CrowdStreet

Strengths

- Opportunity to invest in commercial real estate

- CrowdStreet charges no fees to use the platform

- High returns

- Invest in individual properties, investment funds, or a fully managed commercial real estate portfolio

Weaknesses

- Accredited investor status is required

- High minimum initial investment

- Lack of liquidity

- Email customer support only

Do you want to invest in real estate but you’re not entirely sold on the idea of real estate investment trusts (REITs)? If so, you may want to take a close look at CrowdStreet.

CrowdStreet is part of a new and fast-growing class of real estate investing vehicles, often referred to as real estate crowdfunding, where investors come together to invest their money in real estate projects offered by real estate sponsors.

CrowdStreet not only offers you an opportunity to invest in real estate but also in one of the most popular real estate investments among institutions and wealthy individuals: commercial real estate. Real estate has the benefit of potentially providing both stable regular income and capital appreciation upon the eventual sale of the underlying properties.

Why invest in commercial real estate? According to NAREIT, equity-based real estate investments earned 12.87% between 1978 and 2016. Compare that to compared to the S&P500 which earned 11.64% over the same time period. You can see why real estate is such an attractive investment.

CrowdStreet is one way to invest in commercial real estate and take advantage of those potential returns.

🚨 This Wall Street Journal article titled “Missing Millions and a Rabbinical Arbitrator: Real-Estate Deal Gone Bad Hits Popular Crowd Funder” shares some harrowing news about some of the deals on Crowdstreet. “A Wall Street Journal review of 104 completed deals and other deals that were aborted or still in process found that many failed to meet returns suggested in sales pitches. When developers fell short of funds, they asked investors to pony up more cash or risk losing their investments. CrowdStreet also helped raise cash for a firm that lied about its track record to investors, according to the Securities and Exchange Commission and the Justice Department, and whose chief executive was later sentenced to prison for fraud for the fundraising.” Until these issues are addressed, we no longer recommend Crowdstreet but this does highlight the importance of due diligence. You can’t rely on the platform to do it.

Table of Contents

- Who is CrowdStreet?

- Is CrowdStreet for Accredited Investors Only?

- Minimum Initial Investment

- Account Types Offered

- Income Distribution Frequency

- Investment Availability

- Customer Support

- Account Security

- CrowdStreet Investments

- Investing with CrowdStreet

- CrowdStreet Pros and Cons

- Are the Deals on CrowdStreet a Good Investment?

Who is CrowdStreet?

Based in Portland, Oregon, CrowdStreet has been in business since 2014. While that may not sound like a long time, understand that the whole business of real estate crowdfunding didn’t exist until the passage of the Jumpstart Our Business Startups (JOBS) Act in 2012. One of the primary outcomes of that act was the opening of access to private equity investments, including commercial real estate projects, to more investors.

Until then, access to commercial real estate investing was limited to wealthy investors and institutional money, like pensions and insurance companies.

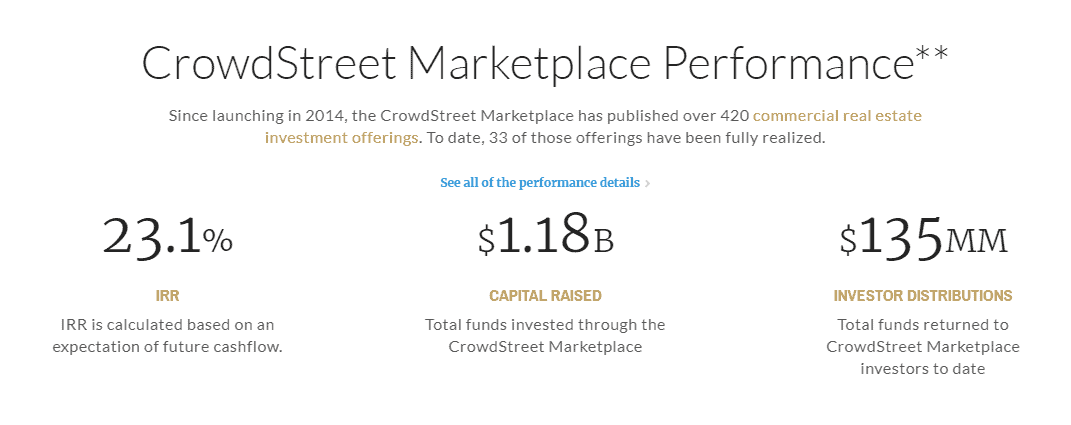

In the space of just six years, CrowdStreet has funded more than 430 commercial real estate investment offerings, raising more than $1.22 billion in capital. Thirty-three of those projects have since exited (sold).

