Interest rates on savings and certificates of deposit are at highs we haven’t seen in decades.

Just the other day, I saw a CD that yielded over 7% from a small credit union in Michigan. No tricky conditions to satisfy, just deposit cash into a 7-month CD (it had a maximum deposit of $7,000) and collect over 7% APY for your trouble (if you qualified).

These “sky high” (ok ok, relatively speaking) interest rates sound almost too good to be true, and a few years ago, when the Federal Reserve set target interest rates at 0.00%, they were too good to be true. The only accounts offering 8 and 9% rates were scammy cryptocurrency websites.

But with the target rate so high, getting 5% from a savings account and 6% from a CD isn’t a red flag. It’s normal. (it’s criminal that brick-and-mortar banks can get away with paying nothing in interest)

When I saw a fintech company called Save offering “market returns” on a “savings account,” I had to dig deeper. To me, “market returns” means S&P 500 market returns… something that comes with significant risk. Savings accounts are the opposite of risky, they’re completely safe.

Is Save legit?

Table of Contents

What is JoinSave?

Save, also known as Save Advisers LLC, is a fintech company that partners with Webster Bank (FDIC #18221) to offer a savings product that claims to earn a variable APY* that’s higher than market rates for typical savings accounts. As I’ll explain below, they do this by pairing your savings with an investment account.

Save was founded by Michael Nelskyla, a former Managing Director at UBS, Goldman Sachs, and several other large banks; and is based out of Houston, Texas.

Save Advisers is technically an advisory service, and so they’re registered with the Securities and Exchange Commission (CRD # 306053/SEC#:801-118060). If you go to the Investor.gov website, you can see all their filings, such as their Form ADV and ADV Part 2A.

The document that gives you a good understanding of their approach is their Relationship Summary, Form CRS.

They call themselves Save, but the website is JoinSave.com.

How Does Save Work?

When you open a Market Savings program, your funds are FDIC-insured3 and deposited into a non-interest-bearing deposit account at Webster Bank. You’re also opening an investment account at Apex Clearing (they are a well-known clearinghouse, and your funds are SIPC insured3). 1

Your money will forever sit in that account at Webster Bank, 100% safe.

Then, you will select a portfolio for your investments. The investments are held in your Apex Clearing account. That investment will mature in either 1-year or 5-years, which you chose upfront. The 1-year term has a minimum deposit amount of $1,000 and the 5-year term has a minimum deposit amount of $5,000.

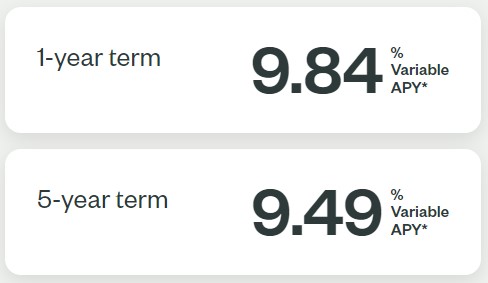

When I first posted this article, in August 2023, the rates being estimated are 8.96% APY for a 1-year term and 9.06% APY for a 5-year term. In this latest update, in November 2023, the rates have changed a little:

The rates are determined by their investment returns so I’d expect it to change.

After the term ends, you get your deposit back and gains (if any) minus fees. You can withdraw your money early, but you have to surrender any gains and are subject to advisory fees and early withdrawal costs. It’s a little like a CD in this regard.

Where it’s not like a CD is that the income is not ordinary income. Since your returns are generated in an investment account at Apex Clearing, it’s considered capital gains.

It’s important to note that the variable APYs* shown above are estimates. This is not a CD where the rate is guaranteed. The only guarantee is that you will not lose money.

What is the Early Withdrawal “Penalty?”

If you need to withdraw your money early, you might have to surrender your gains. There is no penalty in the sense that you could lose money. The amount you surrender is explained in their ADV as:

Cost associated with early withdrawal prior to maturity: Clients who choose to withdrawal deposited funds associated with any given strategy-linked security prior to the maturity of that investment, will be responsible for the early withdrawal trade closure costs associated with such early withdrawal, including but not limited to prorated Program Cost Obligations and subsequent rebate, the prorated Wrap Fees, and any additional trade closure or unwind costs associated with unwinding the strategy-linked security prior to maturity. Early Withdrawal Trade Closure Costs will vary based on the maturity term originally selected. Any Save bonus investments received by Clients that are associated with the deposit being withdrawn prior to maturity will be forfeited. Additional details related to Early Withdrawal Costs and calculations are available for each Program directly within your Save Customer Profile.

What Are The Investment Options?

