Synchrony Bank

Product Name: Synchrony

Product Description: Synchrony Bank is an online bank that offers competitive APYs on savings, CD, and Money Market accounts.

Summary

Synchrony Bank is an online bank that offers competitive APYs on savings, CD, and Money Market accounts. Deposits are FDIC-insured, and there are no monthly fees minimum deposit requirements.

Overall

Pros

- High yields on savings and select CDs

- No minimum deposit requirements

- Synchrony Premier World Mastercard pays Unlimited 2% cash back on all purchase

Cons

- Does not offer a checking account

- Online banking only, there are no local branches

Synchrony Bank is an online bank that offers competitive APYs on savings, CD, and Money Market accounts. Deposits are FDIC-insured, and there are no monthly fees or minimum deposit requirements. You can also access a no-fee cash-back credit card. But with no checking account and limited retirement investing options, is Synchrony right for you?

At A Glance

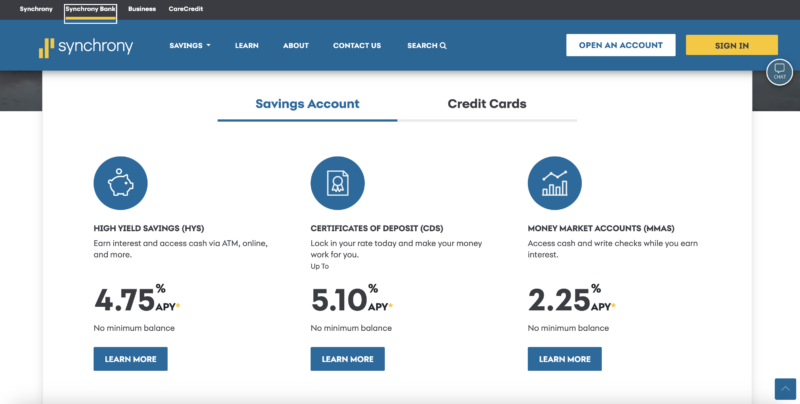

- Competitive high-yield savings APY of 4.00% APY

- No monthly fees or minimum balance requirements

- Wide range of CD terms

- IRA CDs and MMAs

- Doesn't offer a checking account

Who Should Use Synchrony Bank?

Synchrony Bank is best-suited for customers looking for an online bank with high APYs on savings and certificates of deposit (CDs), who already have a checking account elsewhere to manage their day to day finances. If you're looking for a flat-rate cash-back credit card, Synchrony's Premier World Mastercard is also worth considering. It has no annual fee and offers a generous 2% cash back with no spending limit.

If you need an online bank to manage all of your financial transactions, including day-to-day banking and investments, then Synchrony is probably not your best option.

Get Started With Synchrony Bank

Synchrony Bank Alternatives

| Savings APY | 4.81% APY | 3.75% APY | 4.01% APY |

| Min. Balance Requirement | $500 | $0 | $25,000 |

| Monthly Fee | $0 | $0 | $0 |

| Learn More | Learn More | Learn More |

What Is Synchrony Bank?

Synchrony Bank is the online banking subsidiary of Synchrony Financial based in Stamford, CT. It offers various deposit, credit, financing, and lending products. It's also a leading private label credit card provider, and is the backbone behind popular store credit cards such as Amazon, Lowes, Walmart, and Gap.

Synchrony Financial (SYF) had revenues of $13.5 billion in 2023 and is a component of the S&P500 index. Synchrony Bank is FDIC insured (#27314), and they're headquartered in Utah.

You can contact Synchrony Bank customer service by calling 1-866-226-5638 (Monday through Friday, 8 a.m. to 10 p.m. EST, Saturday, 8 a.m. to 5 p.m. EST, Closed Sunday).

Synchrony Bank's routing number is 021213591.

Deposit Products

Synchrony Bank offers the full menu of deposit products – money market (similar to checking), savings, high-yield savings, certificates of deposit, and even IRA accounts.

- High-Yield Savings: No monthly service fees, 4.00% APY, no minimum balance.

- Certificates of Deposit: Maturity periods of 3 months to 60 months, no minimum deposit, with the 9-month CD paying 4.00% APY

- Money Markets: No monthly service fee, mobile check deposit, no minimum balance, up to 2.25% APY

- IRA: You can open a regular IRA account or an IRA CD account or Money Market account. APYs are the same as they are for regular taxable accounts.

