Who doesn’t want some more passive income?

I know I do.

Passive income is the goal.

It is said that millionaires have seven streams of income and I personally believe income streams free you from the shackles of employment.

But passive income can be a little… irregular.

Irregular income isn’t a problem if you know how to handle it, but if you’re building something from scratch, why not build a passive income stream that works for you?

Fortunately, if you are looking to build passive income through dividends, there’s a way to structure it so you get a monthly payment.

For this, you can employ two (or both) strategies:

- Invest in dividend stocks that pay out monthly

- Invest in three sets of companies that pay out quarterly

Get 15 free stocks from Moomoo

Before you do anything else, sign up for a free brokerage account at Moomoo and get up to 15 free stocks based on how much you deposit.

- Deposit $100, get 5 free stocks (worth $2 – $2,000 each)

- Deposit $1,000, get 10 additional stocks (worth $2 – $2,000 each)

Moomoo is a commission-free brokerage regulated by the U.S. Securities and Exchange Commission. There are no monthly fees and the only requirement is that you keep your funds there for 60 days.

Table of Contents

Monthly Dividend Payers

I’m not a huge fan of this approach because most monthly dividend payers represent the same asset class – they’re often Real Estate Investment Trusts (REITs).

I have nothing against REITs but putting your monthly income in one basket feels a little too concentrated for my tastes. If this is an approach you like, or you want to put a percentage of your holdings into REITs, by all means.

It’s hard to say which are the best REITs out there, and many websites claim to know so you can do some googling, but one company worth taking a closer look is Realty Income Corporation (O). They pay on a monthly basis and often invest in single tenant properties (much like crowdfunding real estate investment platform Rich Uncles)

If you’re thinking about going with a mutual fund REIT, like the Vanguard Real Estate Index Fund (VGSLX), just check the distribution schedule. Many REITs pay out monthly but many REIT funds pay out on a quarterly schedule.

Establish Your Baseline Schedule

Before you start, you need to look at your holdings and understand what is happening already. You are already receiving dividends from your holdings, even if you aren’t sure when they happen. If you own shares of any S&P500 or Total Market index fund, you’re getting dividends.

It can help to enter your holdings into a dividend tracker to facilitate this.

For example, if you owned shares of Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), you received dividends in March, June, September, and December of last year. And the year before. And the year before that. The yield was OK, around 2%, but it’s still something.

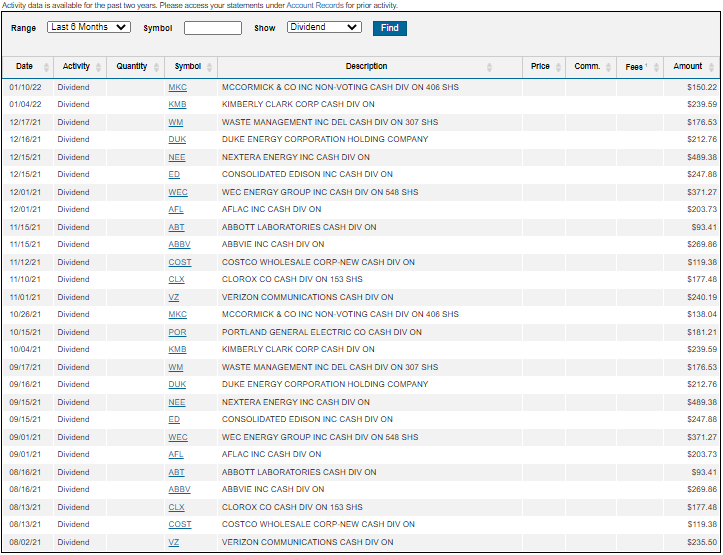

If all your shares are in one place, you can just look at the activity for the last year (the snapshot below is from the last six months) and record who is paying dividends when and for how much.

Just one quick look shows me that I have dividends coming in each month, completely by accident. When I built this dividend portfolio, I was aiming to build a growth dividend portfolio. I wasn’t trying to get monthly checks. But happy accidents happen!

The distributions are not evenly distributed though. I have more in the 2nd and 3rd months of a quarter compared to the first. But I already have a good baseline to work with.

If you look at your distributions, you probably have a similar situation.

From here, you can start filling in the blanks (or filling up the lower months) with some more reliable dividend payers.

What is the Payable Date?

In this article, when I refer to the date that a dividend is “paid,” I mean the “payment date.” The payment date, or payable date, is when the dividend is paid out. The ex-dividend date is what is used to determine which shareholders are entitled to the dividend, so you’ll want to own the stock before the ex-dividend date to get the dividend.

Since we’re building a passive monthly paycheck, we use the payment date.

