American Express® Personal Savings Account

Product Name: American Express® Personal Savings Account

Product Description: American Express Personal Savings Account is American Express' deposit product that offers a competitive interest rate but no associated checking account. They also offer certificates of deposit but it is not meant as a transactional account. With no minimum balance and no monthly fees, it's a nice offer but with rates that aren't marketing leading, it's only appealing if you want to expand your relationship with American Express.

Brand: American Express

About American Express

American Express is best known for their suite of credit cards but they’ve also expanded into deposit products too, with the American Express Personal Savings Account as their flagship product.

Overall

Pros

- Very competitive interest rate (APY)

- No minimum, no fees

Cons

- No checking account

- Below average CD interest rates

- No app

- No mobile check deposit

American Express (AMEX) is best known for its credit cards but they do much much more. Credit cards are where they started, many years ago, but now they offer bank accounts too.

We know they have great perks on their credit cards, but what about their bank products?

Their high yield savings account is called the American Express® Personal Savings High Yield Savings Account and currently offers a very competitive interest rate compared to many of its peers, we keep a list the best online savings accounts and its rate is in the same ballpark.

Table of Contents

About American Express

American Express is an iconic financial brand with decades of history. It was founded back in 1850, is one of the thirty components of the Dow Jones Industrial Average (AMEX has been a component since 1982 when it replaced Johns-Manville Corporation), and accounts for over 20% of the total dollars transacted on credit cards.

Did you know that American Express started as a mail business? In 1850, it was created as an express mail service in New York from the merge of two existing express companies owned by Henry Wells and William G. Fargo (do those two names sound familiar?) and John Warren Butterfield (who? — just kidding, he doesn’t have the name recognition but he played a role in AMEX and Wells Fargo too).

Soon after, in 1857, American Express launched a money order business. Then a traveler’s cheque business. Then, during World War I, American Express saw it’s express mail business, which was facilitated by its railroad network, taken over by President Wilson to move troops, supplies, and coal. The railroad business was taken over by what became the American Railway Express Agency.

In 1958, American Express issued its first card and the rest is history.

American Express National Bank (FDIC #27471) was established in 2000 and headquartered in Salt Lake City, UT. If that date seems strange to you, it’s because American Express sold its previous banking division to Standard Chartered in early 2008.

If you need to contact American Express National Bank:

- Call 1-800-446-6307, open 24 hours a day, 7 days a week

- Mail American Express National Bank, P.O. Box 30384, Salt Lake City, Utah 84130

The American Express National Bank ABA routing number is 124085066 and there are no physical branches. It’s either online, over the phone, or nothing (hence 24/7 telephone support).

American Express Banking Products

American Express National Bank offers high yields savings and certificates of deposit. You won’t find any lower interest checking accounts, for that you’ll need to go elsewhere, but you can link up to three bank accounts to your American Express® Personal Savings.

A quick summary of the two products (rates as of 4/26/2024):

- High Yield Savings: No monthly fees, no annual fee, no minimum balance, competitive rate of 4.25% APY.

- Certificates of Deposit: Maturity periods from 6-months to 60-months, no minimum deposit and the 60-month CD yields 3.00% APY

It’s important that there’s no transacting account, like a checking or money market account. This means that you’ll need to ACH money out of the account to access it on a daily basis. ACH transfers can take as many as 3 days.

This also means there’s no ATM access.

If you want cash, you’ll have to transfer money out of your AMEX Personal Savings account to your checking account. If you want to deposit a check, you’ll have to deposit checks by mail. Sign them, write “For Deposit Only in Account” underneath your signature, include instructions, and mail it to them at American Express National Bank, P.O. Box 30384, Salt Lake City, Utah 84130.

Finally, your maximum account balance is $5 million. I didn’t even know you could have an upper limit, 0.0000001% problems I suppose. 🙂

Opening a Personal Savings Account

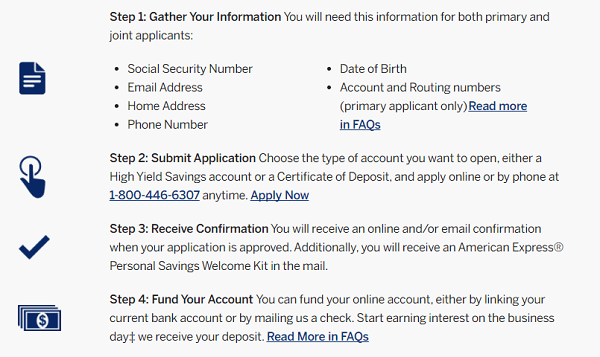

Opening an account is a super simple 4-step process:

- Gather your Information (primary and joint applicants): This includes Social Security Number, Email Address, Home Address, Phone Number, Date of Birth, and Account and Routing numbers for the accounts you want to link to the personal savings account you’re opening.

- Submit Application: Pick which account you’re opening (personal savings account or CD) and apply online or via the phone at 1-800-446-6307 24/7.

- Receive Confirmation: When approved, you will receive a confirmation online and/or via email. You’ll also get an American Express® Personal Savings Welcome Kit by mail.

- Fund Your Account: Once your account has been opened, you can fund it with the linked account or mail them a check.

That’s it! It’s super simple and fast. You will not receive any debit cards, checks, or an ATM in the mail though. Those are just for checking and MM accounts.

Fees & Penalties

American Express® Personal Savings doesn’t have a minimum balance and doesn’t charge a monthly fee on their high yield savings. The same goes for their certificates of deposit.

Since the high yield savings is a savings account, you are subject to the 6 ACH limit rules. If you exceed 6 transfers in a statement cycle, American Express may close your account if this happens too much (this is standard practice, in fact, most places will charge you a fee). There does not appear to be a fee.

Their certificates of deposits have early termination fees on this schedule:

- Term 12 months or less: 90 days of interest

- Terms of more than 12 months: 180 days of simple interest

These interest penalties are better (more generous) compared with most banks but still lag behind the best of the best, Ally Bank:

- Term 24 months or less: 60 days of simple interest

- Terms of more than 24 months but less than 36 months: 90 days of simple interest

- Terms of more than 36 months but less than 48 months: 120 days of simple interest

- Terms of 48 months or more: 150 days of simple interest

I don’t see this as a reason to avoid American Express National Bank (their current CD rates are meh, that’s a reason not to use them for CDs). No other bank comes close to matching Ally Bank’s CD penalty structure.

Conclusion

American Express® Personal Savings is a middle of the road online savings account. Its rates are competitive, so if you have an account there I wouldn’t suggest switching away for interest purposes (it rarely makes sense, unless we’re talking a move from 0% to 1%).

There’s no checking account, so you’re limited by Regulation D’s 6 transfer rule (which has since been suspended), and the CD rates are lower than other high yield banks.

Overall, it’s average and I’d consider other options if you’re picking an online bank for the first time.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone and have not been reviewed, approved or otherwise endorsed by American Express.

Thanks! I’ll update it and notify our data partners too.

This may be a silly question, bit does AMEX check your credit score when applying for a savings account? And if so, even if you already have a credit card with them?

Generally speaking, very few banks will check your credit score (hard inquiry) before giving you a savings account. They usually do a soft inquiry to confirm the details of your account.

AMEX does have mobile check deposit fyi