When you're the son of first-generation immigrants, your childhood home is an enclave.

We had hanging scrolls, framed texts, and photos of our relatives in Taiwan. My friends had movie posters of the Goonies, Back to the Future, and ET.

As a kid, I was embarrassed when my friends came over.

Why were there so many paintings of goldfish on the wall?

But that was my culture and it wasn't until many years later that I would finally understand what it all meant.

Decades later, my lovely wife and I went with my parents to visit our ancestral home in Wenzhou, China.

When we landed at the airport and deplaned, you would've thought we were rock stars or foreign dignitaries with how many of our family greeted us. I didn't understand, at the time, how momentous an occasion this was for the family.

In the period after the civil war in China, my grandfather visited Taiwan on a tourist visa and never went back.

HE NEVER WENT BACK TO COMMUNIST CHINA.

(they frown on that type of thing)

This decision would forever change the trajectory of his life and, as a result, his entire line. There were serious repercussions back home in Wenzhou, a weight he would carry with him for the rest of his life. His sister, who tested extremely well, was not allowed to go to college. And it would be decades before he'd ever see anyone in his family.

In 1978, my father emigrated to the United States from Taiwan on an education visa. He bought a one-way ticket, that's all he could afford. He left my mom, her extended family, his extended family, his first language, and their entire social support structure behind. While there were no government-sponsored repercussions, there was the small matter of 7,800 miles between them.

It was a difficult move but one that forever changed the trajectory of his life and, as a result, mine.

My mom would join him a year later, once he'd saved enough money to purchase a ticket, and they were so happy to be together again that I was born a year later. 🙂

My grandfather and my father made those moves, at great peril to our family, because it represented a better life. Not a better life for themselves, necessarily, but certainly one that was better for their children. The sacrifice they made, to give up comfort and relative safety, was a calculated bet that the grass would truly be greener on the other side, as long as they were willing to do the work to seed it.

Moving from China to Taiwan was a Level Up.

Moving from Taiwan to the United States was a Level Up.

These days, you can change your life's trajectory without having to take such big risks to health or big sacrifices to your near-term happiness.

What Is a Level Up?

But if you feel like you need more, then doing the “same old thing” isn't going to get you new results. The same old thing will get you single digit raises when you need much bigger shifts. The same old thing will get you the same old thing.

To get more, you need to change your trajectory. You need to identify and take advantage of opportunities that will shift your trajectory so you take a new path. These shifts are Level Ups.

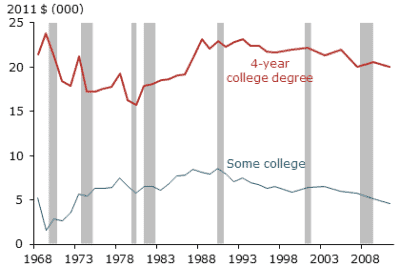

Level Up: Graduate College

While not discussed in the study, if the college graduate invests some of that difference, the $800,000 becomes much much larger.

College is one of the oldest Level Ups in the book.

Like all other Level Ups, it's not a guarantee. It merely gives you a higher probability of success.

Level Up: Online Education

What if you want to continue your education but you're not able to continue your education in a traditional classroom environment? What if you don't want to be saddled with tens of thousands of dollars in student loan debt?

There are a lot of online education options and not all of them are expensive.

What if I told you that you could get a certification from Harvard Business School for less than a thousand dollars?

You can take HBX's Entrepreneurship Essentials course for just $950. It's 25 to 30 hours of material developed by Professor William A. Sahlman, a Baker Foundation Professor of Business Administration at Harvard Business School. HBX is the online classroom for Harvard Business School.

If you want more than 30 hours, you can take advantage of their Credential of Readiness (CORe) program – a series of three courses (Business Analytics, Economics for Managers, and Financial Accounting) – that will prepare you to “contribute to business discussions and decision making.” It's a 17-week program that costs around $2,000.

Level Up: Whiten Your Collar

In the past, the term blue collar referred to manual work and workers while the term white collar referred to administrative, managerial, and office type of work. Blue referred to the blue collars of overalls while white pointed to the white collars of dress shirts.

If you look at the concepts themselves, you see a similar delineation in a variety of areas. In retail, you have the folks who work in the stores and those who manage them. Even in office work, you have folks who “do the work” and those who “manage” it. In the military, you have a similar line between the enlisted and the officers.

The military's pay scale is public information. The Army's basic pay for a Private (E1) with less than 2 years of experience is $18,378. A Second Lieutenant (O1) with <2 years experience gets $34,862.40, a difference of $16,484.40 a year. A Staff Sergeant (E6) with six years of experience earns a basic pay of $35,578.80. Officer basic pay is significantly higher. To Level Up, if you work in a blue-collar role, you need to find out what you need to do to move into a white collar role. This is often done through education or the accumulation and demonstration of skills. If you've ever wondered why white collar work is more valuable, it's all about impact. As a blue collar worker, you are often doing manual work producing a single widget. As a widget maker, how many can you make in a day? A dozen? If you are really good, maybe you can do 15? 20? When you manage a factory, you have a hand in managing hundreds of workers making widgets. Your decisions impact their production capabilities and your improvements could have a magnified impact. Make one change and everyone goes from twelve widgets a day to thirteen. Your factory goes from 1,200 widgets to 1,300 - a difference of a hundred widgets. The bigger your impact, the bigger your value to the enterprise, and the more you'll be paid.

Level Up: Start a Business

The first two examples focused on something you would do for yourself and your primary occupation. With College, you improve your education and your future job prospects because you have a degree in a high-demand field. With Whitening Your Collar, you add skills and put yourself in position for a greater role in your organization so you can have a bigger impact and, as a result, earn more.

