Spruce

Strengths

- No monthly fees or minimum balances

- Free overdraft protection

- 55,000+ fee-free Allpoint ATMs

- Earn cash back on debit card purchases

- Web and mobile platforms

Weaknesses

- Savings account doesn’t earn interest

- Some benefits require receiving direct deposits

- No physical branches

- Limited bill pay features

- Paper checks are available but are expensive

Traditional banks aren’t always the best option, as their fees are often higher, and you can’t always maximize the benefits. In addition, the membership requirements can also be challenging if you don’t have a clean financial history.

Thankfully, there are alternatives, like Spruce Money. Spruce offers free mobile banking and other hands-on tools to make saving money easier. For example, you can earn cash back at merchants, get free overdraft protection, and make savings goals.

But how does Spruce compare to other online banks, like Chime and Current?

In this Spruce Money Review, I’ll cover the various features and benefits, pros and cons, and share a few Spruce alternatives, to help you decide if Spruce is worth it.

Table of Contents

What Is Spruce Money?

Spruce Money is a free banking app from H&R Block that provides a debit card and savings account. While you don’t have to use H&R Block to join Spruce Money, being backed by such a large, reputable company is reassuring.

For clarification, Spruce Money isn’t a bank but actually a “modern mobile banking app.” Pathward, N.A. (FDIC Cert# 30776) – previously MetaBank – provides FDIC insurance of up to $250,000 on your eligible accounts.

Spruce strives to provide banking services to the “underbanked” who may not currently have a checking or savings account. They can enjoy basic banking features free of charge without balance requirements or having to make a minimum number of monthly debit card transactions.

Account Opening Requirements

You must be at least 18 years old and live in the United States to open a Spruce Money account. The application process takes less than 15 minutes to submit your details and review the paperwork.

Applicants must provide these details:

- Legal name

- Social Security number (SSN)

- Home address (P.O. boxes are not accepted)

- Phone number

- Email address

As soon as your Spruce Money account is activated, you’ll receive a virtual debit card to add to your mobile wallet. A physical debit card arrives within 7-10 business days at no extra cost.

You can download the Spruce Money mobile app (Android or iOS) or access the online dashboard to enroll in direct deposit, link external accounts, and set up other account features.

Spruce Money Fees

Spruce Money offers no-fee banking with the exception of cash deposits, over-the-counter withdrawals, and check orders. Here is a full list of services and corresponding fees:

- Monthly Fee: $0

- Foreign Transaction Fee: 0%

- Minimum balance fee: $0

- Mobile check deposit: $0

- Overdraft fee: $0

- In-network ATM transactions: $0

- Non-network ATM transactions: $3 per withdrawal (third-party fees cost extra)

- Cash deposits: Up to $4.95 (varies by location)

- Over-the-counter withdrawals: $4.95

- Checkbook: $15 per 25 paper checks

A free checking account can be a better option to avoid some fees that Spruce Money charges. For example, other alternatives are more likely to reimburse non-network ATM transactions and may also offer free paper checks.

Spruce Money Features

Spending Account

The Spruce Money spending account comes with a free debit card and zero minimum balance requirements. You can also provide your banking details to receive direct deposit from your employer and government benefits.

Paper checks are available for an additional fee when you need to write a check; however, the $15 fee for 25 checks is hefty.

Funding Options

You can fund your Spruce Money account using the following methods:

- Direct deposit

- ACH transfers from linked accounts

- Cash deposits at third-party merchants

- Mobile check deposit (available 30 days after account opening)

Once eligible, the mobile check deposit limits are up to $2,000 per day and $5,000 in a rolling 30-day period.

Savings Goals

You can begin setting aside money in an FDIC-insured savings account as soon as you open your account. A Spruce Money savings account has no monthly fees or minimum balance requirements.

The platform lets you create up to three subaccounts to save for different goals. You can schedule recurring transfers or make one-time transfers. You can also round up debit card purchases and transfer the difference to your desired goal for effortless saving.

Unfortunately, the account doesn’t earn interest and is best for short-term savings targets. Instead, consider a high-yield savings account to earn interest on larger cash amounts.

Overdraft Coverage

Spruce’s Courtesy Coverage feature provides up to $20 in fee-free overdraft protection.

Qualifying transactions include:

- ATM withdrawals

- Debit card purchases

- Over-the-counter withdrawals using your Spruce Debit card

If your account goes into overdraft, you have 30 days to cover your negative balance. Typically, Spruce automatically collects the overdrawn amount from your next deposit. You won’t pay any fees or interest during this situation.

For transparency, you must receive at least $200 in qualifying deposits (direct deposit, ACH transfers) in a 35-day period to be eligible, and you must opt-in for the overdraft overage to take effect.

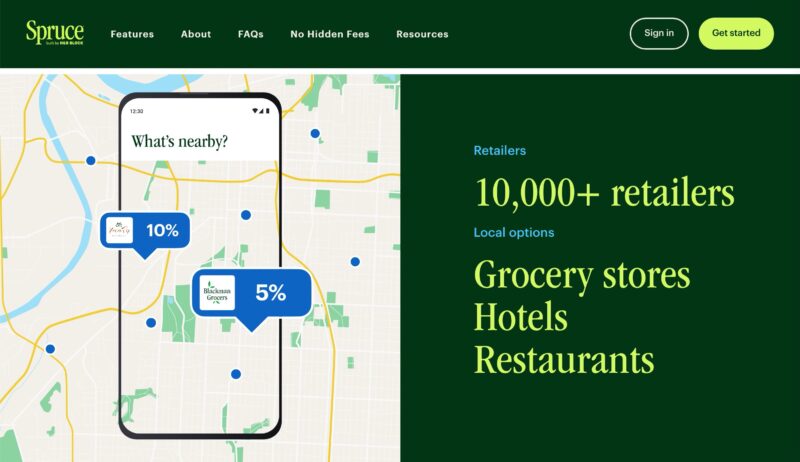

Cash Back Offers

Spruce partners with Dosh to reward customers with cash back at participating in-store and online retailers. Over 10,000 retailers participate, including national brands and small businesses.

