Raisin

Product Name: Raisin

Product Description: Raisin partners with banks and credit unions to bring you higher interest rates on your savings, through high yield savings accounts, certificates of deposit, and no penalty CDs.

Summary

Raisin partners with banks to bring you the highest rates on deposit accounts available. With Raisin, your funds are deposited with their partner banks, who are fully FDIC insured. You get just one tax form at the end of the year, regardless of how many partner banks you work with. The rates you get through Raisin are often higher than what’s available directly with the bank. Minimum deposits are just $1 and there is no maintenance or other monthly fee.

Overall

Pros

- Multiple account options and partner banks

- Above-average interest rates

- No service fees

- $1 minimum deposit

- One dashboard to manage several accounts

Cons

- No checking or online bill pay services

- They partner with smaller banks and credit unions with less name recognition

- Your account is in a pooled account at partner banks

- Personal banking only (no business accounts)

Securing a great savings account interest rate is one of the easiest ways to earn income on cash deposits. However, with so many banks and savings accounts to choose from, the process can be time-consuming.

Raisin is a savings account platform that can simplify the rate research process. It partners with FDIC-insured banks, often regional and smaller ones, to offer high interest rates on various deposit products. The high-yield savings and CD rates you get through Raisin are often higher than what’s available to the general public on the bank’s website.

In this Raisin review, I analyze their offers and tell you how good the savings interest rates are and if the platform is legitimate.

🔃Updated February 2025 with updated screenshots of the latest rates and removal of their $100 bonus for the New Year.

At a Glance

- Works with banks to provide top interest rates for saving accounts and CDs

- Allows you to easily switch from one bank to another when rates change

- Gives you access to credit unions you may otherwise not qualify for

Who Should Use Raisin?

Consider using Raisin if you’re looking for the highest rates for savings accounts, term CDs, and no-penalty CDs. The offers can be better than those from well-known national banks, although you must be comfortable using a community bank with a smaller customer base.

Also, the banking experience can differ from opening an account directly with a partner bank or credit union. You schedule deposits and withdrawals through your Raisin account instead of visiting the bank website, which you may use for other services.

Raisin Alternatives

| |||

| Aggregates top rates | Yes | No | No |

| Minimum deposit | $0 | $0 | $0 |

| Fee | 0.04% per quarter (min $20 per quarter) | $0 | $0 |

| Learn more | Learn more | Learn more |

Table of Contents

- At a Glance

- Who Should Use Raisin?

- Raisin Alternatives

- My Raisin Experience

- What is Raisin?

- How Does a Custodial Bank Account Work?

- Cash Account

- Referral Program

- Savings Account Promotions

- Who Can Use Raisin?

- How Can Raisin Offer Such High Rates?

- Deposit Account Options

- What if a partner bank fails?

- What if Raisin fails?

- What are Raisin Fees?

- Raisin Partner Banks

- How Does Raisin Work?

- First, Create an Account

- Then Compare Offers

- Link & Fund New Account

- Managing Accounts

- Transferring Funds

- Renewing / Managing CDs is Easy

- Just One Year-End Tax Document (1099-INT)

- Is Raisin Legit?