Save offers five different named portfolios, four of which are available now (the descriptions are from their website):

- Save Global Diversified Markets Portfolios – “The Global Diversified Markets portfolios utilize a sophisticated rules-based investment approach that captures returns across a wide range of asset classes and regions, seeking to maximize the consistency of returns.” (There are three versions of this portfolio)

- Save ESG Portfolio – “The ESG portfolio utilizes the same investment techniques as the Save Global Diversified Markets portfolios and maintains a similar global multi-asset class approach, while utilizing ESG-focused ETFs where possible and avoiding certain assets.”

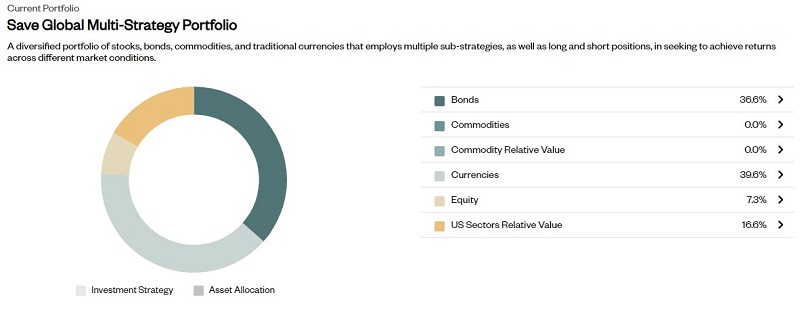

- Save Global Multi-Strategy Portfolio – “The Global Multi-Strategy portfolio seeks to generate returns across market regimes by combining 6 sub-strategies, built using a cutting-edge quantitative approach that exploits how financial markets respond to themes and patterns, or ‘narratives’.”

- Save US Macro Portfolio (Coming Soon)- “The US Macro portfolio seeks to generate returns by allocating across asset classes using macroeconomic variables such as interest rates, inflation and the US dollar. This portfolio focuses on the US equity and bond markets, along with commodities.”

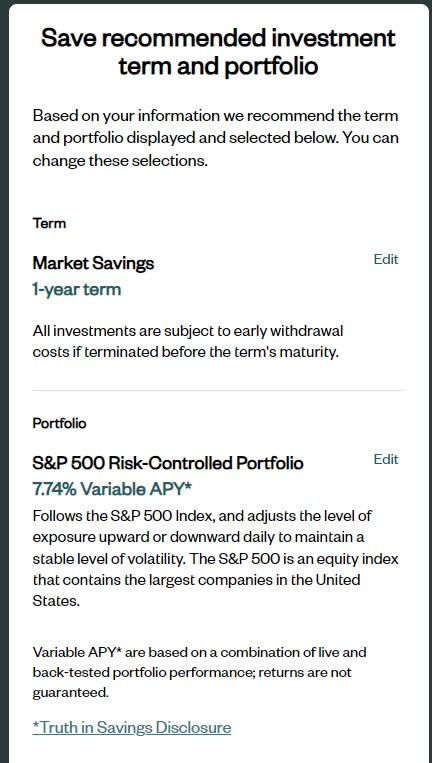

- S&P 500 Risk-Controlled Portfolio – “The S&P 500 Risk-Controlled portfolio follows the S&P 500 Index, and adjusts the level of exposure upward or downward daily to maintain a stable level of volatility.”

If you read the description of each, they all sound very active. Even the S&P 500 Risk-Controlled Portfolio has a lot of activity – it “adjusts the level of exposure daily” – so it’s not just an index fund.

What are they doing behind the scenes? Their SEC forms give us a hint at what’s happening behind the scenes, and they use various investment vehicles to “adjust” the approach.

Where Does Save Get The Money to Invest?

If I deposit my money with Save, they put it in an FDIC-insured3 bank account. Then they invest an equivalent amount in the markets. Where do they get that money?

The answer is in their FAQ:

How are Market Savings deposits FDIC insured and, at the same time, Save invests on my behalf?

We utilize two accounts; one deposit account with our partners at Webster Bank, N.A., Member FDIC, and one investment account with our partners at Apex Clearing Corporation. For the Market Savings program, all cash deposited by customers is placed in an FDIC-insured bank account† and is not used to fund investments and is therefore not at risk of loss. It is important to note that Save is not a bank, but we partner with FDIC-insured member banks.

This allows the principal to be FDIC-insured,† and invest equivalent portfolio investments at the same time. What we mean by equivalent portfolio investments is essentially taking the economic value of your deposits and purchasing an equivalent investment on your behalf. Any equivalent investment is funded by Save partner banks, not from customer deposit accounts, and there is no requirement for customer outlay of their own capital.

link

I added the emphasis – but the basic gist is that they borrow the money from the banks themselves.