You can earn cash back on the following purchases:

- Clothing

- Dining

- Groceries

- Hotels

- Merchandise

First, scan available offers within the Spruce mobile app. Next, pay with your Spruce Money debit card, and the cash back is automatically transferred into your savings account. No activation is necessary.

Fee-Free ATMs

Spruce money customers have access to no-fee withdrawals at 55,000+ Allpoint ATMs across the United States. You can locate ATMs using the Spruce Money mobile app or website.

Non-network ATM fees include a $3 withdrawal fee plus any surcharges the ATM owner tacks on.

You can deposit cash at GreenDot locations, which are located at many retail stores and pharmacies nationwide. The cash deposit fee costs up to $4.95 per transaction, and the price varies by merchant.

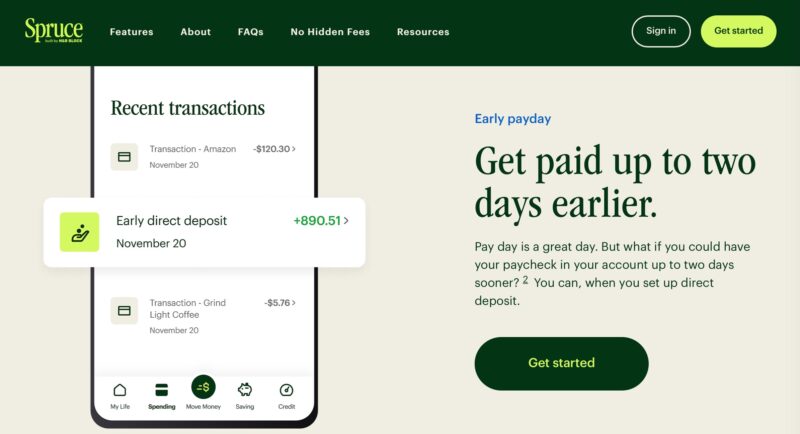

Early Payday

With Spruce, you can access your direct deposits up to two days early. You’re automatically eligible once you receive at least $200 in qualifying deposits from an employer or government agency (excluding tax refunds).

Other banking apps advertise this feature, but the timeframes vary.

Free Credit Score

Spruce members can automatically track their FICO Score 8 through Experian from the member dashboard. The service is free.

The score updates every 30 days, and checking it doesn’t hurt your credit score. In addition to displaying your current credit score, the app lists the factors that are either helping or harming your credit journey.

Spruce Money Pros and Cons

There’s a lot to like about Spruce Money, but it has some drawbacks, too. Here is my list of Spruce pros and cons:

Pros

- No monthly fees or minimum balances

- Free overdraft protection

- 55,000+ fee-free Allpoint ATMs

- Earn cash back on debit card purchases.

- Web and mobile platforms

- Check your credit score for free

Cons

- Savings account doesn’t earn interest.

- Some benefits require receiving direct deposits.

- No physical branches

- Limited bill pay features

- Paper checks are available but are expensive.

Spruce Money Alternatives

Before signing up with Spruce, you may want to take a closer look at the following Spruce Money alternatives, all of which offer a similar service.

Chime

Chime provides a free spending account and an interest-bearing savings account. In addition, there are no service fees or balance requirements. Additional benefits include overdraft protection, online bill pay, and over 60,000 fee-free ATMs. At the moment, Chime is paying 2.00% APY on savings, a big plus compared to Spruce Money, which doesn’t pay interest.

You can also be eligible for a Chime Credit Builder secured credit card to help build a credit history and improve your score. Read our Chime Bank review for more information.

Current

Current can help you extend free banking services to your entire family as this banking app offers free teen accounts. Membership benefits include cash back on qualifying debit card purchases, up to $200 in overdraft protection, and interest-bearing savings pods. Read our Current Bank review for more.

Step Card

If you want a free banking account that can help you build credit, consider the Step Card. Step is primarily to help teens learn the basics of money and earn cash rewards by completing short lessons. Additionally, parents (and teens older than 19) can enjoy credit-building benefits from the three bureaus with monthly reporting. There are no fees or balance requirements, and this isn’t a high-risk credit card.

Spruce Money FAQs

Yes, Spruce Money is a legit online banking app built by a reputable company. Its fee-free spending and savings accounts are FDIC-insured through Pathfinder, N.A. (formerly MetaBank).

It’s open to all legal adults and can make it easier to receive deposits and plan for purchases. However, the bill pay limitations and lack of local branch access will be frustrating to some that need advanced banking services.

Pathfinder, N.A. provides Spruce’s spending accounts and savings accounts. The accounts are FDIC-insured. Pathfinder previously operated as MetaBank but changed its name in July 2022.

You can apply online and log into your banking accounts through the website (sprucemoney.com) or the Android/Apple mobile app.

Live chat and phone support are available.

Final Thoughts on Spruce Money

Spruce Money is one of the better starter banking apps. It’s backed by H&R Block, a large, reputable company. You can easily avoid fees and access your cash. The cash back rewards are a nice perk, as is the no-fee overdraft protection, albeit it’s only $20.

Unfortunately, Spruce won’t appeal to many online banking fans until they begin paying interest on savings account deposits, especially when competitors like Chime and Ally Bank are paying much higher interest rates.