- Alternatives to Raisin

- Raisin FAQs

- Final Thoughts

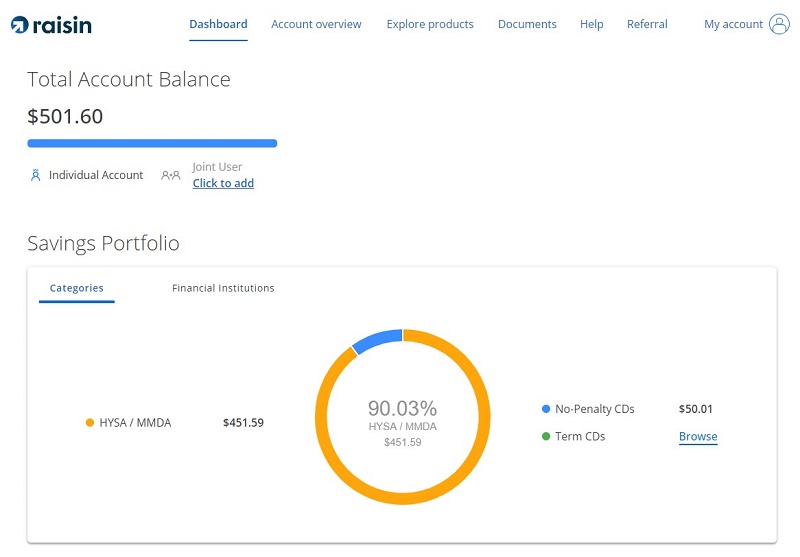

My Raisin Experience

I opened a Raisin account last year, and it was fast and easy. You just register, link up an external bank account (in my case, Ally Bank), and transfer funds into a partner bank. I chose Western Alliance because they had the highest rates at the time.

Registration took only a few minutes, the transfer of funds took the typical ~3 days that an ACH usually takes, and I was earning interest shortly after that.

I have yet to have an account for an entire year, so I have no first-hand tax experience yet. Raisin has said that they will issue Form 1099-INTs per custodian bank, rather than per bank or credit union you’ve had deposits. This can significantly reduce the number of forms, which will be nice.

All screenshots below are from my account.

What is Raisin?

Raisin is an online platform that partners with over seventy banks and credit unions to offer competitive rates on high-yield savings accounts, money market accounts, and CDs (certificates of deposit).

Raisin GmbH is Raisin’s parent company (founded in 1973), and they’ve been doing this in Europe for years. Raisin works with approximately 400 banks in more than 30 countries. They only recently expanded into the United States with Raisin.

At Raisin, you will find banking offers from regional banks and mid-sized institutions that don’t appear in most savings account searches. As a result, you have more banking options and can earn a potentially better rate on your savings.

For instance, Raisin will let you open a high-interest account from Citizens State Bank, Ponce Bank, or The State Exchange Bank. You won’t see national names like Axos Bank, Capital One 360, or Discover® Bank.

Unfortunately, the platform doesn’t offer checking accounts or online bill pay services. So, you can only open savings accounts, MMA, and CDs to maximize your cash reserves.

Using a separate bank for high-yield savings is not uncommon, so this limitation isn’t a deal-breaker for many.

How Does a Custodial Bank Account Work?

When using Raisin, you might put your money with one bank but don’t get a separate bank account. Your money is pooled with other Raisin customers at the bank in a custodial account. You won’t be able to transfer money into and out of the partner bank directly, and you won’t get an account number at the bank; it has to go through Raisin.

When you transfer funds from your existing bank to the new Raisin-linked account, you transfer funds to a custodial account held by Lewis and Clark Bank. A big benefit of this is that you can put your money into credit unions that you would otherwise not qualify to be a member of. Lewis and Clark is a member and you’re using that account to earn interest.

You get FDIC or NCUA insurance through the partner bank (pass-through insurance), not Lewis and Clark Bank. Lewis and Clark Bank is the custodian bank. Your funds will not be in your name at the partner bank, but legal records indicate how much you have there and you are fully insured by FDIC or NCUA insurance.

You get $250,000 of FDIC coverage at each bank. If you open accounts at two partner banks, you get $250,000 from each bank for a total of $500,000 (it’s $250,000 at each bank, the amounts don’t pool together, so you can’t get $300,000 at one and $200,000 at the other). Remember, the coverage isn’t from Raisin but the partner bank itself (not to belabor the point, but this can get confusing).

This is the exact mechanism used by many fintech companies who offer bank-like services but are themselves, not a bank. For example, Betterment works with fourteen program banks and offers $2 million in FDIC insurance.

Also, this is how nearly all individual stock market holdings are managed. The shares of stock you “own” at any brokerage are not literally in your name. They’re held by a custodian, such as Apex Clearing, who keeps track of who owns what (known as “street name”). This makes it easier to transact on the shares and this is a good thing.

Cash Account

When Raisin first started, there was no “Raisin” account to hold your money. Your money was either with a partner bank or in your own account.

