Behind every mainstream story about a couple retiring in their 30s and traveling the world is a story of struggle, sacrifice, and smart trade-offs.

The idea that you could retire early, that is to say before you were in your 60s, has been around for centuries.

The earliest FIRE bloggers, or FI/ER if you want to stay true to the acronym, started in the mid-2000s just prior to the Great Recession but after coming out of the depths of the dot-com boom. I remember some of them from back when I started my first personal finance blog Bargaineering. Some, like Early Retirement Extreme, still exist and are going strong.

If this is something you are interested in and you want to read first-hand experiences, rather than the “made for TV” stories you read on the likes of Yahoo or MSN, check out these blogs because they will really open your eyes to what is possible and what it takes to FIRE.

These blogs are not one size fits all. You may not like the approach of Mr. Money Mustache or you disagree with what Jim Collins writes, but the key is to take what you do like from each to build your own strategy to early retirement. This is also just a starting point – use this to propel you to dig deeper into this world and learn more about the myriad of people, styles, and approaches within it.

Here they are, in no particular order (originally published March 2018):

Table of Contents

- Pete – MrMoneyMustache.com

- Jacob Lund Fisker – EarlyRetirementExtreme.com

- FIRECracker & Wanderer – Millennial-Revolution.com

- Jeremy & Winnie – GoCurryCracker.com

- The Mad FIentist – MadFIentist.com

- Tanja Hester – OurNextLife.com

- Jim Collins – JLCollinsNH.com

- Carl (Mr. 1500) – 1500 Days to Freedom

- Joe Udo – RetireBy40.org

- Justin – RootOfGood.com

- PoF – Physician on Fire

- Big Ern – Early Retirement Now

- Steve Adcock – SteveAdcock.us

- Jess & Corey – The Fioneers

Pete – MrMoneyMustache.com

Pete, who goes by Mr. Money Mustache, started the blog in 2011 – six years after he and his wife had actually retired. Both he and his wife studied engineering and computer science, and worked in “standard tech industry cubicle jobs” during the 1990s and early 2000’s.

Their secret to early retirement? Living a lifestyle that’s about 50% less expensive than most of their peers, and investing the money in index funds and rental property.

He started the blog in response to claims from friends and former coworkers about the difficulties of middle-class life. On the blog, he shares his secrets to early retirement, including how to live on a lot less money.

- The Blog: Mr. Money Mustache

- Follow on Twitter: @mrmoneymustache

- One of my favorites: Getting Rich: from Zero to Hero in One Blog Post – I enjoy this post because it’s his version of a “Start Here,” it captures his story and as someone who is one of the OGs of FIRE, it’s worth knowing its history.

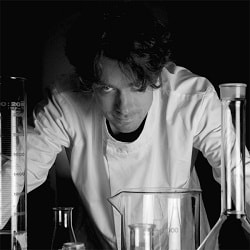

Jacob Lund Fisker – EarlyRetirementExtreme.com

Another FIRE OG, and arguably THE OG if you wanted to pick just one, Jacob is (or was) a nuclear astrophysicist by trade, but started the blog to enable people to become financially independent in as little as five years. He advocates running your personal finances like a business that’s flexible, agile and adaptable. From there, he shows you how to save between 40% and 80% of your income, on the way to accumulating a six-figure net worth.

Jacob takes the position that early retirement is about much more than cutting expenses, but rather creating an entirely new philosophy of life. He claims to have enough money socked away to maintain his lifestyle for – get this – the next 129 years!

- The Blog: Early Retirement Extreme

- Follow on Twitter: @extremejacob – He’s not very active on Tiwtter though

- One of my favorites: Manifesto – Much like MMM and knowing your history, I think it’s powerful to read Jacob’s post from 2008 (yes, nearly 10 years ago) because it very much captures the spirit of FIRE. “Success is having everything you need and doing everything you want.” — not a bigger house and more space and more stuff and… read it. Then read it again. Then chase it with this post on how he became financially independent in 5 years (it’s not some bull-shit clickbait title, it’s legit).