Is CrowdStreet for Accredited Investors Only?

The short answer is yes. Because of the high risk/high reward nature of CrowdStreet investments, accredited investor status is required.

To qualify for accredited investor status, you must meet either the annual income or net worth requirements as follows:

- Have an annual personal income of at least $200,000 (or $300,000 jointly with your spouse) in each of the past two years, with a reasonable expectation of reaching the same income in the current year, or

- Have a minimum net worth of $1 million, not including your personal residence.

Unlike some investment platforms that require only that you self-certify your accredited investor status, CrowdStreet does require independent verification. You can do this either by using VerifyInvestor.com through the CrowdStreet Transaction Center, or certified by an independent third-party verifier, such as your CPA, attorney, or wealth advisor. The third-party can provide verification by supplying a verification letter, which is available in template form through CrowdStreet.

Please note sending forms of self-certification, such as providing income tax returns, W-2s, or financial statements, are not acceptable forms of verification.

If you are not an accredited investor but are interested in real estate investing, consider Fundrise. They offer REITS and do not require accreditation. Here’s our full review.

Minimum Initial Investment

The typical minimum is $25,000, though some deals may require at least $100,000. Minimum investments will usually be listed in the individual investment details.

If you don’t have $25,000 to invest in real estate right now, here are several ways to get started with as little as $1,000.

Account Types Offered

Crowdstreet offers individual or joint investment accounts, or IRAs when included in a specialized self-directed IRA (SDIRA). These are not common self-directed IRA accounts, such as those offered by investment brokerages. They’re usually highly specialized IRA custodians that work specifically with alternative investments, including private equity commercial real estate.

CrowdStreet has built out online integrations with Millennium Trust, Entrust, and Equity Trust specifically for IRA accounts.

Income Distribution Frequency

Depending on the deal, some investors might receive income distributions during the hold period, but most of the distributions come when the property sells.

Investment Availability

CrowdStreet deals are available in all 50 states and open to U.S. investors.

Customer Support

Customer support is only available by on-site email. No phone contact is indicated and there is no mobile app.

Account Security

As with most investments, CrowdStreet is not protected by either FDIC or SIPC.

CrowdStreet Investments

CrowdStreet investments are sourced and reviewed by a team of real estate professionals with more than 60 years of combined private equity real estate experience, and involvement in more than $6.5 billion in total real estate transactions.

Each real estate deal offered on the platform must pass a three-step process:

- Sponsor Vetting. Here the real estate developer or operator’s background and track record are investigated and evaluated for professionalism. That includes deep background checks, reference checks, and a review of a sponsor’s previous projects. Sponsors will be classified as either emerging, seasoned, enterprise or tenured.

- Deal Screening. This step involves the evaluation of the investment itself. CrowdStreet looks to ensure that the proposed investment aligns with the sponsor’s background and CrowdStreet’s general investment thesis.

- Offering Terms Review. The terms of the proposed offering and associated documents are reviewed against CrowdStreet’s standard investor deal terms criteria matrix. This step may result in the sponsor adjusting certain details or the deal being rejected completely.

For example, all deal sponsors must co-invest in the deal and state their co-investment amounts for equity offerings.

Only once all three criteria are met will deals be made available on the platform for investment.

Deals on CrowdStreet fall into four risk categories. Two offer more conservative returns – and less risk – while two others have both higher returns and higher risk levels.

The four risk profiles include:

Opportunistic Deals

These are real estate investments that target the highest returns but also have the greatest risk. The category includes ground-up developments that have little to no cash flow and often represent very complex business plans.

To date, CrowdStreet has published 102 opportunistic deals, seven of which have been sold and fully exited.