In June 2024, they introduced a Cash Account can hold your cash as you transfer it to partner banks. If you’re working with two partner banks, you can transfer into Raisin and then back out — no need to use your linked account anymore. This will make the transfer process faster.

Referral Program

Raisin also has a referral program in which you can earn $100 when you refer someone who deposits at least $5,000 and keeps it there for 90 days. There is a cap, which is typically $1,000 but can also be raised during promotional periods.

Savings Account Promotions

The appeal of Raisin is that it’s negotiated higher interest rates with its partner banks. Banks offer these promotional rates because they want more deposits, and the offers are limited in nature. You will usually see a lower rate if you go directly to the bank website. The higher rates on Raisin will come and go; the only way to lock them in is by opening a certificate of deposit.

Banks may use above-average rates to attract new customers who may not live within their local service area. For example, you can join a Florida-based community bank even if you live in California (you open an account online).

If you currently bank with partner institutions, you can be eligible for better rates as they are available to all Raisin users. The only difference is that this account won’t show in your bank dashboard.

These ongoing above-average rates can often be superior to bank promotions, which usually offer a one-time cash bonus.

Who Can Use Raisin?

To open deposit accounts, you must be 18, live in the United States, and have a Social Security number (SSN). This is the same as the requirements for a regular bank account.

You don’t need to create an account to compare the latest interest rate offers. They publish them on the website!

How Can Raisin Offer Such High Rates?

A typical commercial bank spends a LOT of money on advertising and marketing. I’m sure you’ve seen radio and TV ads for your local bank, not to mention magazine and print ads. M&T Bank pays $5 million annually to sponsor the Baltimore Raven’s stadium.

I’ve seen reports that they pay at least $400 in advertising fees for a personal bank account and twice that for a business account. This is why bank bonuses are often hundreds of dollars – they’d rather pay you than an advertising company. (and you’re happier when YOU get the money!)

However, smaller regional banks can’t compete at that level, so they partner with Raisin to increase their deposits. Instead of paying a big bonus, they offer higher interest rates (and they pay Raisin directly). They’re FDIC insured, so this is a risk-free rate and often beats what you can get elsewhere.

Deposit Account Options

It’s currently possible to open an individual or joint account. The platform plans on offering IRA banking services in the future to minimize your taxable interest, but right now, you can choose between:

- High-yield savings & money market accounts

- High-yield Certificates of Deposit

- No Penalty CDs

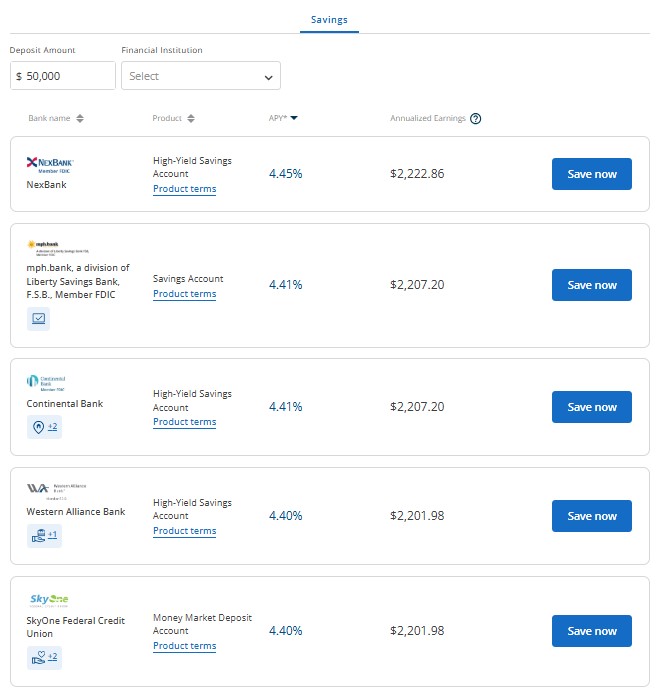

High-Yield Savings Accounts

You can open a high-yield savings account or a money market deposit account with a minimum $1 balance. This savings product is online only and typically permits up to six monthly withdrawals.