- Checking: Not offered

Get Started With Synchrony Bank

Credit Cards

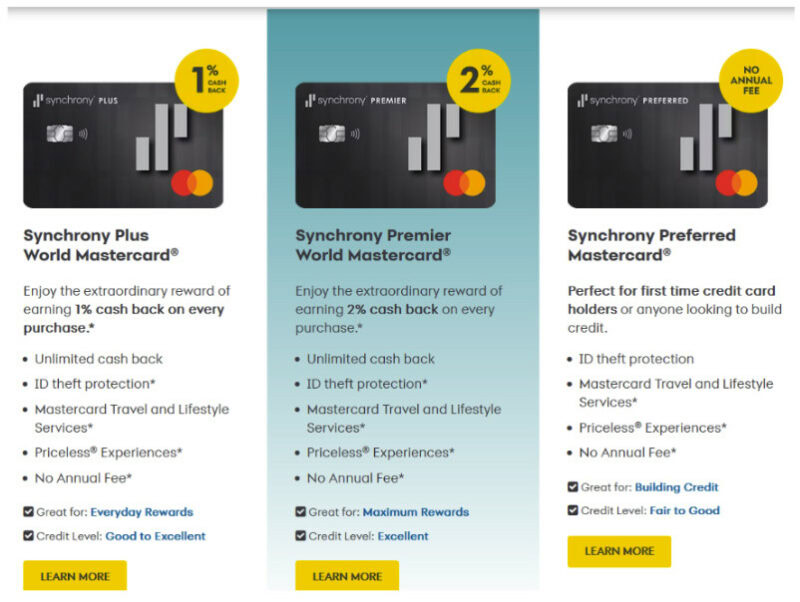

Synchrony Bank offers three credit cards, each with its own distinct features and benefits.

Synchrony Plus World Mastercard has no annual fee, and pays an unlimited 1% cash back on all purchases. The card also includes some Mastercard benefits, incliding Travel and Lifestyle Services and Priceless Experiences.

The Synchrony Premier World Mastercard is the company's premium card offering. It doubles the unlimited cash back to 2% on all purchases. While it lacks the additional benefits offered by many premium rewards cards, such as complimentary insurance coverages or annual statement credits, there is no annual fee.

Finally, the Synchrony Preferred Mastercard is offered for applicants with either no credit or fair to good credit. There is no cash back, but the card provides an opportunity to either build or rebuild credit with no annual fee.

Synchrony Bank also issues several white-label credit cards, meaning they're run by Synchrony Bank but they are branded with others names. One popular Synchrony Bank powered credit card is Amazon.com's Amazon Prime Store Card – which gives you a $10 Amazon.com gift card upon approval plus 5% cashback at Amazon.com with no caps. No annual fee, special financing on orders $149 or more, and all the typical protections of credit cards, like $0 liability.

They also power other retail cards like American Eagle Outfitters, Athleta, Chevron, Old Navy, PayPal & eBay, Sam's Club, Toys “R” Us, Walmart and more. If you have one of those cards, you may have seen SYNCB appear on your credit report. I had SYNCB/PPC and was surprised to see it because I didn't know it stood for Synchrony Bank / PayPal Credit! It's normal though, just looks weird.

Fees and Penalties

Like most online banks, Synchrony Bank does not charge any monthly fees on its savings or money market accounts. There are also no minimum balance requirements.

What is rare is that they will not charge you a fee if you exceed six withdrawals/transfers in a statement cycle. Many banks will charge this because you aren't supposed to (according to the Federal Reserve) treat a savings account like a checking account, but Synchrony won't. They do, like other banks, reserve the right to close your account if it happens too much.

CD Early Withdrawal Penalties

There is an early termination fee if you make a withdrawal from a Synchrony CD before the maturity date:

- Term 12 months or less: 90 days of simple interest at the current rate

- Terms of more than 12 months but less than 48 months: 180 days of simple interest at the current rate

- Terms of 48 months or more: 365 days of simple interest at the current rate

These interest penalties are fairly standard – it's the exact same as what Bank of America and any major bank would charge.

Get Started With Synchrony Bank

Synchrony Bank vs. Alternatives

Western Alliance Bank

If you’re looking for an even higher yield on savings, Western Alliance Bank is worth checking out. It currently pays 4.81% APY on all balances on its High-Yield Savings Premier account. You can open your account online in less than five minutes, with a minimum deposit of $500.