How Does Save Make Money?

Save doesn’t charge a set-up fee or any monthly maintenance fees, so you might wonder how do they make money?

For the Save Market Savings and your referrals, they charge a 0.35% management/advisory fee when there is an APY* above 0.35%.

If you don’t make enough (over 0.35% APY*) to cover that fee, they don’t collect the fee at all.

They make money from you only if you make money.

How to Join Save

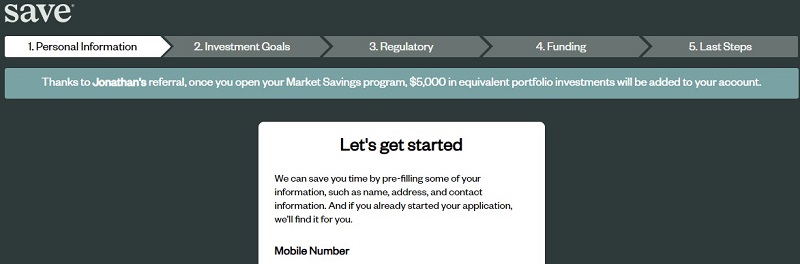

I joined Save around the end of July through a referral link and the sign-up process took only a few minutes. The first step involves giving them your phone number:

The first screen asked for my mobile number and birthday.

Once you verify your phone, you can proceed. I was surprised to see it pre-populated a lot of my information, including my social security number and address. It could be because they’re linked to my phone number on my credit report.

There were a few more questions, like my investing experience, employment, and income. For some of these questions, I was surprised to see that I couldn’t put “N/A” or otherwise not answered them. I don’t know why they need to know my income or net worth.

These questions were all used to set a term and portfolio, but you can edit those.

You can click edit and change it, but here are the variable APYs* of the other options (as of July 27, 2023):

- Save Global Diversified Markets Moderate Portfolios – 8.96% variable APY*

- Save Global Diversified Markets Conservative Portfolios – 8.70% variable APY*

- Save ESG Portfolio – 8.70% variable APY*

- Save Global Multi-Strategy Portfolio – 18.67% variable APY*

- S&P 500 Risk-Controlled Portfolio – 7.74% variable APY*

There was an interesting asterisk next to the Save Global Multi-Strategy Portfolio and it’s eye-popping 18.67% variable APY* –

If the Save Risk Profile Scoring system did not select / suggest the Save Global Multi-Strategy Portfolio for you, DO NOT select it solely based on the current potential variable APY* presented.

This portfolio contains a “Long/Short” component, where the underlying assets are comprised of both long and short positions simultaneously. Although a “Long/Short” style portfolio component may provide greater returns by investing in multiple sources of risk and return; theoretically this also increases the probability of unknown outcomes associated with the variable APY*. Regardless of any outcome, your deposit is still FDIC insured and is not invested, encumbered, collateralized, or put at risk.

I went with the Save Global Multi-Strategy Portfolio anyway – it’s $1,000 and my principal is protected. I might as well go for a bit of a ride, right? (the current 12-month CD rate is 5.51% APY)

Here’s what’s inside:

The Bonds allocation is 25% BNDX and 75% IEF. Cool cool.

The Currencies allocation is 100% UUP.

The Equity portion is 100% SPY.

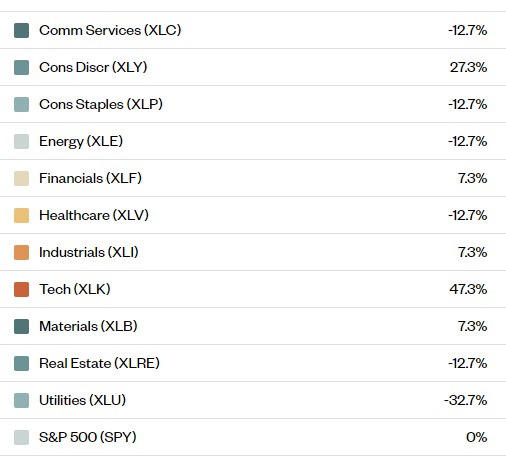

Up until now, it’s all pretty standard stuff… until you get to US Sectors Relative Value:

This is where all the funky stuff is likely happening, with the negative values being short positions (maybe?). For example, XLV is a State Street Global Advisors fund that tracks the health care sector. With a negative percentage, I’d expect this to be a short position. Either way, this is probably where they allot their special sauce.

OK, back to the opening process.

