I’ve been saving into Series I bonds for quite some time but it wasn’t until the last few years that we’ve seen some eye-popping rates out of Series I bonds.

I got in on the fervor a few years ago when inflation was running hot and we saw Series I bonds offering inflation rates of 3.56%, 4.81%, and 3.24%. Of course, they came with fixed rates that were 0.00% – but they still put Series I bonds rates into the stratosphere.

But with inflation slowing down and inflation rates going down, a lot of those Series I bonds no longer sport lofty interest rates. (if you have a 0% fixed rate bond, your current interest rate is simply 2 times the inflation rate)

The question now is, given the penalty rules for Series I Bonds, should you redeem them or hold them? Or redeem them and re-buy back in now that fixed rates are higher?

Table of Contents

We will being with a refresher of the withdrawal rules, then a look at how you can review your specific Series I bonds, then a decision tree on what you should consider.

Series I Bond Withdrawal Rules Refresher

Briefly, let’s review the Series I bond withdrawal rules:

- You cannot redeem your bond within a year of issue.

- If you redeem your bond within five years of issue, you lose the last three months of interest. It works out to be the current calendar month you’re in and the last two. So in November, you lose November, October, and September.

- If it’s past five years, you can redeem them without penalty.

Before you can redeem them, you have to review them to see what you’re able to do and what they are earning.

This is how you review your bonds:

How to Review Your Series I Bonds

The first step is to look at your current Series I bonds and see what they are earning.

To do that, log into your Treasury Direct account and look for your bonds. My Savings Bonds are at the bottom of the screen:

Click the circle to the left of the Series I Savings Bond row and click Submit.

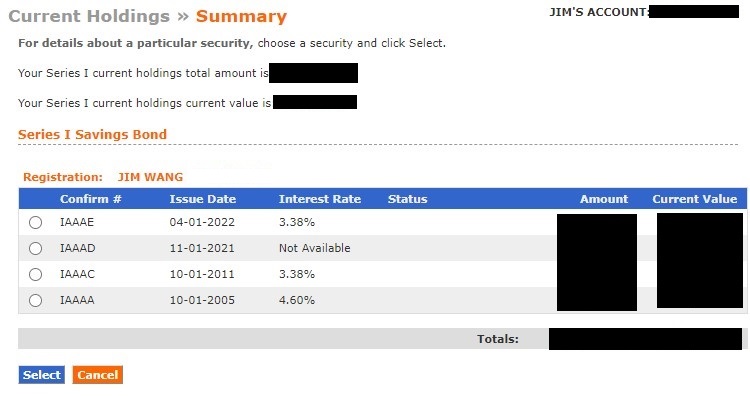

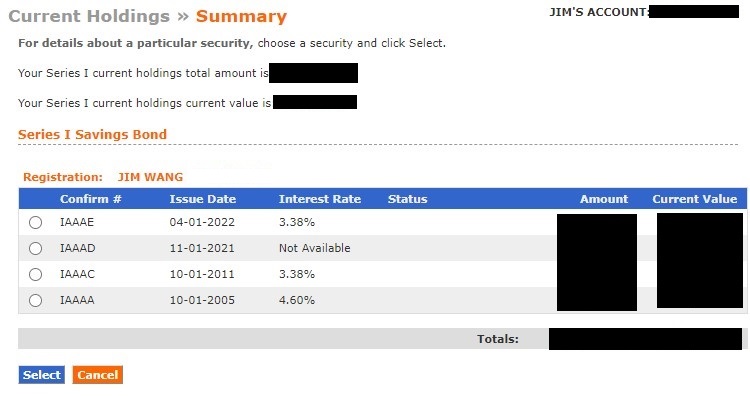

As you can see, I have four Series I Bonds that I can redeem. All four are beyond the one year withdrawal restriction but only two of them are beyond the five year restriction.

The “Interest Rate” shown in the table above is the calculated rate based on the bond’s current inflation rate and its fixed rate, set at issue.

Unfortunately, there’s no way to see the breakdown of the rate into those two numbers. If you click on the circle and “Select” the bond, it shows you basically the same information:

To know the current interest rate breakdown, you have to look it up on the Series I Bond page.

Based on the Issue Date of 10-01-2005, we have a fixed rate of 1.20%. The inflation rate lags because an issue date of October 2005 means we started with the May 2005 inflation rate for six months. This means for October 2023, we are looking at the May 2023 inflation rate for our inflation rate component.

Fixed rate of 1.20% on the bond, 1.69% inflation rate for May 2023 = 4.60003%.