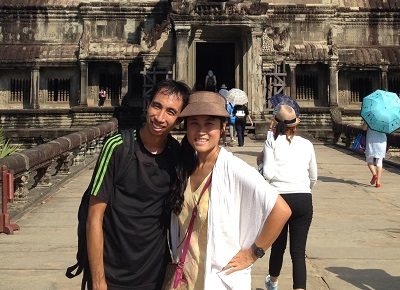

FIRECracker & Wanderer – Millennial-Revolution.com

Written by FIRECracker (Kristy) & Wanderer – they are a pair of former computer engineers who retired at age 31 to travel the world.

Like virtually all the bloggers who inhabit the early retirement space, they got there largely by living very differently than everyone else. Rather than buying a house, they chose to rent and invest their money. By the time they retired, they had built a seven-figure investment portfolio and they say they’re traveling the world on $40,000 a year using the “safe withdrawal rate” of 4%.

They do a lot of “Reader Cases” analysis – where a reader emails them their situation and the pair offer up their advice. Readers send in very detailed scenarios, down to how much they earn and spend, and they “math that shit up” (their words and I love it!) to come up with a plan.

- The Blog: Millennial Revolution

- Follow on Twitter: @FIRECracker_Rev

- One of my favorites: The Three Paths to Financial Independence – There are many ways to get to financial independence and this post shares the three – Hustler, Optimizer, and the Investor. It gives you a good framework towards thinking about these paths.

- Her favorite underrated FIRE blog (and why): Mr. Tako Escapes because “He’s FI with 3 million in the bank, but his wife continues to work. He talks about dividend investing, index investing, and awesome tips about how to save money and become FI while raising 2 kids.”

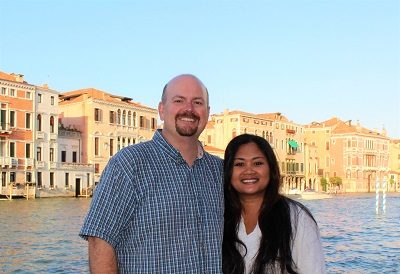

Jeremy & Winnie – GoCurryCracker.com

Jeremy and Winnie’s secret to success included living in a small apartment in an old building, walking and biking instead of owning a car, and preparing most meals at home. Like other bloggers on this list, they saved a disproportionately large percentage of their income, investing it for retirement. Having retired in their 30s, they’ve now joined the ranks of other early retirement bloggers in traveling the world and experiencing life to the fullest.

If you’re wondering why it’s called GoCurryCracker! – it goes back to their honeymoon and a snack they used to make for their hikes. It’s a cute story, I love it. Makes me not feel so bad I called my first blog Bargaineering.

- The Blog: GoCurryCracker!

- Follow on Twitter: @GoCurryCracker

- One of my favorites: 10 Years and A Day – A great post that truly simplifies how your savings rate and early retirement are intertwined. 10 Years and A Day refers to how long it took for him to decide he wanted to retire early and when he actually retired early. It’s a very elegant post, if you know what I mean.

The Mad FIentist – MadFIentist.com

Another pseudonym, this blogger goes by “The Mad Fientist”. What’s a “fientist”? Actually, he’s probably the only one. Fientist is a blending of the words “FInancial independENCE”, to get “FIence”. And as a practitioner of fience, and so he’s The Mad Fientist – I like it and I like portmanteaus.

He achieved financial independence by analyzing the tax code and looking at personal finance through the lens of early financial independence to develop advanced strategies to get there. The blog, and podcast, provides actionable advice and innovative tax avoidance strategies for people who want to break away from full-time employment very early in life.

- The Blog: The Mad FIentist

- Follow on Twitter: @madfientist

- A favorite post: The Complete History of the Mad Fientist gives you not only his complete history but a walk through his blog and some gems contained within. It’s like a map of the good stuff, so I didn’t want to share a post that was just an end-point when I could give you a starting point that contained all the great end points. His actual retirement moment is a great recap of his story and how sometimes things don’t always go according to your plan… but still work out.

- His favorite underrated FIRE blog (and why): Lacking Ambition, a blog that hasn’t been updated since May of 2014, that he really enjoyed when it was still being updated.