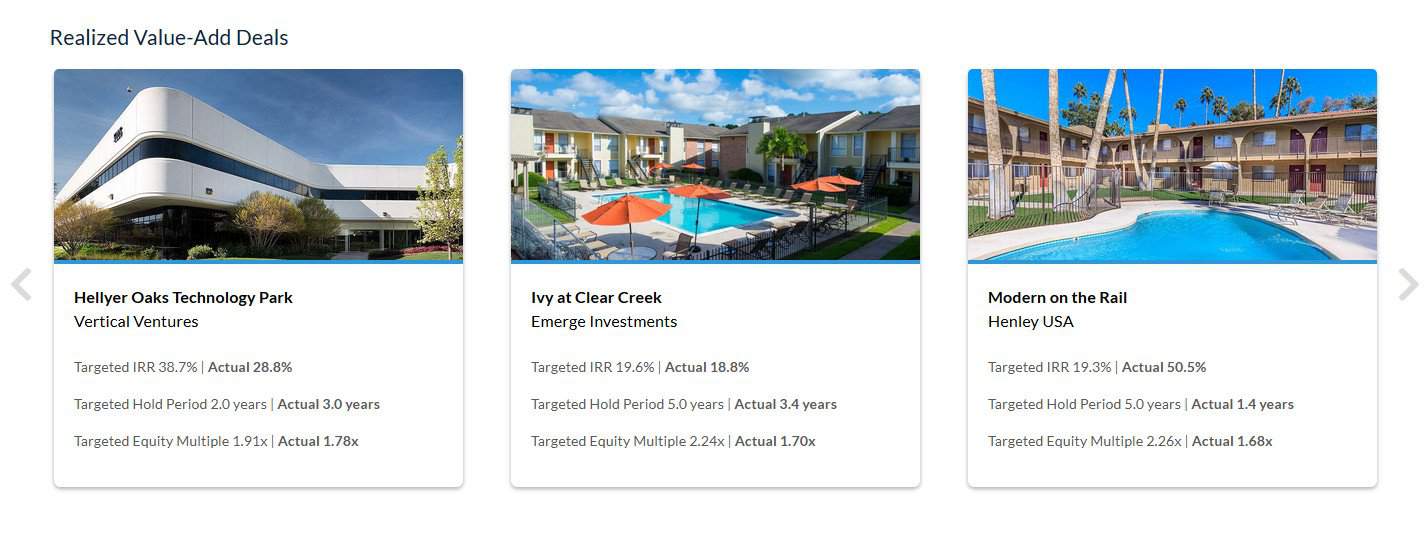

Value-Add Deals

This is another risk profile where the goal is to significantly increase the value of the property. This is done by making large-scale improvements to the property.

CrowdStreet has offered investors participation in 227 value-add deals, 23 of which have sold and exited.

Core-Plus Deals

Core-plus investments are high-quality properties that are mostly occupied but have some monthly income allocated for future maintenance and upgrades. Put another way, they’re more conservative investments with lower potential annual returns. Of the 70 offerings, three have exited.

Core Deals

Core deals have stable, predictable cash flows, are located in major markets, and are usually fully occupied and need no major improvements.

A less common deal on the Marketplace, CrowdStreet has only published five core deals, with none having exited yet.

Investing with CrowdStreet

When you invest with CrowdStreet you’ll have a choice to invest in individual deals and/or funds and vehicles.

Individual Deals

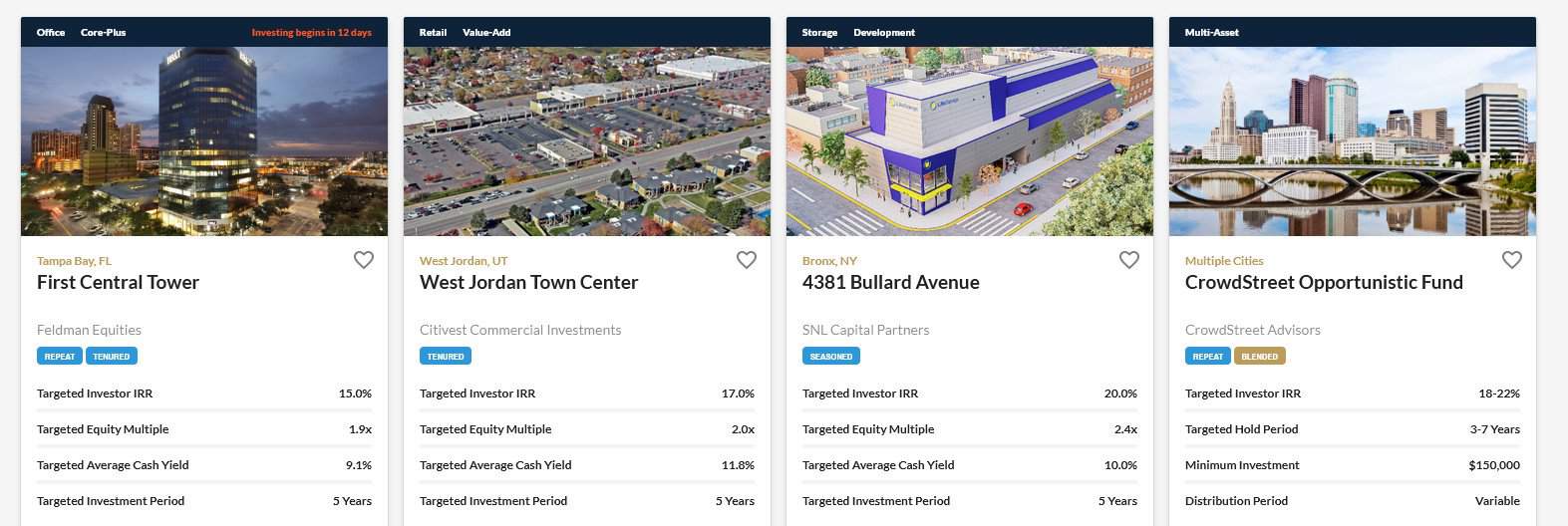

If you invest in individual properties, the platform provides details of the specific parameters of each deal. For example, they’ll provide five basic pieces of information:

