Alternative investments come in all shapes and sizes. For some, alternative means anything that’s not the stock market. Real estate is an alternative asset. Farmland is an alternative asset.

For others, it has to be “out of the ordinary” like a collectible – think wine, art, and NFTs.

In fact, NFT’s are bringing alternative investments to a whole other level. Last week, I spent $9 on a pack of three NBA “moments” – short video clips from NBA games. It was a three-pointer by Steph Curry, a dunk by Tomáš Satoranský, and a jump shot by Nikola Jokić.

If I wanted to sell those three moments right this second, I could get $28 minus a 5% transaction fee. A nice little return, except I’ll be holding these.

Why am I messing around with NBA Top Shot? It’s fun.

I never collected sports cards as a kid, I was more into Magic: The Gathering and comic book cards. I was a big fan of the NBA as a kid (still am today) but never got into the cards – so I “get” the appeal even if I never participated in it.

If you are going to participate in alternative investments, you should do your homework and truly understand the pros and cons of alternative assets, which apply to these less-regulated (or not at all regulated) assets.

Let’s check out the pros and cons you must be aware of when it comes to alternative investments:

Table of Contents

Pro: May Not Correlate with Stock Market

It’s easy to see how a piece of real estate or a bottle of wine may not directly correlate with the stock market and that’s part of the appeal.

If you’re invested in an index fund, such as the S&P 500, you have a big investment in technology. When you look at the S&P 500 Companies by Weight, The top six are tech (Apple, Microsoft, Amazon, Facebook, Alphabet/Google) and they make up, as of this writing, 20.7% of the index!

While stock market performance can impact other investments, or rather the factors that impact the market can also impact other investments, it’s nice to have something outside of the market.

Pro: May Have Greater Upside

The stock market is a pretty big animal and it doesn’t move very quickly. In fact, the stock market has “circuit breakers” to prevent massive downward moves because of how impactful (in a bad way) they would be on the system.

But alternative investments don’t have these protections.

Let’s take a look at Bitcoin. It can be classified as a currency and an investment but the reality is that it’s only as valuable as the next person thinks it is. It’s no different than any other collectible, like a work of art.

But check out this chart for the last year:

And this chart for the last month:

I took those screenshots in mid-May but a few days later, after a few tweets by Elon Musk and news about crypto in China, the price dropped even further to under $41,000 per coin! It’s a wild ride.

Volatility is a great way to make (or lose) a lot of money!

Pro: Expertise Matters

If you have expertise, it can be a massive edge in alternative investments.

Real estate is a prime example of this. If you are an experienced flipper, you have an edge over novices and companies that are looking to do a ton of volume. You can analyze deals faster, find opportunities that others may overlook, and you then able to execute those deals far better. If you have an existing rehab team, you can get to work immediately when others have to get quotes and work with new contractors on a deal.

Most importantly, you avoid time and money sinks because your expertise can identify those earlier on. These are all edges that you can use, over and over again, to improve your returns.

The same could be said for the stock market but I’d argue that there is a lot of existing expertise in the stock market. There simply won’t be the scale of competition if you were to pick real estate in a small geographic region.

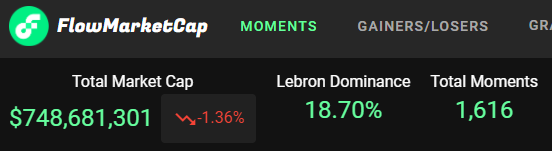

It gets even smaller if you look at niche markets that may be large but still relatively new. For example, NBA Topshot is essentially a marketplace of NBA “Moments” NFTs with a $750 million dollar total market cap (as of May 15th, 2021) and very new.

There are some sophisticated investors on the platform but it’s nothing like the stock market. I’m not suggesting that you go out and become an “investor” on the platform but there are plenty of areas like that.

Pro: May Be More Fun

Maybe reviewing financial statements is fun for you but it’s not really fun for me. That’s why my stock market investments are almost exclusively in index funds. I have a few dividends stocks but it’s mostly boring Vanguard index funds.

I find many alternative investments far more interesting and fun to study and learn about. I recognize that I may be sacrificing some return for this fun but since my “responsible” investments are checked off, I think having a bit of fun and educating myself in the process is a good way to spend my time.

By fun, I don’t mean fun like NBA Top Shot – I mean fun like farm investments via AcreTrader and wine on Vinovest or Vint.

Con: May Have Tax Headaches

The biggest problem you’ll face (tax-wise) is that you’ll start getting a lot of Form K-1s.

When you invest in property, you’ll do so as a limited partner and you will receive a Form K-1 every year. And you will get one for every single partnership.

This also means you will have to file a tax return in every state in which you have an investment. If you buy a piece (of a piece) of property in Illinois, Louisiana, and Kentucky, you will have to file a state tax return in Illinois, Louisiana, and Kentucky. If those K-1s show enough income and you failed to make estimated payments, you’ll owe penalties too.

At best, you’ve invested in some minor headaches that you’ll have to deal with at tax time. At worst, you’ll have made a small investment just to pay a penalty. 🙂

Con: May Be Highly Illiquid

Many alternative investments are highly illiquid. They make a point of saying so in the prospectus.

If you buy a fractional share of art, you can’t sell that share unless the platform has a secondary market. Many do not have a secondary market because that requires even more regulation, and so you’re stuck with your investment until it is sold. That’s why it’s important to learn how to invest in art ahead of time, if you intend to do it. You don’t want to learn about how illiquid it is when you need your money back!

This is true for shares of any private real estate investment trust (REITs). If you invest in a publicly-traded REIT, like American Tower (AMT) or Crown Castle (CCI), you can sell it on the open market whenever the market is open.