Consider this account if you don’t want your money locked up for several years or face potential early redemption policies as bank CDs require.

The interest rates are variable, but the Raisin offers can yield more than many of the best high-yield savings account rates.

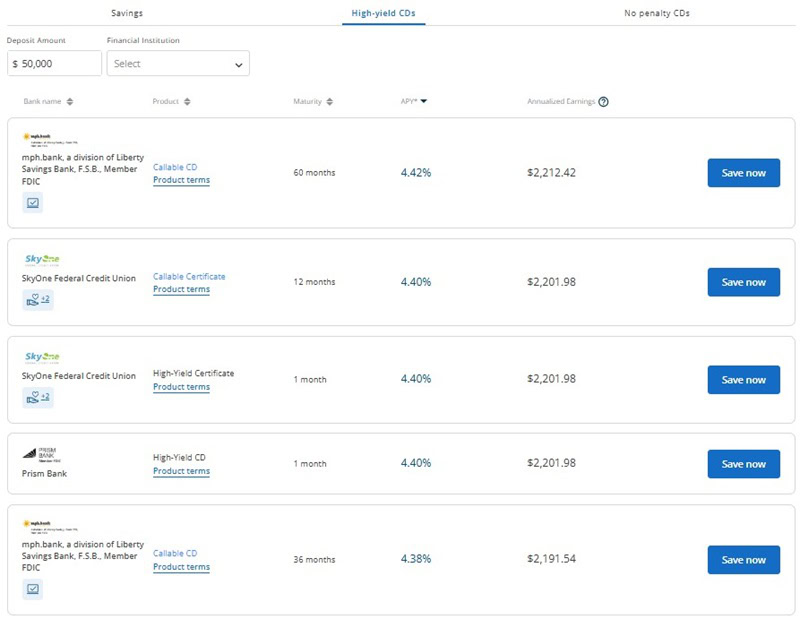

High-Yield CDs

Bank CDs are becoming an attractive option to earn attractive yields if you’re seeking a fixed income.

The rates are higher than an online savings account, but the investment term is usually nine to 24 months. However, they do have an offer of a 60-month (5-year) CD, though it’s not the highest rate at the moment.

Unlike most CDs, which require depositing at least $500 or $1,000, the minimum deposit is only $1 through Raisin.

This low minimum investment makes it easy to build a CD ladder and earns a higher yield on the cash you won’t need for immediate expenses.

Additionally, the rates are competitive with other platforms. For example, you might earn 5.00% on a 12-month CD term through Raisin but only 2.75% directly from a commercial bank.

The best CD rates fluctuate regularly, but you can usually get the best returns with an 18-month or 24-month term.

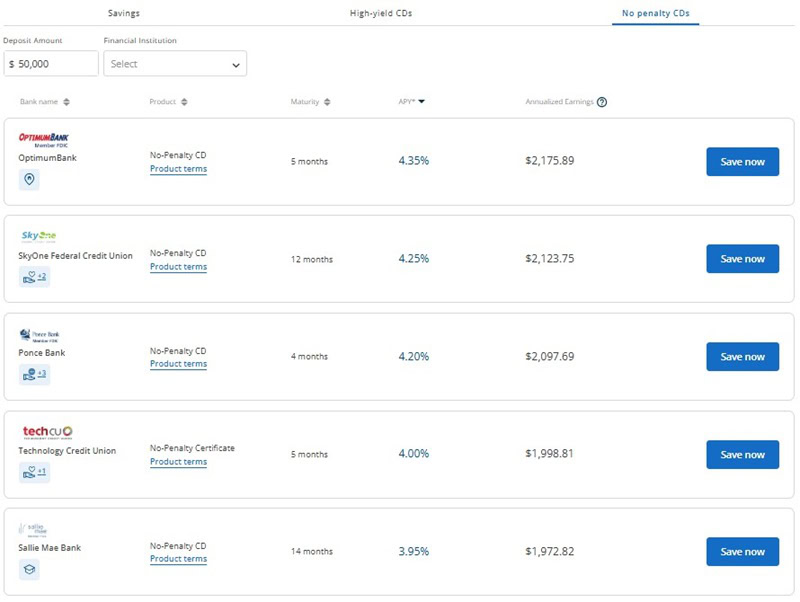

No-Penalty CDs

A no-penalty CD can balance the benefits of high-yield savings accounts and traditional fixed-term CDs.

