Seeking Alpha

Product Name: Seeking Alpha

Product Description: Seeking Alpha is a personal finance and investment platform that publishes news and analysis that investors can use to make better decisions. In addition to the free content, they also offer several paid platforms including Seeking Alpha Premium and Alpha Picks.

Summary

Seeking Alpha is a personal finance and investment platform that publishes news and analysis that investors can use to make better decisions. In addition to the free content, they also offer several paid platforms, including Seeking Alpha Premium and Alpha Picks.

Overall

Pros

- Ability to interact with other investors/subscribers

- Emphasizes fundamental value rather than technical analysis

- Three different service plans are available, including a free plan

- Various stock metrics to help you choose suitable investments

- 14-day free trial

Cons

- Specific investment recommendations not provided

- The PRO plan is pricey at $2,400 per year

- Ten thousand monthly investment ideas can be overwhelming

- No refunds once you have paid the subscription fee

Seeking Alpha can provide the information and analysis you need to invest in stocks and ETFs. While they don’t offer investment recommendations, you can access cutting-edge research, news, and analysis to match many investment strategies.

Here’s how the platform works and the essential features.

At a Glance

- In-depth stock and fund analysis

- Exclusive Quant Ratings

- Interactive stock screener

- Portfolio tracker

- Charting tools

Who Should Use Seeking Alpha?

Seeking Alpha Premium is ideal when you regularly trade individual stocks or ETFs and rely on independent research and in-depth ratings. It’s also great for tracking multiple brokerage accounts under a single platform.

Seeking Alpha Alternatives

| Pricing | $34.95 monthly or $249 annually ($20.75/month) | $99 for the first year, then $199 | Free, $79.99, $179.99, or $279.99 annually |

| Best Research Tools | Stock and funds ratings, fair value assessment, analyst reports, stock screener, portfolio tracker | Monthly research reports and stock screener | Stock ratings, charts, screener, and portfolio tracker |

| Model Portfolios | Highest-rated lists for stocks, ETFs, and mutual funds | Two monthly stock picks | Guru Portfolios for hedge fund investment strategies |

| Learn more | Learn More | Learn More |

Table of Contents

- At a Glance

- Who Should Use Seeking Alpha?

- Seeking Alpha Alternatives

- What is Seeking Alpha?

- Seeking Alpha Features and Benefits

- My Portfolio

- Top Stocks

- Stock Ideas

- ETFs

- Unlimited Access to Premium Articles

- Stock Quant Ratings

- Author Ratings

- Top Stock Lists

- Side by Side Comparison

- Seeking Alpha Plans and Pricing

- Signing Up with Seeking Alpha

- Seeking Alpha Alternatives

- Should You Sign Up for Seeking Alpha?

Seeking Alpha Black Friday Sale

Seeking Alpha is offering a massive Black Friday sale on both Premium and Alpha Picks, valid until December 5th.

Seeking Alpha Premium is now just $209 (down from $299) and you get a 7-day trial to see if you like it. This price is available to everyone, including previously paid subscribers (no free trial though).

For Alpha Picks, you can get it for $359 a year, down from $499 – a huge $140 discount.

If you want both, you can get it for just $509, which is a $289 discount.

If you’ve been thinking about it, this is a great time to get a huge discount.

👉 Learn more about Seeking Alpha

⏰ This offer expires on midnight December 5th, don’t wait to start the trial!

What is Seeking Alpha?

Founded in 2004, Seeking Alpha is a widely quoted financial information source for the entire investment industry. The Seeking Alpha website is free to anyone and everyone, so you can get a ton of value without paying a penny.