There are no fees for this account, giving you the benefit of the entire APY. Western Alliance Bank is part of a $70 billion financial organization. The bank also offers an extensive line of business banking services, including checking and savings accounts, global market services, treasury management, business credit cards and various specialized loan programs.

Here's our full review of Western Alliance Bank.

Get Started With Western Alliance Bank

Discover Bank

Discover Bank offers its Online Savings Account, currently paying 3.75% APY on all account balances, with no monthly fee. While this rate is lower than what Synchrony is currently offering, Discover has a free checking account and a debit card that earns 1% cash back on up to $3,000 in purchases.

There also are no fees for excessive withdrawals, expedited delivery for official bank checks, returned items, stop payment orders, or insufficient funds.

Like Synchrony, Discover is an all-online bank. But unlike Synchrony, Discover has one of the best credit card offers in the industry. The Discover it card pays 5% cash back on rotating quarterly spending categories, such as groceries, restaurants, and gasoline, and unlimited 1% cash back on all other purchases. It also matches your accumulated cash back within the first year of account opening.

Get Started With Discover Bank

Customers Bank

Customers Bank is a relative newcomer to the banking scene, having been established only in 2009. But the bank has grown and now has over $22 billion in assets.

Its High-Yield Savings Account currently pays 4.01% APY on the full balance. Unfortunately, the minimum opening deposit of $25,000 limits the number of customers who can benefit from the high APY. The account has no monthly fees.

Note that Customers Bank gives back to schools and organizations in their local communities, so you will be helping local communities just by opening an account at the bank.

Get Started With Customers Bank

FAQs

Synchrony Bank was established in 1932, as GE Capital Retail Bank, and currently has more than $95 billion in assets. It rates only 1.1 out of five stars (“Bad”) with Trustpilot, though that's based on only 20 reviews.

However, users of the mobile app have a decidedly positive opinion about the company. It scores 4.6 out of five stars among more than 5,000 Android users on Google Play, and 4.8 out of five stars among more than 22,000 iOS users on The App Store.

Synchrony Bank is based in Stamford, Connecticut, but as an online bank, it has no physical branches. Access to Synchrony Bank, transactions takes place entirely online and through mobile devices.

In late 2023, reports surfaced of a lawsuit against Synchrony Bank, alleging the company has been “installing tracking software to invade customers privacy and track their browsing habits.” No further information is available as to the legitimacy of the claim, or whether it will be accepted by the court.

Get Started With Synchrony Bank

Summary

Synchrony Bank has a compelling offer for anyone looking for a no-fee online savings account with a competitive yield. Throw in a solid cash-back credit card and a wide range of CDs, and you can save with Synchrony. However, there are better options if you're looking for a complete banking solution or want a bank that can handle your investments as well as your savings.

Hey Jim! I’m a huge believer in online banks; switched about 5 years ago and never looked back. The only reason I can think of to have a brick-and-mortar bank is if you need to frequently do large cash deposits and withdrawals (and in that case I would probably use a credit union).

I still see a lot of people, though, that like to personally know the people that work at a bank, and are very reluctant to switch to online banking because of that. But I’d say that’s costing them money.

Cash transactions (and how rare are those!) are one of the few reasons to have a brick and mortar bank account… maybe also medallion guarantees (even rarer!).

We have the Amazon store card which is by Synchrony. I didnt know they offered a high interest rate at 1.30% (with no minimums.) My husband went with Discover at 1.10% because it was the easiest (no upkeep, no minimum etc.) but I think we should have shopped around some more.

Haha are these real replys above me? Synchony bank is a joke, i currently have three different credit accounts and all are over 25%. I had to take out a loan from my current good bank SECU to pay the one care credit account I have through them. Making more than minimum payments don’t help. Will never recommend them to anyone.

You’re talking about credit, this was more of a review of their deposit products. Your interest rate will be a function of your credit score as well as other debt related factors. If you feel it’s too high, I’d recommend trying to find a balance transfer to a lower rate card.

Syn-crappy Bank is a joke. It price gouges the public on basic credit cards for staters and does not pay that much on CD’s or savings. So why would anyone recommend them unless they work for them? I just cancelled 2 credit cards with them for TJ Maxx, & Amazon because they price gouged me by tacking on an EXTRA $27.00 late fee for one month. Now I only have 2 credit cards, and only because they offer (I thought), good perks, but this past month Syn-Crap took liberties and charged me an extra $54.00 in total for me not… Read more »

I always get the bill in the mail for my loan 4 days before the due date. I send it out the next day – 3 days before the due date. I figure it takes the Post Office 2 days to deliver it (maybe 3). Synchrony Bank apparently takes a day or two to get it through their “system”. So every month my payment is marked as “Late”. They “can’t mail [my] bill out sooner”, and suggest automatic deduction. You can’t pay online (it is the ONLY loan I have that I can’t pay online!). You can’t even set up… Read more »

That’s incredible… no online billpay???