This product can earn a potentially higher interest rate than a savings account as you’re pledging your funds for a specific duration. However, you can make penalty-free withdrawals seven business days after account opening.

Most no-penalty CD terms are from 10 months to 17 months. However, some banks offer a 36-month term.

The rates are not as attractive as a term CD, and you should consider locking your money if you’re confident you won’t need to tap it. But if there’s a reasonable possibility that you will need the funds, consider this option or stick with a high-yield savings account for peace of mind.

What if a partner bank fails?

If you have cash at a partner bank and that bank fails, your money is protected by FDIC insurance — as if you had your money in the bank directly.

The process for a bank failure is the same whether you have an account directly with the bank or through Raisin. Your funds would be frozen while the process resolved itself (often over a weekend), and your money would be returned to you or transferred to an acquiring bank.

What if Raisin fails?

Raisin isn’t a bank, so there’s no risk that they would “fail,” However, if Raisin goes bankrupt or no longer operates as a company, your money is still safe in an FDIC-insured bank in a pooled account.

What if Raisin completely disappeared and all of its data were erased? The partner bank should still has information about your account. Raisin shares a daily file with the partner bank, including all customers’ positions and balances.

What are Raisin Fees?

There are zero fees for using Raisin. You keep 100% of your interest income. You also avoid the hidden fee of high minimum balance requirements since you only need to deposit $1 per account.

The only potential fee is an early redemption penalty for term CDs if you withdraw your funds before the CD maturity date — this is true at any bank that offers CDs. You can avoid this by opening a savings account or a no penalty CD.

While you won’t pay a fee, Raisin makes money by collecting marketing fees from partner banks and credit unions. But it’s a win since you often can get a higher interest rate than going to the bank directly.

Raisin Partner Banks

As of June 2024, you can find offers from these banks and credit unions (they are all FDIC or NCUA insured, we just haven’t looked up every FDIC certificate number yet):

- Adda Bank, a subsidiary of Bank 34 (FDIC Cert# 29087)

- AVB Bank (FDIC Cert# 2326)

- Axiom Bank (FDIC Cert# 31390)

- Banc of California (FDIC Cert# 24045)

- Border Bank (FDIC Cert# 20776)

- Central Bank of Kansas City (FDIC Cert# 17009)

- CF Bank National Association (FDIC Cert# 28263)

- Citizens State Bank (FDIC Cert# 12501)

- Cloudbank 24/7, division of Third Coast Bank SSB (FDIC Cert #58716)

- CNB Bank

- Columbia Bank

- Continental Bank (FDIC Cert# 57571)

- Cornerstone Bank

- Customers Bank

- Dayspring Bank

- DR Bank

- First Community

- First Financial Northwest Bank

- First Mid Bank & Trust

- First Resource Bank

- First State Bank

- Freedom Bank NJ

- FVCbank (FDIC Cert# 58696)

- Generations Bank

- Grand Bank

- Hanover Bank (FDIC Cert# 58675)

- Idabel National Bank (FDIC Cert# 4241))

- Lemmata Savings Bank, a subsidiary of California Bank of Commerce (FDIC Cert# 58583)

- Liberty Savings Bank (FDIC Cert# 32242)

- Mission Valley Bank (FDIC Cert# 57101)

- mph.bank, a subsidiary of Liberty Savings Bank (FDIC Cert# 32242)

- Nelnet Bank

- NexBank

- OceanFirst Bank

- Optimum Bank

- Paprika Capital Bank

- Patriot Bank (FDIC Cert# 39928)

- Ponce Bank (FDIC Cert# 31189)

- Prism Bank

- Quontic Bank

- RBMAX (Republic Bank)

- Sallie Mae (FDIC Cert# 58177)

- Security State Bank

- Select Bank

- The State Exchange Bank (FDIC Cert# 13551)

- Sun Canyon Bank

- SWNB

- Western Alliance Bank (FDIC Cert# 57512)

These institutions typically provide brick-and-mortar banking services to personal and business accounts. Thanks to the Raisin relationship, membership is open nationwide to improve your banking needs.