Tanja Hester – OurNextLife.com

Until recently, the authors of Our Next Life were anonymous (and not big fans of capitalizing words too!). They were working as consultants, traveling across the United States, and didn’t want their plans of early retirement to get out and jeopardize their plans for early retirement. It’s a common theme since early retirement is still an oddity and if word gets out, coworkers may doubt your resolve in the company you’re working for! It’s unfair but true.

Fortunately for them, it never came up. They retired and now Tanja, who retired at 38, and her husband Mark, “the Accomplice” who retired at 41, can write without those silly emoji faces on their head all the time. They knew since before they were married that they wanted a different kind of life, and that’s what they’ve worked to accomplish.

They have a more technical strategy for early retirement, breaking it down into three distinct phases. During the accumulation phase, they spent six years aggressively saving money and paying off their mortgage. Then there’s the early retirement phase when they’re living off their taxable investments and rental income. And finally, there’s the traditional retirement phase, as they begin tapping traditional retirement savings plans beginning at age 59 ½.

Tanja recently wrote a guest post on Wallet Hacks about What We Would Have Done Differently While Saving for Early Retirement (If We’d Known Better) and has a great book called Work Optional.

- The Blog: our next life

- Follow on Twitter: @our_nextlife

- One of my favorites: 10 Qs to Retire Early is very much in the “technical” nature of how their minds work – it goes through the ten questions you need to answer before you retire. It’s a great way to start thinking about FIRE. Oh, also, another good post is my guest post (haha) about what they don’t tell you about retiring early.

Jim Collins – JLCollinsNH.com

Jim describes his journey as an eight-year-old selling flyswatter’s door-to-door, through a matrix of other afterschool jobs to landscaper, ad agency founder, account executive, investment officer, entrepreneur, consultant, speaker, writer, radio talk show host, publisher and group publisher, and everything in between (if anything is left!). Along the way, he’s traveled to dozens of countries around the world.

When it comes to life experience, I can’t imagine anyone who has had a more varied one. And that informs much of his blog.

He doesn’t claim to be rich (yet) but he left his last full-time job in 2011 and works full-time on the blog. Based on the timeline from his “About” page, he’s one of the older early retirement bloggers which, in turn, adds a lot of knowledge to his blog.

- The Blog: jlcollinsnh

- One of my favorites: How I failed my daughter and a simple path to wealth is not about early retirement specifically but about broader money management. It also hit close to home since it talks about him trying to share his money lessons with his daughter. As a father to young kids, this is something I hope to do one day.

Carl (Mr. 1500) – 1500 Days to Freedom

Carl blogs under the pseudonym Mr. 1500 and the 1500 refers to 1500 days until retirement. He describes himself as a family guy living in Colorado with his wife and two young children. Though he studied biology and chemistry in college, he became a software developer. He’s currently 41 years old, with the goal to reach retirement by 43. Tick tock buddy!

Carl’s better half is none other than Mindy of BiggerPockets, who writes about their house flipping oddeseys. I actually knew Mindy before I met Carl (and not even realizing she was Mrs. 1500 all those years), so it goes to show how small the world really is sometimes!

He explains that it all started when he attended a money management seminar in college. That’s where he learned savings always comes first. That’s when he and his wife began maxing out their retirement accounts and flipping houses. Carl cites Mr. Money Mustache as the inspiration for making his retirement goal public with the blog and we are the beneficiaries of that spark!

- The Blog: 1500 Days to Freedom

- Follow on Twitter: @retirein1500

- One of my favorites: My Death March to Financial Independence – This is the blog post to read after you get sick and tired of all those rosy posts about 25 year olds who retired with a million in the bank and are traveling the world. Those stories aren’t real life, this death march post is real life. He also interviewed me a couple years back, but the death march post is the one to read.

Joe Udo – RetireBy40.org

Joe started the blog in 2010 with the intention of retiring at age 40. He was a computer engineer but was becoming increasingly uncomfortable with the job. He started the blog to keep tabs on his early retirement journey. He formally left the corporate world in 2012 and, to be perfectly honest, seems a whole hell of a lot happier.