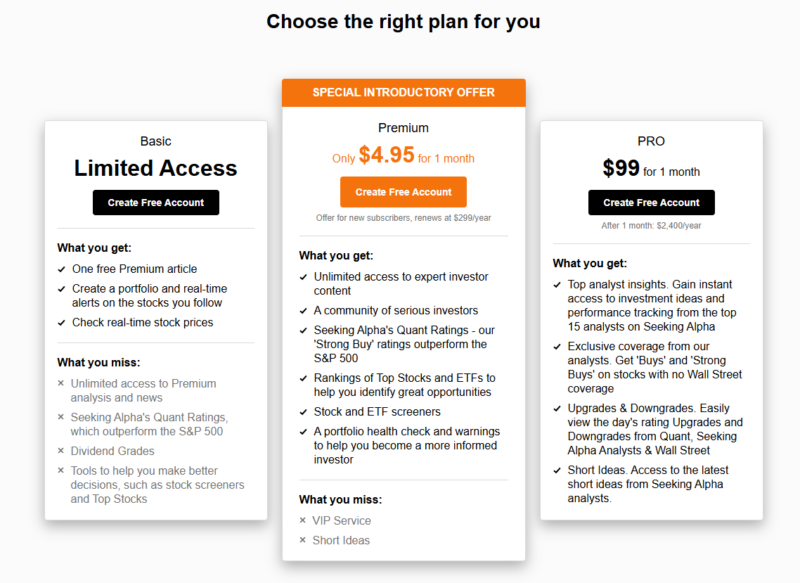

Three different plans are available, two of which require a subscription fee. Each provides a higher level of service, including more in-depth information and analysis than what is freely available on the website.

Speaking from experience, the majority of investors will benefit most from the mid-tier Premium plan, which offers unlimited articles, access to exclusive quant ratings, and a stock screener. This review primarily focuses on the Seeking Alpha Premium features.

Further, the free Basic tier is suitable when you only research one or two stocks monthly.

The company’s mission is to provide ordinary investors with exclusive investment tools that were once available only to investment professionals. You can utilize these tools for a reasonable cost through the web and mobile platforms.

Customer service: Seeking Alpha representatives are available by email and phone, Monday through Friday, 8:00 AM to 4:00 PM, Eastern time.

Mobile app: Seeking Alpha’s mobile app is available for download by iOS users on The App Store and Android devices at Google Play.

Seeking Alpha Features and Benefits

When you’re on the Seeking Alpha website, the sidebar will show the various services offered by the platform. But in most cases, you’ll have only limited access to those services and features. For example, you may be provided with a basic list of companies, with much of the most important information grayed out. You’ll need to sign up for one of the three subscription services to get deeper information.

Let’s take a closer look at the Seeking Alpha features, including premium-level access.

My Portfolio

You can create a portfolio right on the Seeking Alpha platform. In addition to assembling your current holdings, you can also get email alerts and push notifications about stocks you’re considering. This service is available with a free Basic account.

Top Stocks

This feature is at the core of the Seeking Alpha program. It offers the following categories:

- Top Rated Stocks

- Top Rated Dividend Stocks

- Top Growth Stocks

- Top Stocks by Quant

- Top Value Stocks

- Top Short Squeeze Stocks

- Seeking Alpha’s Quant Performance

- Stock Screener

- ETF Screener

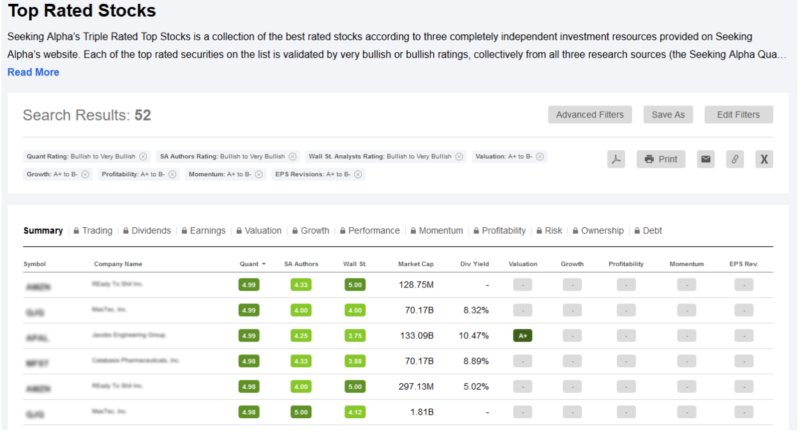

Look at the Top Rated Stocks screenshot below as an example of how the plan levels work.

If you access this page directly from the website, you’ll see the possible search results and certain numeric information.