How Does Raisin Work?

The service acts as a middle man making it possible to open interest-bearing accounts with several banks, but manage your balances with a single platform. You only interact with Raisin, but the partner bank holds your funds in a custodian account and pays interest.

If you like chasing yields and don’t mind shifting your funds to the bank with the highest interest rate, this streamlined approach can make it easier to manage your accounts.

First, Create an Account

The first step is creating a Raisin account by providing your name, email address, and password. Once you open an account with a particular bank, you will submit the usual legal details to verify your identity.

Then Compare Offers

You can compare rates for these banking products:

- High-yield savings accounts

- Money market deposit accounts

- Fixed Term CDs

- No Penalty CDs

Tapping an offer lets you review the product terms and look at vital details such as the yield, minimum deposit, and withdrawal limits.

Link & Fund New Account

You will fund your Raisin accounts by linking an existing checking or savings account through the third-party app Yodlee or manually submitting your routing and account number.

If you log into your account, turn off any adblocking extensions on your browser. If you have an ad blocker installed, it will mess up the log-in widget.

All deposits take up to three business days to complete, and you begin earning interest when the bank custodian receives your deposit.

Managing Accounts

Managing your account is as intuitive as you think.

You can log into your Raisin account to view your current balance, interest rate, and earnings.

This dashboard also lets you schedule deposits or withdrawals. Your monthly statements and tax documents are in the “Documents” section.

Interest compounds daily and deposits monthly for your various accounts.

Transferring Funds

If your funds are in a partner bank and you want to move them over to a new bank, you can transfer the funds to your Raisin Cash Account and then to the new bank.

For example, if you have funds in a Western Alliance Bank account and want to open a new CD at Wex Bank, you must first transfer your funds to the cash account. Then, once it has made it there, you can transfer them into a new Wex Bank account.

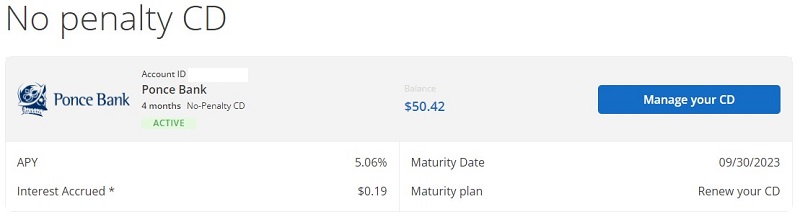

Renewing / Managing CDs is Easy

When I published this article, I opened a 4-month CD with Ponce Bank earning 5.06% APY. Approximately 30 days from its maturity date, Raisin sent me an email asking me what I wanted to do with the CD once it matured.

The default is to renew the CD.

To change it, you have to log into your account, view the CD, and click the “Manage your CD” button:

From there, you can Edit the Maturity Plan (the two choices are to renew the CD or do not renew the CD). You can also cancel your CD and incur any potential early closure fees. Since this is a no penalty CD, there would be no fee.

Super easy to do.

Just One Year-End Tax Document (1099-INT)

Besides a higher interest rate, this is one of the best benefits of using Raisin — you only get a single Form 1099-INT at the end of the year!

If you chase rates from bank to bank, you’ll get a Form 1099-INT from every bank where you earned $10 or more in interest (though you still owe taxes on any interest you make, even without a form).

With Raisin, you only receive one 1099-INT tax document, even if you have cash in multiple accounts!

Despite dealing with multiple banks, just one form means less paperwork when filing your taxes. This can save you a lot of time. You also avoid the annoying situation of forgetting to report a form and having to submit an amended return.

Is Raisin Legit?