What’s interesting to note is that he started the blog in 2010 and retired in 2012. A mainstream media news article would probably spin that into a “blogger retires after two years!” type of story but Joe is far more honest – “I had been saving and investing since I started working full time in 1996.” With the blog, that direction accelerated. He’s now a full-time dad/blogger, so technically he isn’t actually retired but I give him credit for it.

As he puts it, “you don’t have to quit working when you retire.”

- The Blog: RetireBy40.org

- Follow on Twitter: @retirebyforty

- One of my favorites: I handed in my Two Weeks Notice is an eye-opening post. He quit his job after 16 years of service and the part of the post that opened my eyes was the section on his health. It’s a very honest post and might be uncomfortable to read (especially if it hits home), but worth it.

- His favorite underrated FIRE blog (and why): Accidental FIRE because “he has a genuine voice. He enjoys the outdoor and blogs frequently about health. Also, he lives a moderate lifestyle and doesn’t take being frugal too far. Most people can relate to this more than being extremely frugal to retire early. It’s a fun blog to read.”

Justin – RootOfGood.com

Justin retired in 2013, at the ripe old age of 33. His wife got on board, retiring in 2016. He describes himself as among the “hard-core savers that accumulated great wealth at a young age.” This has come about through a combination of living frugal, saving a large proportion of household income, and investing wisely.

He says that he and his wife had regular jobs, and were able to save most of their paychecks. Just before retiring, their household income was around $150,000. From college to retirement, they reached millionaire status.

The purpose of the blog is for Justin to share his wisdom about money in a way that will help readers.

- The Blog: Root of Good

- Follow on Twitter: @RootofGoodBlog

- One of my favorites: Zero to Millionaire in Ten Years is Justin’s journey from zero (technically, $49k) to, well, one million dollars. Peek into the guy’s balance sheet and his play by play. Also, his retrospective on the first 1,000 days of early retirement is good for a perspective on what that transition to retirement looks like (at least for him).

- His favorite underrated FIRE blog (and why): Birds of a FIRE (no longer available)

PoF – Physician on Fire

PoF is one of the newer FIRE bloggers, having started in 2016, and he attained financial independence at 39 (his definition) though he continues to work as an anesthesiologist. He’s one of several great physician-written blogs and his blog is meant to “enlighten, educate, and entertain” fellow physicians (and others, but I suspect he resonates most with physicians).

I didn’t know this but apparently, physicians are not great with money… fortunately they’re good with the human body. 🙂

- The Blog: Physician on Fire

- Follow on Twitter: @PhysicianOnFIRE

- One of my favorites: How Much Money Does a Doctor Need to Retire? is a post that breaks down how much you need to save to actually retire. Here’s the thing – his approach applies to everyone.

- His favorite underrated FIRE blog (and why): actuary on FIRE because “he’s good with numbers. He excels with spreadsheets (pun intended), but he’s also quite good with words and mixes humor into his posts, making them more enjoyable and relatable.”

Big Ern – Early Retirement Now

Big Ern is the pen name of the guy who writes Early Retirement Now (his real name is Karsten, just revealed a short time ago when he quit his job!), probably one of the most, if not the most, technical and analytical FIRE blog. This makes sense because he has a Ph.D. in economics, has worked at the Federal Reserve in Atlanta and worked at the research department of a large investment manager. Not a lightweight. 🙂

If you are the type who loves data and analysis, this is the blog for you.

- The Blog: Early Retirement Now

- Follow on Twitter: @ErnRetireNow

- One of my favorites: The Ultimate Guide to Safe Withdrawal Rates – Part 1: Introduction is the first post in a 23-part series (not including reader case studies!) about safe withdrawal rates. You won’t find a more comprehensive look at this so don’t bother trying. But read it… and try to follow. 🙂

Steve Adcock – SteveAdcock.us

Steve managed to retire at 35 and now lives the life of freedom, traveling around in an Airstream with his wife. Like other early retirement bloggers, he mixes frugality with maximum savings. But he also makes a point of being purposeful about knowing what makes him happy, which informs a lot of his blog posts.

His first blog was ThinkSaveRetire.com and he sold it in 2019 (which is why his name may sound familiar). Now, you can find his writing at SteveAdcock.us. His new blog provides specific strategies on how to save and how to retire, and – most interestingly – how to think. That’s an underestimated category since early retirement really does require moving beyond conventional thinking.

