Are you looking to find out how much it’ll cost you to prepare your taxes with TurboTax in 2025?

TurboTax has several versions, and in this article, you’ll learn how much it costs to prepare your taxes for Tax Year 2024 — filing in 2025.

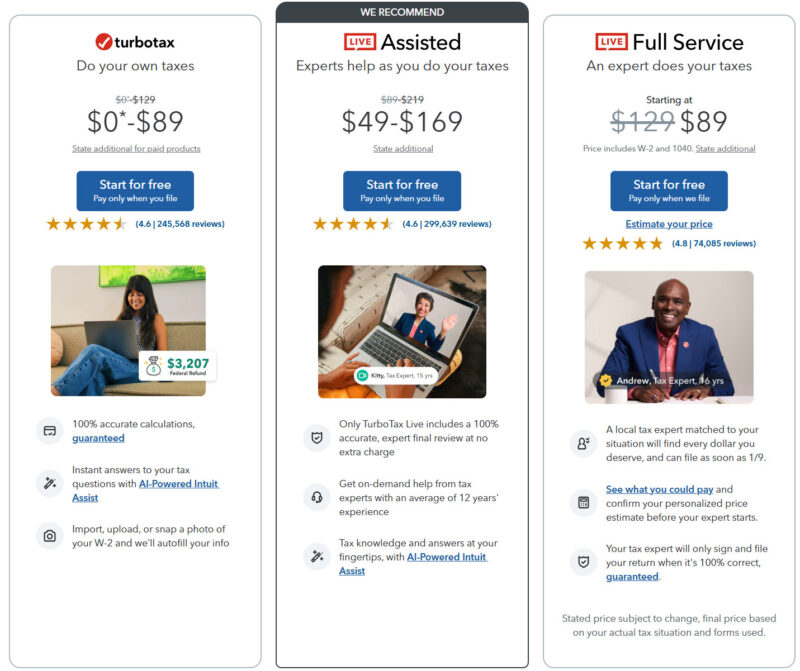

When you go the TurboTax website, you don’t see the familiar packages like Deluxe, Premium, Home & Business, etc. anymore.

Instead, they’ve organized it by the level of “assistance” you need. From there, the final amount you’ll pay is determined by how complicated your taxes are.

The ranges are accurate, but the pricing isn’t shown to you until you click on the “Start for free” button. You have to register, start the tax preparation process, and then you learn how much it costs.

Table of Contents

TurboTax Pricing Structure for Tax Year 2024

TurboTax still has three tiers of service – DIY, Assisted, and Full Service.

The tiers are based on how much assistance you need. DIY has no assistance, meaning you can’t ask a live tax expert questions. You can still access all of TurboTax’s resources, such as its information articles and calculators. You also get unlimited access to an AI bot to answer tax questions.

Assisted gives you unlimited access to a tax professional as well as informational audit support. Tax pros are available via chat, phone, or video call. They can’t see you, but you can see them and you can share your screen and they can help with your return. They will also review your return before you submit it.

Audit support consists of answering questions about any letters you receive from the IRS, they do not represent you to the IRS.

With the Full Service plan, a tax professional prepares your return on your behalf. It also includes informational audit support.

Do It Yourself Pricing

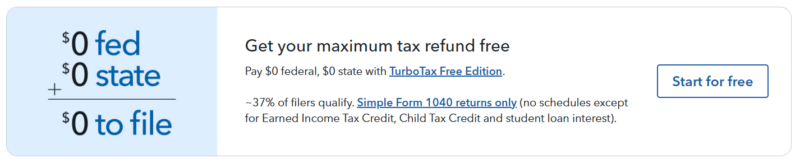

Filing for free with TurboTax is possible if your return is simple.

More complicated returns won’t qualify, and you could pay up to $89 for the federal return and $39 per state return.

You will have access to AI tax assistance and the community forum for questions. You’ll get the TurboTax guarantees, such as the Maximum Refund Guarantee and the 100% Accurate Calculations Guarantee.