How Much Interest Do You Give Up?

You don’t want to have to calculate this for all your bonds. Fortunately you don’t have to.

When you look at your table of Current Holdings, the “Current Value” column is the value of your bonds minus the interest you’d surrender for early redemption. I blacked it out for mine for security reasons.

What if you want to know if you’re giving up “bigger” interest payments? Perhaps waiting a month would help?

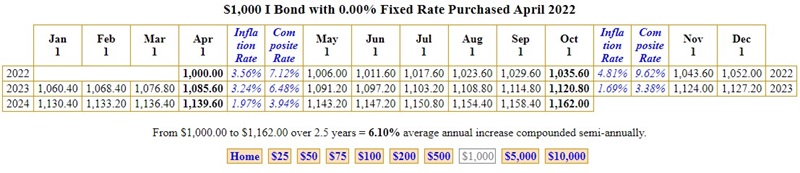

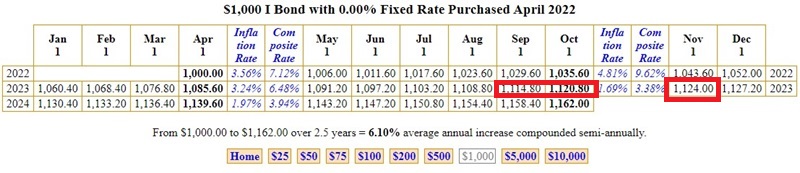

There is a website Eyebonds.info that will show you exactly how much interest you will give up. The Eyebonds website shows you the value of your bond based on its issue date (and you can select a bond value to help with calculations) and you can use it to know how much interest you will pay.

For example, here is the table for my April 2022 Series I bond (set to $1,000):

If I redeem my bond, I surrender the last three months (September, October, and November of 2023) – or $15.20.

If I had a $1,000 Bond issued in April 2022, the “Current Value” in my table of Current Holdings would show $1,108.80.

Should You Cash Out Your Bonds?

You now know all of your bonds and how to look up their fixed rates. You also can see their current interest rate as well as how much interest you’d surrender if you redeem it within 5 years of issue.

For me, the decision tree looks like this:

- If you are outside of the 5 year penalty period, check your rates against what you can get from a 12-month certificate of deposit (currently in the mid-5%). Chances are you can cash out, stick your money in a CD, and earn more with greater flexibility. Even with Series I bond interest being exempt from state and local taxes, the CDs may still be a better rate.

- If you are within the 1 year no withdrawal, no decision to be made here!

- For everyone else in between, that’s the difficult choice of whether you want to keep your bonds or redeem them. You surrender the last three months of interest if you redeem.

I set the bar for whether I should redeem my bonds at the best interest rate for a 12-month CD. That’s my personal bar. I feel that given the current rate environment, if it’s not beating a 12-month CD, it’s time to move on. I set it there because the 12-month rate isn’t the highest rate out there. You can get a higher risk free rate just from other Treasuries (check the latest auction rates).

Check the fixed rate. Many of us are holding Series I bonds with a 0.00% fixed rate (set in May 2020 and stayed there until it was increased on November 2022). Check how much interest you’d be surrendering by redeeming right now (from the website above) and see whether you can do better with an alternative (chances are you probably can).

The inflation rate has been under 2% since May 2023. This means a bond with a 0% fixed rate and a 2% inflation rate is now only getting you 4%. That’s a far cry from the 5%+ you can get elsewhere. And since you’ve been getting less than 4% interest for quite some time… it’s a safe time to redeem.

Finally, one option is to redeem the 0% fixed rate Series I bonds now and “flip” them (up to the $10,000 annual per person maximum) into new Series I bonds with a higher fixed rate. November 2023 Series I bonds have a fixed rate of 1.30% and a composite rate of 5.27% so those could be a good option for folks in high tax states.

As always, there are always special circumstances. If you expect higher education expenses, the interest from Series I bonds can be exempt from federal income taxes. If you know you’ll be spending it there, it might make sense to keep holding them.

What I Am Doing With My Series I Bonds

Here’s what I’ll be doing with my four bonds, shown above:

| Bond # | Issue Date | Interest Rate | Fixed Rate | What I’m Doing |

|---|---|---|---|---|

| IAAAE | 04-01-2022 | 3.38% | 0.00% | Wait until January 1st |

| IAAAD | 11-01-2021 | 3.94% | 0.00% | Redeem |

| IAAAC | 10-01-2011 | 3.38% | 0.00% | Redeem |

| IAAAA | 10-01-2005 | 4.60% | 1.00% | Redeem |

For the first bond (IAAAE), I was earning the composite rate of 6.48% through October 1st. This means I should wait until January 1st to redeem it so I surrender three months of interest at the 3.38% composite rate.