- The Blog: Steve Adcock.us

- Follow on Twitter: @SteveOnSpeed

- One of my favorites: If you want to be a part of the 1%, you can’t live your life like the other 99% is a post that really talks about mindset. If you want to be above average, you can’t keep acting like your average. Early retirement is not a common pursuit and you’re surrounded by people who don’t have that as a goal… so they don’t do the things they would need to do to achieve it. So they can’t be your model! They can’t even be your default. It’s a good post that really sharpens your thinking.

Jess & Corey – The Fioneers

Jess and Corey are a thirty-something couple who both work at mission-driven nonprofits. They started their blog in September 2018 and are proponents of a flavor of FIRE they termed “Slow FI.” Slow FI is the idea that your journey towards FI is just as important as reaching it, so you might as well savor the trip. I loved this idea so much, I asked Jess to share it in greater detail in a blog post here titled SlowFI: Write Your Own Script; Early Retirement Might Still Be Someone Else’s.

- The Blog: The Fioneers

- Follow on Twitter: @thefioneers

- One of my favorites: Slow FI: The Real YOLO is essentially their manifesto explaining Slow FI and why they are huge proponents of it.

I hope you enjoyed this list of great financial independence and early retirement blogs!

Humbled to be included among these blogging legends. Which means what, five years of experience in this space? But honestly, I wouldn’t have even understood the concept of FIRE if it weren’t for many of the other guys and gals listed above, and I read many of their sites in their entirety before launching one of my own.

Cheers!

-PoF

Thanks so much for including me!

“I actually knew Mindy before I met Carl (and not even realizing she was Mrs. 1500 all those years), so it goes to show how small the world really is sometimes!”

We get that all the time from confused people: “Wait, what… You guys are married?”

Great list! I’m a big fan of Jacob from ERE. It was the first blog I read about FIRE. He really paved the way. Thanks for the inclusion.

Great list, Jim! I’m probably one of the few folks who didn’t stumble across the Mr. Money Mustache blog as there catalyst to FIRE. Joe at Retire By 40 was my wake-up call because his life mirrored a lot of what I was seeing in my life.

Now I consistently read all of the blogs you mentioned (and too many others!). It’s a wonder I get anything done!

— Jim

I think MMM made it more “mainstream” (though I don’t think it’s really mainstream) but the one that probably introduced me to the concepts that would later become FIRE is ERE.

Great list of all the big FIRE bloggers Jim! These guys are great!

There’s lots of great smaller bloggers too … I encourage people to branch out. There’s tons of great information out there!

I frequent basically all of these blogs. Can confirm. Great list!

What about a non-american one? You have to stop thinking only about this small world you’re living in called USA.

Very true! When you say non-American, do you mean just non-English speaking or geographically non-North American?

also, what about someone who isn’t in IT, software engineering, investment banking, medicine, etc? Is FIRE only for the privileged few who have six-figure tech salaries to begin with?

I can only write from my perspective and while I was in software, I never made six figures.

These are all great sounding blogs and I’m looking forward to reading them. Some of them I’ve never even heard of, but it’s so cool to see how many people are on the road to financial independence. I wonder if it’s going to be the new “it” thing to reach FIRE vs. retire for the upcoming generations.

Oh boy I didn’t know the surname of some of these bloggers. Haha Steve…I feel like a second grader. I hope he never reads this comment haha. Great entourage of bloggers!

That’s a formidable list, Jim…

…and I am honored to have made the cut.

I’ve often said the first blog post I ever read was the first I wrote back in the spring of 2011. Somehow, a few months later, I stumbled upon ERE and that lead to MMM and that lead to an amazing journey, adventures and friendships.

JL

Thanks for the mention! This is a list of a lot of heavy-hitters and I’m honored you included me. And you found some really kind words in the write-up, too. If I run into you at the 2018 FinCon I’ll buy you a beer! Cheers and keep up the great work! 🙂

Ha maybe I’ll buy YOU a beer at Fincon after that glowing comment 🙂