👉 Visit TurboTax to start your return

Live Assisted Pricing

If you want some assistance with your return, you can choose the Live Assisted tier. Federal returns are between $49 and $169, and state returns are between $39 and $49.

With this version, you have unlimited access to a tax expert.

Tax experts are available between 5 am and 9 pm Pacific time, seven days a week. If you have a question, you can click on the “Live Help” button on your screen and enter your tax question. You will then select the method with which you would like to be connected. You can choose chat, phone, or video call.

If you choose video call, you can see the expert, but they can’t see you. You can share your screen so they can walk you through where to enter your information.

With this plan, you can choose to have an expert review of your return before you submit it. You’ll also get informational audit assistance and all the TurboTax guarantees.

Business returns

If you have a business your Live Assisted return starts at $489 for federal returns and $64 for state returns, but comes with audit defense. If you get audited, you will receive an agent who can represent you to the IRS.

👉 Visit TurboTax to start your return

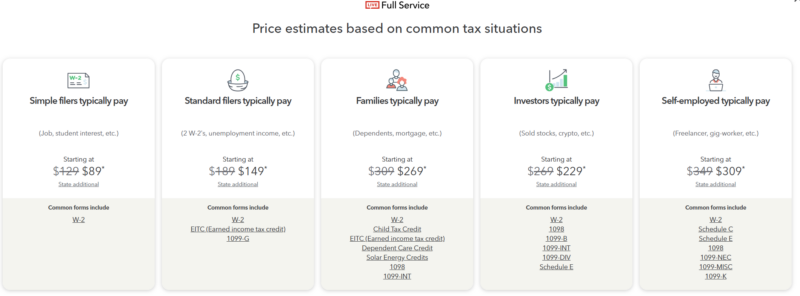

Full Service Pricing

TurboTax Full Service is where they do your taxes for you, similar to other tax preparation services, and the pricing is based on the complexity of your tax return. As a result, they only have “starting” prices, which include Form W-2 and the 1040. Additional scheduled and forms will add to the cost. You can estimate your price on the TurboTax website.

Business returns

For Full Service Business, prices start at $1,169 for federal returns and $64 per state. You’ll receive full audit defense.

👉 Visit TurboTax to start your return

TurboTax Military

If you are in the military, you may get your taxes done for free. Active duty and reservists of an enlisted rank with a W-2 from DFAS qualify for free returns for both federal and state.

When you upload your W-2 and verify your rank, your discount will be automatically applied.

However, you will not receive any tax assistance or audit defense for free; if you want those services, you will have to upgrade.

TurboTax Pricing on Amazon

Amazon still sells the TurboTax software which you can download to your computer. The benefit of this is that you can file up to five federal returns and one state for just one download. There will be an additional charge for each state return you file after the first. This is great if you are filing for several people.

TurboTax Deluxe 2024: This option is good if you want to itemize but don’t sell investments or have a business.

TurboTax Premier 2024: Includes the features of Deluxe but adds the sale of investments, rental property, and trusts. This version also includes tax assistance.

TurboTax Home & Business 2024: This version is for business owners and freelancers. You will also get access to a tax expert.

TurboTax Business 2024: This version does both your business and personal taxes. You will also get unlimited access to a tax pro.

How Does This Pricing Compare to Others?

When it comes to preparing your taxes, TurboTax is not the only company out there. There are plenty of TurboTax alternatives, and they’re worth taking a look at.

If you don’t qualify for TurboTax’s free version, you may want to give FreeTaxUSA a look. Federal returns are free, and state taxes are just $14.99, regardless of how complicated your taxes are. You can add on tax assistance for $39.99 and tax defense for $19.99.

H&R Block, which has been battling TurboTax for years, has an offering similar to the conventions TurboTax used in past years. All paid plans have access to a tax expert.

- Free: Simple returns are free for both federal and state

- Deluxe: Federal $35 and $37 per state

- Premium: Federal $65 and $37 per state

- Self-employed: Federal $85 and $37 per state.

Taxes can be a pain, but understanding the various pricing shouldn’t be. Hopefully, we’ve cleared it up for you!