- Targeted investor IRR – the anticipated average annual return upon completion of the deal, taking into account both average annual cash flows and equity return over the holding period.

- Targeted Equity Mulitple – the cumulative distributed returns, divided by the amount of paid-in capital. For example, if you put $100,000 into a deal, and the expectation is you’ll receive $200,000 in total return upon completion, the targeted equity multiple will be 2X.

- Targeted Average Cash Yield – the anticipated annual rate of return on income distributions you’ll receive on your investment.

- Targeted Investment Period – the length of time that’s anticipated between initial investment and property sale. Depending on the individual deal, that can be anywhere from two years to 10 years, with three-to-five years as an average.

You’ll be able to select the individual properties you want to invest in based on the above criteria, and how well it fits within your own investment expectations.

The platform also offers a filtering search that will enable you to narrow your investment selections based on IRR, deal terms, income distribution frequency, minimum investment size, and investment structure (debt, equity, mezzanine debt, portfolio, preferred equity, or REITs).

You can also filter based on the geographic region in the country, and property type – such as land, hospitality, industrial, medical office, multi-family, retail, student or senior housing, or mixed-use properties.

Funds and Vehicles

CrowdStreet also offers commercial real estate funds. They consist of investments spread across multiple properties within a single, diversified portfolio.

Single-sponsor funds are managed by a single real estate firm and focus on whatever that firm’s specialty is. That can be based on a geographic region or a specific type of commercial property, such as retail, office, or multifamily complexes.

CrowdStreet funds are managed by CrowdStreet itself. There are different funds offered based on different investment strategies.

CrowdStreet Pros and Cons

Pros:

- Opportunity to invest in commercial real estate, which is one of the highest yielding long-term investments available.

- Potential of high returns – the typical investment has a targeted IRR of 22% when annual distributions and capital appreciation upon property sale are included, but you have to review this on a case by case basis.

- You’ll have a choice to invest in individual properties or investment funds.

- You can choose both the geographic location and the specific property types you want to invest in, including large apartment complexes, retail or office space, hospitality, student housing, and more.

Cons:

- Accredited investor status is required and will be verified.

- High minimum initial investment, starting at $25,000.

- Lack of liquidity – this is common to all real estate crowdfunding investments because each is a standalone deal that offers no public exchange for an early exit.

- Investment commitment – terms can run from a minimum of two years to as many as 10 years.

- Very limited contact – email contact only, no phone contact is offered.

- No mobile app from which to track your investments.

- No insurance coverage is offered, such as FDIC or SIPC. However, your investment is secured by the underlying real estate it’s attached to.

Are the Deals on CrowdStreet a Good Investment?

Only you can determine what a good investment is for you based on your own risk tolerance, investment goals, time horizon, and personal preferences.

Even if you qualify as an accredited investor, you should invest only a small percentage of your portfolio through CrowdStreet or any other single real estate crowdfunding platform. Real estate should represent a percentage of your total portfolio equity allocation, and it’s wise to diversify that amount should be spread over several investments. This will be especially important if you are investing in individual property deals.

But if you have the financial wherewithal, and you’re looking to add a true alternative investment to your portfolio – one with expected returns well above average and that competes favorably with stocks – CrowdStreet should be on your shortlist of possibilities.

If you’d like more information, or you’d like to invest, visit the CrowdStreet website.

Disclaimer:

This post contains an affiliate link. CrowdStreet has not endorsed this post. However, if you register with CrowdStreet through this affiliate link, WalletHacks.com may earn a referral fee at no cost to you.

We are real estate investors in single family and looking to expand from there. We have looked at these crowdfunding sites and would be eligible, given accredited status. That said, I find that there are so many platforms now that the due diligence required to really see who has good deals and who will come out on top is almost equivalent to the research we’d need to do to put our own deals together. Needless to say, we haven’t pulled the trigger yet and given the pandemic we’re stockpiling cash since I’m expecting even more fallout in rental real estate.