With a private REIT, you can only get your cash when you redeem them with the company. There may be required holding periods and penalties if you redeem your shares prematurely. If there are times of turmoil, the fund may decide to suspend redemptions – and there’s nothing you can do about it.

Con: May Have Higher Fees

When you invest in a mutual fund, the fees are transparent and published in a prospectus. Since they are regulated, they have to list out everything and typically using labels and terms that let you compare them against other comparable investments.

Every mutual fund will list out their fees using the same terms. For example, Vanguard’s Total Stock Market Fund (VTSAX) has an expense ratio of 0.04% (as of 4/17/2021) with no purchase fee, no redemption fee, and no 12b-1 fees. Fidelity’s Total Market Index Fund (FSKAX) has a 0.015% expense ratio (as of 4/17/2021) and also no purchase fee, no redemption fee, and no 12b-1 fees. Easy to compare.

There are other “costs” associated with mutual funds that offer a bit of variance behind the scenes like how often the funds trade, create taxable events like capital gains, but those are generally smaller in nature and present in any similar investment. You wouldn’t expect the Fidelity fund to trade more frequently than Vanguard fund. With index funds, there may be differences in tracking too – but again should be minimal.

With alternative investments, the vocabulary won’t be the same and you may not be as familiar with them so it’s hard to compare them.

A prime example is if you opt to invest in wine, an asset that has the added expense of climate-controlled and insured storage. A share of stock doesn’t need to be climate controlled or insured.

Vinovest charges investors 2.5% to 2.85% of assets under management, collected monthly. Compared to an index fund, that’s high, but you don’t need temperature control for stocks. 🙂

I started looking for other companies offering investments in wine and found it extremely difficult to even see how much they charged in fees! Is Vinovest expensive? Maybe. I was able to find one warehouse storage service, Vinfolio, and their President (Adam Lapierre) told me that their storage fees are per bottle – starting at $0.39 per bottle per month ($4.68 a year). You have to submit a quote and I wasn’t prepared to spend my time (or waste theirs!) to find out more.

Remember NBA Top Shot? There are no maintenance fees but the platform takes 5% of each transaction!

Con: Less Price Transparency

Going almost hand in hand with little to no liquidity is how there’s no public market so there’s very little price information. You can look up the price of any stock in seconds – it’s harder to look up the price of a piece of commercial real estate. You’re left to researching recent sales and comparable properties – which, if you’ve ever bought a house, is tricky.

Also, with little to no liquidity, price transparency might not even matter. When you’re talking about a small market, price information might be more of a psychological anchor than anything else.

Also, what does it matter how much something is worth if you are unable to sell it?

Con: Investment Platforms Can Fail

With many of these alternative investments, the platform facilitates the relationship. You are still a limited partner in an organization that exists outside of the platform.

I wrote that I wasn’t going to name names but in this case, it makes sense (also, the company is gone so is it really naming names if the entity no longer exists?)

When RealtyShares collapsed, my investments were fine. Each of the properties was in their own LLC, separate from RealtyShares. When IIRR Management Services took over the ongoing operations of RealtyShares, nothing changed with the underlying investments.

I still get reports about the last active investment I still have on the platform (it has a target exit date of April 2022 so it’ll be a while!) and everything is going well:

So while everything was fine, it’s not fun to hear that a company has gone under and you have thousands of dollars invested through their platform.

Con: They May Have Risks You Didn’t Consider

Risk can take on many forms.

There are other considerations you may not have even thought about. For example, when you buy shares of stock, you don’t take ownership of actual physical shares. The system is set up so that you never have to and so things can happen much faster. (It’s known as “in street name,” the brokerage holds the shares in the brokerage’s name and not yours.)

What if you invest in wine? It’s certainly possible for you do it but that introduces another layer of complexity. With that asset class, you have all the concerns of any investment (Am I buying the right wine? Will it appreciate? Is this a good price?) but then you have the risks of storage, especially if you do it home (Is it the perfect environmental conditions? Will it be protected?).

You can offload that storage risk with platforms – for example, Vinovest is a platform that facilitates investing in individual bottles of wine. They will store it in perfect climate-controlled environments with insurance to protect them but you still have all the other concerns about pricing, fees, etc.

This, of course, is possible with any investment but those that require specialty storage add another layer.

What about fraud and fakes? With shares of stock, you don’t have to worry about the shares not being real. With wine or with collectible trading cards or something that can be faked, you have to worry about fakes. You can use a platform that can vet the items but that relies on the platform (or rating agencies) to be 100% correct – and that might not be the case.

This is similar to risks you have with real estate and undisclosed (or unknown) problems with a piece of property. At least, in that case, the property still has value (albeit diminished) but a fake collectible is going to be worthless.

Again, a consideration you don’t have with traditional investments.

Did I capture all the pros and cons of alternative investments?

Hi Jim – thanks for covering wine as an alternative investment! I’m not sure where you received the information that we charge 1.5% of the value of the collection for storage, but that statement is wildly inaccurate. I’d be happy to speak with you to provide details around our program – it’s certainly not a waste of our time to ensure your readers have comprehensive, accurate information when considering investment vehicles.

Adam Lapierre

President

Vinfolio

I’ll send you an email and we can get this fixed, thanks Adam!

In regards to your bullet “expertise matters” and your comments about investing in art and farmland, did you really have expertise there? What thoughts do you have for someone like me who does not have that expertise, but would still like to diversify that way. How did you determine what would be a good investment?

I don’t have expertise in art or farmland (or real estate) but you invest with operators who do and you can get higher returns for that asset class (but you pay for it in fees).