This example explains how in your spare time you could find a hobby or interest you can transition into a side business. When I talked about transitioning from blue to white collars, the core idea was about impact. How many people can you impact? When you think about starting a side business, think about what you can do to increase your impact on the world. The internet and social media have given each of us an outsized reach and ability to impact the lives of others – that's why starting a blog is such a popular way to start a business.

The opposite of this is having an outsized impact on a small number of people. I have a friend who sells medical equipment to hospitals and earns a healthy six figure income by selling just one of these units a year. It's an expensive device so each of these sales takes quite a bit of time but he gets compensated well for it because they're so dang expensive. If you have an outsized impact and can capture just a little bit of that for yourself and your family, you can find prosperity.

Level Up: Life

Not all Level Ups have to do with money and your career. Money is important but it's not all-important. Your health, your relationships, your sense of fulfillment and self-actualization – those are all crucial as well. Those all have an impact on your life's trajectory.

My uncle was business partners with a very wealthy man in China. The partner had grown his wealth through real estate speculation and was worth several hundred million dollars, if not into the billions. He was wildly successful in business but his relationship with his wife and daughter was terrible. His health was terrible despite being a relatively young man (he took a dozen pills a day and was in his 50's).

He had changed the trajectory of life through business.

But, unfortunately, while his net worth was higher than most, his lifespan was shorter. He wouldn't get to enjoy the fruits of his labor.

Remember what it's really all about… because it's not the money.

Thanks for sharing the personal story Jim. What sacrifices your grandfather and father made to level up. Great stuff. I’m sure difficult at the time, but well worth it in the long run. A great lesson we can learn from today.

Thanks Brian, their stories are pretty incredible and gives me something epic to live up to. 🙂

Jim, you really hit a home run with your closing section. Leveling Up at the expense of your family and general quality of life is a foolish trap that many fall into without even knowing it. In a sense, it can be Leveling Down.

Thank you 🙂

The closing story is really sad. The relationship and health issues were all within his control, to a certain degree, and it was unfortunate that he put business and earning money before relationships and maintenance. I’ve resolved not to let that get so out of balance for myself. Earning money and providing for your family are important, but providing means more than money. It means being there and present as much as it means keeping the lights on and the heat running.

As a fellow Asian American your story resonates with me. I think children of immigrants often share some attributes…we work hard because we know the sacrifice our parents made so that we could have a better life. I’m sure your parents are proud of what you’ve accomplished already. P.S: The last part of the section of the Leveling up: Start a Business got cut off. That’s the Level up I’m trying to attain =)

We learn so much from our parents, much of it is only what we see and not what they necessarily say. You can see hard work, you can see people fighting through frustration and all the other positives. You can also see the negatives too and potentially emulate those as well, so it’s good to retain what is positive and try to work past that which is negative. 🙂

I really enjoyed hearing your family’s story, and I also appreciate your balanced view about seeking a level up. If you want a change, make it happen! But money is not the only important thing in life. Couldn’t agree more–well said.

It’s important to work hard but to also work smart. 🙂

And yes, money isn’t the only important thing in life. It’s important… but don’t sacrifice everything for it.

Jim:

I really like this article.

It’s a great exercise to look back and realize the decisions that our parents, grandparents, and relatives before them made and how those decisions impacted not just their lives, but future generations.

The same applies for us. The decisions we make today can have downstream consequences for our children, grandchildren, and beyond.

Leveling up takes courage, but nothing risked, nothing gained.

Very inspirational!

Very inspirational Jim!

I’ve been wanting to level up in my life and career and am constantly thinking of the next thing I can do. Hopefully my current path will lead me to better places 🙂 I’d eventually love to start my own business (not sure what just yet) because I would love to not have to be at the mercy of an employer who dictates my schedule.

Time is our most precious resource 🙂

Great article, Jim. I would add that you need to Level-up your physical and mental health…

yes 100%!

The interesting thing about leveling up, is how the higher you get, the harder it becomes to make a large change.

Moving to a better economy – big reward. Once you’re at an upper level – good economy, good education, good career – you run into a diminishing rate of return on your effort. Starting your own business is a level up but comes with some serious risks.

I’ll be self-employed eventually, due to my age if nothing else, but I’d rather focus my energy on passive income streams to save the time to spend on friends, family, and life.

That’s true. Opportunities are fewer and the rewards are fewer as a relative percentage, but that’s kind of how it should be. The jump from No GED to GED is big. From GED to college grad is also big. From college grad to graduate degree is less percentage-wise, but still valuable. Sometimes it’s not always clear what the benefits are though too and different industries value different things.

For example, you can’t be a doctor without a medical degree, significant on-the-job training, and other certifications. You can’t practice law without passing the bar.

This is fabulous, Jim! I’m always thinking about life in this way and it’s a struggle to find balance. Our lives are good, but not as good as they could be. So, it’s a balance between enjoying the life we have now and making the sacrifices that feel like leveling down but might eventually lead to leveling up. And your family’s story is amazing!

Sacrifices are just short term NO’s so you can have long term YES’s – and they’re sometimes scary because a No today doesn’t always mean a Yes tomorrow.

Thank you Jim for sharing a personal story. Learning about your family’s experience, can create growth or changes in your own decision making. Opportunities are more abundant than people realize, but missed, because we get caught up in everyday pressures. Leveling up, just takes action.

Yes, the day to day is necessary but if you don’t take a step back and look at the big picture, you can get lost and end up in somewhere completely different. That’s why they tell entrepreneur operators that they need to put on the CEO hat sometimes. When you’re a one person operation, you just put out fires. If you don’t pay attention you’ll forever be putting out fires.