We are wonderfully predictable creatures, aren’t we? 🙂

We love to gamble. We love the get rich quick story. We love the lottery. We love the rags to riches story so much that it is the basis of many classic stories.

And no one likes to gamble, get rich quick, or play the lottery like a group of human beings thinking together. The mob.

Oh, that beautiful mob.

The mob is what creates investment bubbles. Whether it’s the often cited tulip bubble in 1636-1637 or the more recent bubbles in the dot-com, housing bubble, and financial crisis/Great Recession, speculation inflates prices to the point where they’re ripe for a nice painful pop.

One of the hard parts about investing is that we are drawn to these exciting areas but these exciting areas can cause financial ruin.

The most recent bubble to pop was bitcoin. More tulip bulb than a house, it reached a peak near the end of 2017 of almost $20,000. It’s only worth less than $3,500 now (at the time of the original writing of this post).

(it’s since had a resurgence getting up to around $40,000 a coin!)

How do you avoid these investment bubbles?

Table of Contents

Have a Plan, Stick to It

You avoid them by avoiding the temptation. You avoid temptation by building a financial plan and sticking with it.

If you don’t have a financial plan, it’s time to create one. This plan will help you understand how much you need to save, the returns you need on those savings, and when you can retire.

Your plan will not include you “winning the lottery” or “making 200%+ on Bitcoin.”

“But Jim! Don’t you want to retire earlier? Wouldn’t it be great to win the lottery?”

Yes, it would. But that’s not part of the plan. And the probability you don’t win the lottery and don’t make money on Bitcoin is greater than the probability you do.

Plus, no one retires early because they made a series of risky speculative bets and won them all. All those stories you hear of winning bets are surrounded by even more untold stories of losing bets. Very few people put their failures out in the open (mine aren’t spectacularly bad because I don’t make spectacular bets!).

If you want stories, go to Vegas. You can double your money in seconds with odds that are well published. You can carve out a piece of your investment portfolio for risky speculative bets if you want to scratch that itch. I did it… but I put it in dividend growth stocks… so wild! 🙂

The Game Keeps Going

In sports, there are walk-off home runs and game-winning shots. The game ends at some point and whoever has the most points is declared the winner.

Investing isn’t like that. Making a winning bet is fine for today but you need to make a winning bet over and over and over again for it to matter.

If you don’t make good bets, or you make too many bets, the end of your life will be miserable.

The money you invest is the product of your hard work converting your life into money. A winning bet gets you more investment capital but a losing bet could cost you hours of your life. (and these are not hours of your life today, these are hours of your life added onto when you planned to retire)

To keep the sports analogy going… you want to make a series of base hits, mixing in a few doubles and triples from time to time. You don’t need the home runs. And you surely want to avoid as many strikeouts as possible.

You’re A Minnow in a Sea of Sharks

Another way to avoid the temptation? Know that you will get eaten ALIVE.

If you want any high-level competition, you’ll know that regular folks don’t stand a chance. We recognize this in sports because we can see it. The CDC says the average height for a male is 5′ 9″ tall. The average height of an NBA player is 6′ 7″ tall.

What we don’t see are the mental aspects and the preparation. Kobe Bryant has a routine that starts 4 hours before game time. It includes a 20-30 minute period where he puts up 250+ shots. If that’s his pre-game routine, can you imagine his practices?

At the highest levels of anything, you have a mix of physical and mental ability plus technology and preparation.

At the highest levels of investing, you’re competing against brilliant minds backed by an army of analytics and computers programmed by the smartest people you know.

In the stock market, your only advantage is that you have no shareholders and are not required to show annual gains. You have the benefit of time. If you try to compete in speculative investments, you need an edge or you’re meat.

Few Winners, Many Losers

With the lottery, you know that there are a few winners and many many many losers.

You don’t realize it happens with other investments because it’s not obviously baked into the system.

With the stock market, there are winners and losers but the constant inflow of money, into the market and into businesses, makes it possible for the prices to go up over a long enough time period (that and inflation). Since you’re not a fund manager who has to file quarterly and annual reports, you don’t need to show a return this year. Or next year.

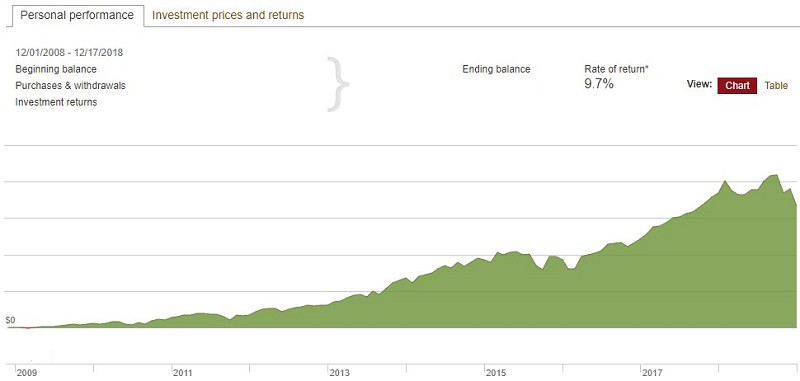

This is a look at my Vanguard portfolio’s returns over the last 10 years. It includes the most recent Q4 stock market “correction” (ouch) that erased all of 2018’s gains. I don’t get 9.7% every single year, it’s far lumpier than that, but the slow and steady means the annualized return is nearly 10%.