Raisin is a legitimate platform for finding the best savings account and bank CD interest rates. There are no service fees, and the minimum deposit is only $1.

You may hesitate to use Raisin because it’s a relatively new technology company, not an actual bank. They are an extra layer between you and your money saved in a pooled account. However, it partners with FDIC-insured banks and NCUA-insured credit unions. You are fully insured. They send reports of balances daily so everything is reconciled.

Additionally, the savings account offers on Raisin are not advertised on the banking partner websites. This exclusivity can be a red flag for a potential scam as the interest rates sound “too good to be true.”

However, there are several customer reviews of account holders depositing funds, earning interest, and making successful withdrawals to their linked funding account.

Alternatives to Raisin

Perhaps you would rather deal directly with the financial institution, or Raisin’s list of partners doesn’t interest you; there are other ways to secure a great savings rate. Here are a few Raisin alternatives to consider.

MaxMyInterest

MaxMyInterest is similar to Raisin in that it’s a fintech company (not a bank) that helps you get higher yields by depositing your funds in partner banks. The big difference is that they offer an “optimization plan” that can help you boost your yields, but it costs money (Raisin is free). There is a 0.04% quarterly membership fee with a minimum of $20 – so it will cost you $80 a year.

Our MaxMyInterest review covers more.

5% Savings Accounts

High-interest savings accounts that can help you earn approximately 5% interest. You will typically need to complete a specific number of transactions and maintain a minimum balance to earn the highest rate.

These platforms also provide checking accounts that you can use to pay bills and manage your day-to-day transactions.

Discover Bank

You can earn a cash bonus if you qualify for a Discover Bank promotion. It’s possible to receive the bonus after satisfying the deposit requirements. Discover Bank offers a competitive interest rate that may rival the Raisin offers. This online platform also provides rewards checking.

Our in-depth review of Discover® Online Savings Bank provides more details.

Ally Bank

Ally Bank offers high-yield savings accounts and CDs with competitive rates and an easy-to-use platform. You can also open interest-bearing checking accounts and tax-advantaged IRA savings accounts.

There may also be Ally Bank promotions worth considering.

Raisin FAQs

No, Raisin is a financial technology (FinTech) platform that partners with banks. However, you can deposit funds with federally-insured banks and credit unions. Up to $250,000 balances are eligible for pass-through FDIC and NCUA Insurance.

These banks hold your money in a custodian account and award interest. While the banks store your wealth, Raisin manages deposits and withdrawals as requested.

Your deposits are protected with up to $250,000 in federal insurance – either FDIC for commercial banks or NCUA for credit unions. For data security, Raisin uses several practices, including Yodlee, to link to your bank accounts and guard your privacy. The platform is SOC 2 verified and uses external auditors to verify the security protocols to safeguard customer data.

You can contact Raisin from 9 am to 4 pm EST Monday-Friday when you have questions about banking services. Live chat and email support are also available to upload screenshots. An online knowledge library also answers commonly asked questions.

Final Thoughts

Raisin is a unique platform that offers some of the highest savings account and CD rates. You only have to deposit $1 to get started and won’t encounter any service fees.

While banking with FDIC-insured banks, you may still spread out your savings and use better-known high-yield savings accounts to deal directly with the bank when you need help.

Great review of raisin!, thanks for sharing

Thanks for the comprehensive review. Raisin sounds great… I have been playing the account shuffle game for the past couple of years, trying to find the banks with the best rates and moving money around as the rates change. It seems as if Raisin can help make that process much easier and eliminate the need to open new accounts. But so far, I’ve struck out in trying to set up a Raisin account. Every time I go through the account-opening process, I fail the verification and it won’t let me proceed further. I called their customer support (which is not… Read more »

I think freezing your credit reports is fairly standard practice nowadays, given how much identity theft and fraud is out there. I’m surprised they check your credit report, but maybe that’s just to confirm your identity since I don’t recall them asking for a photo ID.

It sounds super annoying though… sorry you had to deal with it!

Mr. Wang,

Thank you for this great article – it was very thorough and answered some questions I had about Raisin.

Thank you Amanda!