If you sign up for either the Seeking Alpha Premium or PRO plans, you’ll receive full information, including company names, symbols, complete rankings, and more.

Stock Ideas

This is an even more detailed feature category. It includes the following topics:

- Long Ideas

- Short Ideas

- IPO Analysis

- Investing Strategy

- Quick Picks and Lists

- Editor’s Picks

- Fund Letters

- Portfolio Strategy

- Closed-Ended Funds

- Financial Advisor

- Stocks Ideas Editor’s Picks

- Bonds

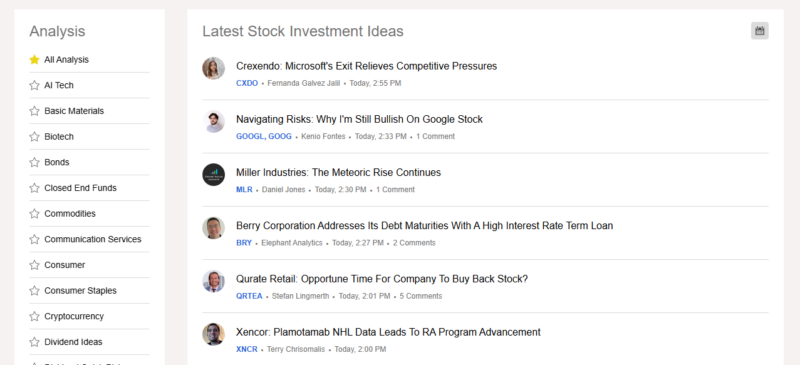

Looking at Long Ideas, the screenshot below shows the articles that will be available to you about individual companies. Most stocks have bullish and bearish commentary from contributors with an assortment of professional backgrounds.

The format is similar to the other categories under the Stock Ideas section. Each will provide a very long list of articles about the topic at hand.

However, you won’t get specific stock or investment recommendations. Instead, Seeking Alpha provides the data to help you decide how and which companies to invest in.

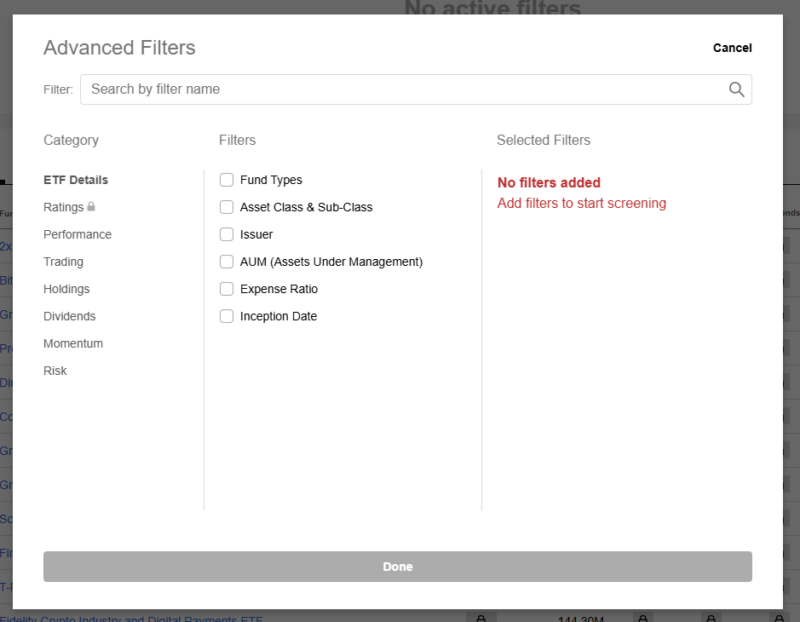

ETFs

Exchange-traded funds (ETFs) have become one of the preferred ways to invest in recent years. Seeking Alpha dedicates an entire category of topics related to ETFs. Examples include:

- ETF Analysis

- ETFs for Bonds

- ETF Screener

- ETFs for Emerging Markets

- ETFs Editor’s Picks

- ETF Performance – Sectors

- ETF Performance – Countries

- ETF Performance – Market Cap

- Let’s Talk ETFs

- ETFs for Commodities

The ETF section also includes lists of articles in some categories. But for others, they provide more technical data, like market performance or analysis.

