help you understand how your money is being allocated. It’s all still in your savings account, but it can help you understand how you’re saving towards each goal.

Finally, you can set how you want new money to be allocated into each bucket. You can keep it 100% Core Savings and manually distribute it or you can set percentages on each category.

Finally, you can set the bucket where interest is deposited (you can only select one category for this).

Round-ups

If you have both an Ally checking account and a savings account, you can use the round-up feature. This feature will round up the transactions in your checking account to the next dollar and transfer the change into your savings account.

The transfer is made when you have accumulated at least $5.

Surprise Savings

Surprise Savings can also be used if you have an Ally checking account. This feature monitors your checking balance and spending habits and then transfers money to savings when it feels confident you can do without those funds in checking.

The amounts it will move will be between $1 and $100. If transfers are made, they are done on Mondays, Wednesdays, and Fridays.

Money Market

Ally’s Money Market account has minimum balance requirements and no monthly or overdraft fees. It earns 3.80% APY.

You will receive a debit card and can use over 75,000 ATMs with no fee. Ally will also reimburse up to $10 per statement for ATM fees charged by other banks.

Certificates of Deposit

There are three types of CDs:

- High Yield CD: This is their name for a standard certificate of deposit. They have all the standard maturity periods up to 60 months (5yrs).

- Raise Your Rate CD: This type of CD allows you to raise your rate should rates increase for your term and balance tier. It’s available as a 2-year and 4-year CD. You can increase the rate once on the 2-year and twice on the 4-year. The drawback of this CD is that the rate starts lower than you’ll find on the High Yield CDs.

- No Penalty CD: You can withdraw your money anytime and pay no penalty. The only exception is that you can’t withdraw within the first six days. This is currently available for 11-month terms only. (If a no penalty CD interests you, our list of no penalty CD rates has some competitive offers.)

| Deposit Product | Yield |

|---|---|

| Online Savings Account | 3.80% APY |

| High Yield CD – 3 months | 2.90% APY |

| High Yield CD – 6 months | 4.05% APY |

| High Yield CD – 9 months | 4.00% APY |

| High Yield CD – 18 months | 3.80% APY |

| High Yield CD – 36 months | 3.40% APY |

| High Yield CD – 60 months | 3.40% APY |

Ally Bank has one of the most generous CD early withdrawal penalties I’ve ever seen:

- Less than 3 months: 30 days

- Between 3 and 24 months: 60 days of interest

- 25 months – 36 months: 90 days of interest

- 37 months – 48 months: 120 days of interest

- 49 months or longer: 150 days of interest

Other Accounts

In addition to bank accounts, Ally also has lending and investing.

Credit cards: Ally offers three credit cards, two of which earn cash back.

Mortgages: You can either finance a new home or refinance your existing mortgage.

Auto loans: Ally offers several options for auto loans, including a new purchase, refinancing, lease buyout, and business vehicles.

Investing: Through Ally Invest, you can access automated or self-directed investing. It also offers personal advice from a human advisor if desired. Here’s our Ally Invest review.

Ally Bank Fees & Penalties

Ally Bank has no monthly maintenance fee, minimum account balance, or fee for incoming wires. You can get cashier’s checks for free and unlimited deposits.

You do pay a fee for:

- Stop payment: $15

- Outgoing domestic wires: $20

- International transaction fee: 1%

- Same-day bill pay: $9.95

- Overnight bill pay: $14.95

Ally Bank Alternatives

Discover

Discover Bank offers several attractive bank accounts, including a checking account that earns 1% cash back on the first $3,000 per month in debit card purchases. It has no minimum balance requirements and fees. See website for details.

Its savings account earns 3.75% APY and also has no fees or minimum balance requirements. It also offers a money market account and CDs with competitive rates.

Here’s our full review of Discover for more information.

Capital One 360

Capital One 360 offers both a checking and savings account. Neither account has a monthly fee or minimum balance requirements. The savings account earns 3.70% APY. It also offers CDs with competitive rates.

One thing that Capital One has that Ally doesn’t is in-person banking. Capital One has 256 branches in the U.S.

Here’s our full review of Capital One for more information.

Sofi Banking

Sofi started with student loan refinancing but has branched out into offering other types of bank accounts. It’s checking account earns with no monthly fees or minimum balance requirements. It also often runs promotions for new accounts, you can see here if there are any currently running.

The savings account earns with no monthly fees or minimum balance requirements. It also has a feature similar to Ally’s buckets, but Sofi calls them “vaults.”

Here’s our full review of Sofi for more information

Final Verdict

If you’re comfortable with an online bank, I can’t think of a better one than Ally Bank. It’s the reason why I opened an account with them many years ago and the reason why I still use them today.

Thank you for the informative post. I’ve been looking into Ally, and I think it’s a pretty solid place to take my money. I’m currently banking with a credit union (member of co-op), and I might maintain that account for cash deposits, atm’s, etc, if I decide to start an online banking account. What are your thoughts on this? Also, what are your thoughts on the similar CIT Bank? Thank you.

I use Ally Bank and am a big fan, as you can probably see in the review, and I have not tried CIT Bank yet. I don’t rate chase with banks so their slightly higher rate on their “savings builder” product doesn’t matter all that much to me.

There are only two negative things I have ever run across with Ally.

The first bad been mentioned, inability to deposit cash. ATMs take cash deposits so I’m surprised Ally hasn’t worked out a solution.

Second is related to their bill pay service. An Ally customer can do nearly anything on the Ally app except the ability to add payees. Adding payees must be done on the Ally web site, and from a computer. Accessing the web site from a mobile browser is not allowed for this function, although there is a work around for the tech savvy.

I hadn’t tried using bill pay on the app so I didn’t know about this limitation, seems odd that they wouldn’t let you add it on the app. Is the workaround to request “desktop version” in a mobile browser?

So you not able to make cash deposit so how you get money on your card ??

You can deposit checks via the mobile app or you can transfer it from another bank.

Do they have text messages alerts ???

Yes, from their FAQ: “We send security, transfers and other alerts automatically to help you keep track of your account activity. You can create custom alerts to stay on top of balances, deposits, overdrafts and transactions.”

You can change what alerts they send but there are automatic alerts you can’t unsubscribe from because they’re for your protection (like transfers).

Can i only transfer 6 times INTO an Ally savings account from another bank without excessive transaction fees?

This limitation is for ALL savings accounts at any bank. You can make the transfers to a checking account though, there are no restrictions regarding that.

Not sure where you got this information. I use marcus and there is NO limit on the number of transactions per month

The Federal Reserve only recently (April 24, 2020) removed the six-per-month limit. My comment was a week or so before the interim final rule.