On the next screen, Savings account agreements, are typical questions brokerages will ask like “do you or anyone in your household work for a securities exchange?” They were, however, written in the affirmative. As in you check the box if they applied to you… which is the opposite of what I think I’m used to.

Afterward, you’re asked to review all their documents and then link an account with your banking information. I was surprised they didn’t use Plaid but I suppose that keeps costs down just a little bit more.

Approval Took ~3 Business Days

I applied for an account on a Thursday (in late July 2023) and was approved on a Tuesday. It strikes me as a little bit long but that could be psychological as there was a weekend in between, but I was surprised it took that long.

When your account is approved, you get an email with the subject line “Transfer of Funds Initiated.” There’s no Welcome email, just a “Hey we’re transferring the cash now.” 😂

Either way, opening an account was a pretty smooth opening process.

I’ll update this post in the future with any new developments.

$5,000 Save Referral Program

One nice perk of having an account is that they have a referral program. When you refer someone to Save, you can both get an additional $5,000 in equivalent investments†† of “bonus exposure.” The minimum investment is $1,000 for the 1-year term. The referral bonus may vary depending on the deposit amount.

After a year, you get your $1,000 back plus whatever you gained on the total equivalent investments†† related to both your deposit and your bonuses after the 0.35% fee has been deducted. You don’t keep the bonus exposure amount. 😂

$1,000 Birthday Bonus††

My birthday has just passed and it turns out that Save gives a Birthday Bonus! A nice little bonus.

The terms of this bonus are similar to the referral bonus, except it’s $1,000 in equivalent investments rather than $5,000 in equivalent investments.††

What’s The Catch?

If there is a catch, I’m not seeing any significant issues.

The main risk is that you don’t get any returns. When savings accounts are yielding over 5% APY and inflation is in the low single digits, not getting returns is a risk but not a catastrophic one. Your dollars are losing purchasing power but if that’s the biggest risk, I’m comfortable with it.

If you give it a try, let me know what you think!

John H Glass says

Hey Jim. Thanks for the information. I talked to Alpena Credit union about their 7 month CD. I think Im going to make a deposit. Thanks. I let you know. I do live in Michigan and I didnt know about this one. You da man!

This one I have to read and read it a few times. If I join I will be sure to use your link.

You have always been a wealth of good reliable information.

Thanks John! If you qualify to open an account there, it’s a good offer because that rate of return is guaranteed. Save’s return is just an estimate and not at all guaranteed.

David Kemp says

Jim, wow! That’s a lot of information and you obviously researched it well. The question that bothers me is, with my money staying safely in the FDIC insured account, whose money is invested to earn the big returns? And why would they give the returns to me if they can’t touch my money?

I don’t expect you to take the time to give me a long, detailed answer. I’m just throwing out my reaction at this point.

Thanks.

Hey David! That’s something I wondered about too (and others have as well via email), I’m going to chat with someone from Save next week and I’ll make sure to ask. I’ll update the post with what they share.

Ekaphonh says

Hi Jim,

I joined Save and used your referral link. Thanks for the $5,000 bonus exposure and excellent article!

Have a blessed day!!

Thank you Ekaphonh!

AK says

If your money is 100% safe in a savings account, then what are they investing? Sounds like you can have your cake and eat it too. I don’t understand Save. Please explain.

From their FAQ – “We utilize two accounts; one deposit account with our partners at Webster Bank, N.A., Member FDIC, and one investment account with our partners at Apex Clearing Corporation. For the Market Savings program, all cash deposited by customers is placed in an FDIC-insured bank account† and is not used to fund investments and is therefore not at risk of loss. It is important to note that Save is not a bank, but we partner with FDIC-insured member banks.

This allows the principal to be FDIC-insured,† and invest equivalent portfolio investments at the same time. What we mean by equivalent portfolio investments is essentially taking the economic value of your deposits and purchasing an equivalent investment on your behalf. Any equivalent investment is funded by Save partner banks, not from customer deposit accounts, and there is no requirement for customer outlay of their own capital.”

The way I read it is that they are borrowing money from the partner banks and investing it.

Chad says

Invested in the Global Multi Strategy back in March. My return shows a paltry .28% gain overall. The referral program and the savings program are in the same strategy, but show different rates of return. Not sure about that. Disappointed in the returns considering what the market in general has done and especially in light of 5% HYSAs.

I’ve only been in it for a little while and I’m seeing 3.75% on my Market Savings but it’s a simple calculation of a rate of return based on the gains. I put in $1,000 and the current gains are $37.53 (again, paper gains) so it calculates it at 3.75%. It can fluctuate (and it has) so it’s not like I accrued at 3.75% APY. We won’t know what the returns are until the year ends.