For example, the ETF Screener is below. You’ll be able to narrow down your list of ETF choices by a variety of filters, including asset class, market cap, dividend yield, expense ratio, risk/beta, holdings, trading volume, and more. The screener will filter the choices based on your criteria and provide you with a list of eligible funds.

Unlimited Access to Premium Articles

With the Basic plan, you can access one monthly premium article. However, with the Premium plan, you get unlimited access to all the articles you want.

Stock Quant Ratings

Even though Seeking Alpha emphasizes fundamental values, they provide quiet ratings, including qualitative ratings of stocks based on over 100 metrics. Ratings are based on value, growth, profitability, momentum, revisions, and other factors.

Author Ratings

Along with quant ratings, you’ll also get access to the rating that Seeking Alpha writers give each stock.

This feature is critical, given the reliance Seeking Alpha places on the thousands of articles they offer on the site each month. Each article will include ratings by the author as very bullish, bullish, neutral, bearish, or very bearish to make it easier to identify the author’s conviction and the particular security recommended.

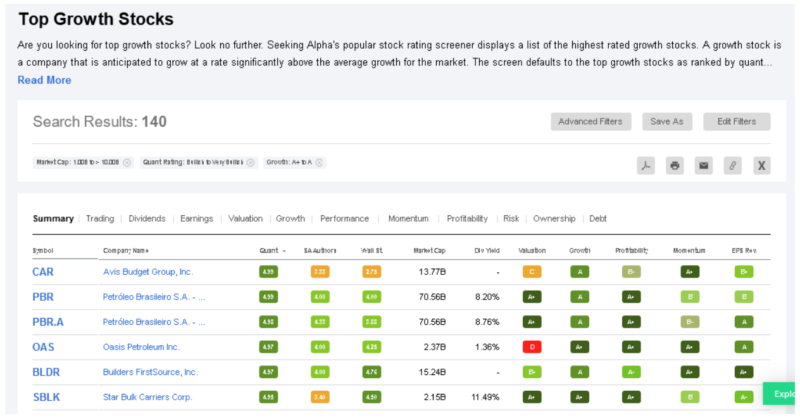

Top Stock Lists

With Premium, you’ll get access to Seeking Alpha’s stop stock lists, including Top Rated Stocks, Top Rated Dividend Stocks, Top Tech Stocks, Top Growth Stocks, Top Value Stocks, and more.

Side by Side Comparison

Once you’ve narrowed your next stock purchase down to a few stocks, Premium will give you side-by-side comparisons showing key stats for up to six stocks.

✨ Related: Action Alert Plus Review

Seeking Alpha Plans and Pricing

Seeking Alpha Basic

Seeking Alpha Basic is free but requires registration for an account. That’s because it offers certain features beyond those available directly on the website.

This plan comes with the following services:

- Stock analysis email alerts

- Real-time news updates

- Access to stock prices and charts

- Wall Street Ratings for every stock

- One Premium article

The free investing newsletters you can choose from are Wall Street Breakfast, Morning Briefing, Stock Ideas, Macro View, Dividends Ideas, Energy Investing, ETF Ideas, Tech Daily, IPO Daily, Cryptocurrency Daily, Global Investing, M&A, and Stocks & Sectors.

I consider the entry-level plan the best option when you want a portfolio tracker and to scan the daily stock market headlines quickly. Frequent investors and those with the time to read the analyst commentary should upgrade.

Seeking Alpha Premium

The normal subscription fee for Seeking Alpha Premium is $299 per year.

It offers all the features of the Basic plan but adds the following:

- Unlimited access to Premium content and investing ideas

- Stock Quant Ratings

- Seeking Alpha Author Ratings

- Seeking Alpha Performance Ratings

- Unlimited Stock Quant Ratings

- Stock Dividend Grades

- Listen to earnings and conference call recordings

- Screen for top-rated stocks with the rating screener

- Download and print financials, earnings, and company presentations

- See three types of ratings for each stock in your portfolio

- Get alerts on upgrades and downgrades on securities in your portfolio

You should also know that the Premium plan comes with “Ad-lite.” You won’t get as many ads as you will with the free Basic plan, but there will be some nonetheless.