(if you’re getting into the weeds on the math, you may wish to redeem the bond even earlier just because the current rate of 3.38% is so low that giving up a couple months at 6.48% might be worth it)

For the next two bonds (IAAAD and IAAAC), I’m earning under 4% (and have for several months), so I’m going to redeem those immediately.

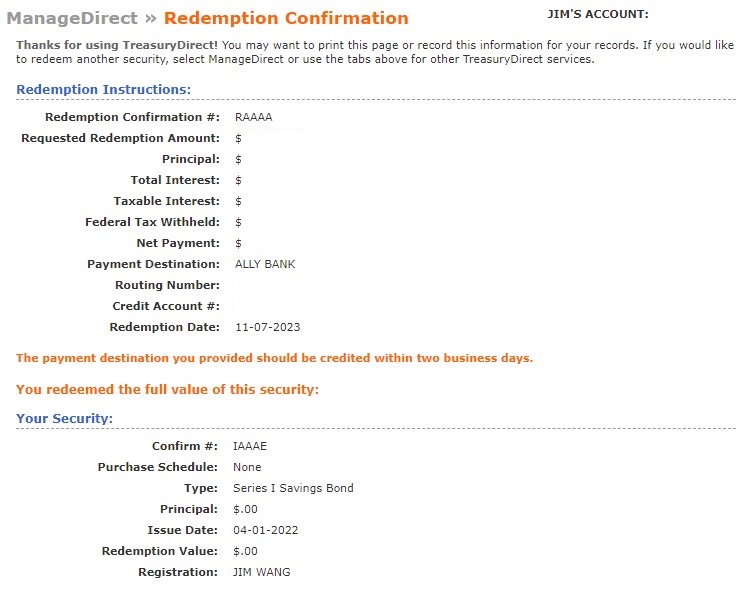

For the fourth bond (IAAAA), it’s beyond the 5 years so I give up nothing (it’s also only valued at $100). The only hesitation comes from the fixed rate but it’s 1.20% – I can get a new bond with a 1.30% fixed rate.

Ultimately, the only thing I give up is that I can only put $10,000 into a Series I Bond each year (the total of these four bonds is far larger).

But with risk-free interest rates outside of Series I Bonds at such favorable rates, the limit has no financial impact.

How to Redeem Your Bonds

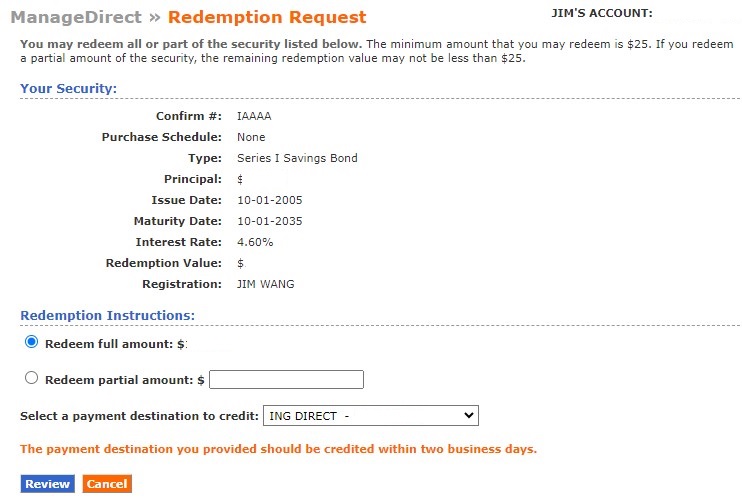

To redeem your bonds, simply go back to the Current Holdings page >> Detail and click Redeem.

You can choose to redeem all or only part of your bond (minimum of $25), one of the benefits of electronic bonds!

Afterwards, you’re shown one confirmation page and then the redemption is complete.

Easy as that!

(and I play on getting the maximum allotment of bonds this year closer to the end of the month)

What will you be doing?

dap says

Thanks Jim. This is a great explanation of how and why to redeem ibonds. I’m leaning towards redeeming next year because I think I can get a tax benefit for using the interest for college expenses for my daughter.

Dude says

Great and easy to understand advice as always, Jim. I will be redeeming mine to take advantage of the great rates on CDs before the Fed drops the rate as expected.