I have used Synchrony to finance a project. NEVER AGAIN! The interest rate jumped up to 29.99 % after the promo period, which is understandable – I agreed to that. I got hit with deferred interest – I slipped. My fault. However, after over 3 years of faithfully paying my bill, they still refuse to lower my rate. I repeat, NEVER AGAIN. I will pay these leeches off, and if I ever have another customer that wants to finance with them, I’ll walk away.

I agree that your post has to do with banking and not credit. However, the company name Synchrony is much more identified with their credit cards. And with that, they are an awful company to work with. I have had credit card companies that have switched and now I shudder when I hear their name. When applying for credit and hear their name, I cancel my request and seek another lender. There are so many customer service and credit companies that deal with all types of consumers, it’s worth shopping around. We deserve better.

My experience with Synchrony bank is hassle free.I recently got a credit card from Walmart which is financed by Synchrony bank and on the very first statement I observed an error.I pointed this out to customer service an the error was corrected without delay. Another positive experience was with my third statement where a supplier/merchant attempted to bill me monthly without my permission.Again ,a call to customer service corrected this issue. Please note that my card payments are done online since I set up an account to transfer my credit payments.

Our 19-year-old daughter had her Chevron card declined last week, because she made the mistake of using her card near home, while we were traveling out of state. Apparently, that constitutes ‘suspicious activity’ to Synchrony Bank. This is very troubling, because a Chevron card is not like most others, in that with most other cards, declining the card won’t leave you stranded, possibly in the middle of nowhere. Declining a card like Chevron can have some very real personal safety consequences. We have never had issues with our Chevron cards since 1980, but after our experience dealing with the idiots… Read more »

Isn’t that the fault of Chevron?

I don’t think it’s a problem with Chevron at all; in fact your flip reply indicates that you are receiving a kick-backs from Synchrony. To be more specific, before allowing a Chevron branded Synchrony C.C, an inquiry/permission request in made to the issuing financial institution. Synchrony, without bothering to check, decided that the daughter, who has a family type card, was not in the area of the primary account owners, could be a card thief, and declined her purchase which in fact could have stranded her in a rest stop somewhere (or worse). As Synchrony, in the world of cell… Read more »

They also manage BP cards and I have had similar issues. I have had a BP card since 1984 when it was Amoco. I closed it today because the idiots at Synchrony cannot figure out when it’s me and when it’s not. Their loss. Unbelievable!

I’ve been a Synchrony customer since GE Capital. I own both credit and deposit accounts , no issues , no worries.

Credit cards are deeply affected by Federal Reserve actions and of late it’s not a borrowers market however I pay off at the end of each month, still no worries.

Synchrony is easy to deal with and that’s it plain and simple. Rates are great and services are available online 24/7 so what’s not to like?

I can highly recommend Synchrony Bank.

I got a syncrony card through amazon. I opted for online billing. The first time I logged in they locked my account for suspicious activity and told me to call their office number. I called the office and they said a pin would arrive in a few days to unlock my account. The pin arrived 3 weeks later and when I called it in I was told it was an invalid pin and my account would remain locked. Unable to pay online (account locked) I called syncrony and asked for a paper bill, no bill came, but I got a… Read more »

Okay….Are you aware Sr. that Synchrony Bank offers their customers 100% fraud protection on the cards they service? They have thunders if not thousands of frodulent charges they have to staff people to investigate and charges they have to eat and they do eat them. I think with that kind of protection they give you a short hold up to place a call to tSynchrony in order to verify the validity of the suspicious charge isn’t as big a deal than itt would be if you were left without that fraud protection and held liable for the fraudulent charges. Those… Read more »

Terrible customer service, complete with flippant attitudes due to highly restrictive policies and antiquated methods (i.e requiring you to fax or mail documents), rude managers, long transfer times into and out of the accounts. Save yourself the frustration and never do business with this bank; it’s not worth the man hours it will take you to get anything resolved should you ever have an issue and in the meantime, they will simply deny you access your money for weeks or longer.