✨ Related: Seeking Alpha Picks Review: Two Stock Picks Per Month

Seeking Alpha PRO

This is Seeking Alpha’s top-of-the-line plan for the most frequent and data-savvy investors. The fee for this plan is $99 for the first month, then $2,400 per year. It has all the features and benefits of Premium but adds the following:

- Top Ideas

- PRO content and newsletters

- Short ideas portal

- Idea screener/filter

- VIP customer service

- Ad-free experience

Signing Up with Seeking Alpha

You can get started with Seeking Alpha by creating a free account. You can do this on the website in the top right corner. You can either sign up using your Google account or complete the single-page application that will appear on the subscription page.

Once you have your free account, you’ll have the option to upgrade. Click “Full Access” in the top right corner to do so.

Seeking Alpha Alternatives

While it can often seem as if all investment advisories provide the same basic information, which is partially true, each fills a particular niche. If Seeking Alpha doesn’t offer the services you’re looking for, consider the following alternatives.

Morningstar Investor

Morningstar is one of the most respected information sources in the investment industry. Major financial media relies on information from the company, and many investment firms use their five-star rating service.

You can sign up for Morningstar Investor to find the best investment choices in mutual funds, ETFs, stocks, and bonds. They offer a free 7-day trial, after which you’ll be charged a monthly fee of $34.95. However, the cost is significantly reduced if you sign up for their annual plan, which has a yearly fee of $249.

Here’s our full review of the Morningstar Investor service for more information.

For a limited time, Morningstar Investor is discounted by $50!

It comes with a 7-day free trial so you can lock in your savings, try the service, and cancel if you don’t think it’s for you.

Motley Fool

Motley Fool Stock Advisor differs from Seeking Alpha and is more of a stock-picking service than an investment information source. They provide two monthly picks and frequent updates highlighting the best investment opportunities within its model portfolio built to hold stocks for at least three to five years.

The service is available for an annual subscription fee of $199, but you’ll pay only $99 for the first year because of a limited-time discount. Motley Fool offers other advisory services with additional subscription fees and more monthly picks.

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

Here’s our full review of the Motley Fool Stock Advisor service for more information.

Stock Rover

Stock Rover is best for long-term investors with impressive free and premium stock screeners. You can link your portfolios to track your investment performance and read the latest stock and ETF ratings for your current and prospective holdings.

Three paid plans are available with incrementally more screening metrics and research tools. Annual pricing ranges from $79.99 to $279.99. You can research over 700 metrics, use portfolio simulation tools, reference guru portfolios, and receive fair value and margin of safety scores.

Here’s our full tock Rover review for more information.

Should You Sign Up for Seeking Alpha?

If you’re serious about investing and prefer to manage your own portfolio, Seeking Alpha has a useful suite of tools that can help you research better and faster. The Basic plan is a good choice for new investors since it offers essential tools and is free. I can’t think of a reason not to sign up.

But should you pay for a premium subscription?

As you become more advanced, you can upgrade to the Premium plan, which offers comprehensive services for a relatively low annual fee. With a one-month trial, you can test drive it to see if it’ll be a good fit.

But if want even more, such as a dedicated stock picking service, Motley Fool may be a better fit, but Seeking Alpha provides plenty of actionable information from a variety of sources too. If you’re comfortable digesting information and doing your analysis, Seeking Alpha is worth the price.

Seeking Alpha Black Friday Sale

Seeking Alpha is offering a massive Black Friday sale on both Premium and Alpha Picks, valid until December 5th.

Seeking Alpha Premium is now just $209 (down from $299) and you get a 7-day trial to see if you like it. This price is available to everyone, including previously paid subscribers (no free trial though).

For Alpha Picks, you can get it for $359 a year, down from $499 – a huge $140 discount.

If you want both, you can get it for just $509, which is a $289 discount.

If you’ve been thinking about it, this is a great time to get a huge discount.

👉 Learn more about Seeking Alpha

⏰ This offer expires on midnight December 5th, don’t wait to start the trial!