As stock prices move, each transaction can create gains and losses. The system isn’t zero-sum, because money keeps moving in, but there are winners and losers.

When the stock market goes down, you can still win if you maintain a long term horizon. If you’re willing to wait, you’re going to be a winner.

Avoid It If You Can’t Understand It

Some old adages are crap, like how you can’t wear white after Labor Day.

Others are gold, like if you can’t spot the sucker at the table… the sucker is you.

I avoid all investments I don’t fully understand.

The stock market is not a simple creature but the fundamentals are straightforward. You are buying shares of stock, which represent ownership, in companies. Everything is built off that basis. Options are contracts that give you the right to buy or sell shares at a set price. You may not be able to price it accurately but you understand what it means.

Do you understand what Bitcoin is? Or blockchain? Or what miners are doing? I don’t understand blockchain nearly as well as I need to for investment. And I’ve studied enough to write a post on how to buy cryptocurrency (which is not something I’ll do).

Like everything else in this world, if you don’t understand it, the folks who do understand it will take advantage of you.

This is something I’m instilling in my kid. After a recent trip to a carnival, I showed my seven-year-old son videos of carnival games and why they are mostly scams … and now he knows not to play them!

Just Wait

Let inertia be your friend!

Fear of missing out is a very real thing and if you were looking at houses in the five years ahead of the housing bubble, it wasn’t clear where the top was. The economy appeared strong, interest rates were low, and homes were selling for a lot on a per square foot basis.

I remember telling my dad we offered a few thousand over asking price, and at the time they last bought a house in 1980, and he thought I was nuts. “No one offers over asking price!” he said – but in the DC area, everyone was offering like 5-10% over asking. (they’re doing that now!)

But houses aren’t like bitcoin. You live in them. You sleep in them. You raise your family in them.

If you are worried, just wait for a little bit. Bubbles pop. Or buy it and be willing to wait for a bit after the bubble has popped for the recovery. After a bubble pops, there’s a lot of waiting.

The home we bought in 2005 was sold in 2014 for less than what we bought it. It appeared to be a loss on paper but I did the math and figured we paid ~$500 per month to live in a townhouse. It would’ve been far more with rent. A nearby house, similar in size and design, was sold earlier this year… selling price was still below what we paid in 2005.

But it’s a house. You can live in a house and just wait it out. Or do the math and tell yourself you paid a way below market rent!

FOMO is real but missing out on a bubble bursting feels pretty good.

When Everyone Is An Expert, Watch Out

My favorite “quote” from the 1929 stock crash was by Joseph P. Kennedy Sr. and chances are you’ve heard it too. He was a businessman, investor, and politician but you probably recognize his last name more for some of his children – President John F. Kennedy, Senator Robert F. Kennedy of New York, and Senator Edward “Ted” M. Kennedy of Massachusetts.

Here’s a quote from a 1996 archived FORTUNE magazine article that explained how he avoided the 1929 crash:

JOE KENNEDY, a famous rich guy in his day, exited the stock market in a timely fashion after a shoeshine boy gave him some stock tips. He figured that when the shoeshine boys have tips, the market is too popular for its own good, a theory also advanced by Bernard Baruch, another vested interest who described the scene before the big Crash:

“Taxi drivers told you what to buy. The shoeshine boy could give you a summary of the day’s financial news as he worked with rag and polish. An old beggar who regularly patrolled the street in front of my office now gave me tips and, I suppose, spent the money I and others gave him in the market. My cook had a brokerage account and followed the ticker closely. Her paper profits were quickly blown away in the gale of 1929.”

Learn From Bitcoin

Bitcoin is still around. It didn’t crumble into ashes like many dot-com companies. It didn’t leave people underwater on their homes or trapped under mounds of debt. It may have hurt to buy Bitcoins at $16,000 and only have them be worth $3,500, but at least it’s not zero. And the technology still holds promise, even if the currency has taken it on the chin.

But now is a good time to innoculate yourself from potential future mistakes by taking it all in. As someone who sat on the sidelines, I did not feel bad that I missed it going from $3000 to $15,000. Nor did I feel happy that I avoided it’s subsequent fall. I’m sure there were folks who made a bundle just as there were folks who lost their shirts.

Either way, it’s a reminder that this type of stuff isn’t for me. Heck, my idea of speculation is buying shares in blue chip companies paying dividends… what do I know. 🙂

It’s called speculation for a reason.

Dave @ Accidental FIRE says

I just use index funds, automate it, and let it go. It’s the easy way to avoid trouble.

DNN says

If I didn’t have teaching in me, I would dabble with investing and see if i could find a way to finegal using other people’s money to buy stocks. This way, if I mess up, it’s not my own money being lost and I would still be A+ ok.

Cathleen Cooks Stuff says

Love references to the Dutch Tulip craze. I think it’s getting more popular with the movie (or was it a TV series?!) that just came out. But as for waiting and holding after the bubble burst, I’d have to argue that there is no one that can fetch a house for a tulip bulb. Even after all these centuries of waiting. So sometimes buy and hold does not work.

But a bunch of the bubble does sounds like gambling- some few win (making others excited to get into the game) and most lose.