Also, some companies pay at the start of the month. Some companies pay at the end. I treat all payments within a month as that month, whether it’s closer to the start or the end of a month.

Finally, we looked up the dividend history for each stock and put down what the company has done the last five or six years. Sometimes a company that pays out near the end of the month has the payment slip to the start of the next month. If they are on a quarterly schedule, we put it on that quarterly schedule even if a payment is made in another month.

List of Dividend Aristocrats by Quarter

This post isn’t a recommendation for any particular stock. I want to list a few ideas for you to research in greater detail.

Remember, you are still investing in individual companies, rather than an index or broader market, so you are sensitive to price changes. The idea here is that you’ll hold these stocks for a while and just collect dividend checks. As you analyze these investments, be sure to keep these dividend numbers in mind.

For this list, we’ll go through all the Dividend Aristocrats and organize them based on when they pay their dividends. A Dividend Aristocrat is a company in the S&P 500 index that has paid increasing dividends for at least 25 years. So they have both a reliable history of paying a dividend (25 years uninterrupted!) dividends, but the amount has increased each year.

Within this list is a subset of companies known as Dividend Kings. A dividend king is a company that has paid their dividend for 50+ years. To be labeled a King, you don’t need to increase your payout each year. In the end, if you can pay your dividend for 50 years straight, that’s an accomplishment. I put a 👑 next to the companies who are also dividend kings.

1st Month of the Quarter

These are the companies that pay out in January, April, July, and October.

The following Dividend Aristocrats pay dividends in the first month of a quarter:

- Automatic Data Processing Inc. (ADP)

- Franklin Resources Inc. (BEN)

- Brown Forman Inc Class B (BF.B)

- Cardinal Health Inc. (CAH)

- Cincinnati Financial Corporation (CINF) 👑

- Ecolab Inc. (ECL)

- Fastenal Company (FAST)

- Federal Realty Investment Trust (FRT) 👑

- Genuine Parts Company (GPC) 👑

- Illinois Tool Works Inc. (ITW)

- Kimberly-Clark Corporation (KMB)

Leggett & Platt Incorporated (LEG)– removed in 2022- Medtronic plc. (MDT)

- McCormick & Company Incorporated (MKC)

- Roper Technologies Inc. (ROP)

- Sysco Corporation (SYY)

2nd Month of the Quarter

These are the companies that pay out in February, May, August, and November.

The following Dividend Aristocrats pay dividends in the second month of a quarter:

- AbbVie Inc. (ABBV)

- Abbott Laboratories (ABT)

- A.O. Smith Corporation (AOS)

- Air Products and Chemicals Inc. (APD)

- Cintas Corporation (CTAS)

- Colgate-Palmolive Company (CL) 👑

- Clorox Company (CLX)

- General Dynamics Corporation (GD)

- Hormel Foods Corporation (HRL) 👑

- Kenvue (KVUE)

- Lowe’s Companies Inc. (LOW) 👑

- Nucor Corporation (NUE)

- Procter & Gamble Company (PG)

- Pentair plc. (PNR)

AT&T Inc. (T)– removed in 2022

3rd Month of the Quarter

These are the companies that pay out in March, June, September, and December.

The following Dividend Aristocrats pay dividends in the third month of a quarter:

- Archer-Daniels-Midland Company (ADM)

- AFLAC Incorporated (AFL)

- Becton Dickinson and Company (BDX)

- Chevron Corporation (CVX)

- Dover Corporation (DOV) 👑

- Consolidated Edison Inc. (ED)

- Emerson Electric Company (EMR) 👑

- W.W. Grainger Inc. (GWW)

- Johnson & Johnson (JNJ) 👑

- McDonald’s Corporation (MCD)

- 3M Company (MMM) 👑

- PepsiCo Inc. (PEP)

- PPG Industries Inc. (PPG)

- Sherwin-Williams Company (SHW)

- S&P Global Inc. (SPGI)

- Stanley Black & Decker Inc. (SWK) 👑

- Target Corporation (TGT)

- T. Rowe Price Group Inc. (TROW)

V.F. Corporation (VFC)– removed in 2023Walgreens Boots Alliance Inc. (WBA)– removed in 2024- Exxon Mobil Corporation (XOM)

Non-Quarterly Dividend Schedules

There are a few Dividend Aristocrats that pay out on slightly different schedules.

Walmart Inc. (WMT) pays out in March, May, September and December.

Coca-Cola Company (KO) 👑 pays out in March, May, August, and December.

Dividend Funds

Alternatively, you can turn to a fund, mutual fund or exchange-traded fund, to execute this strategy (or fill in the gaps).

The advantage to using a fund is you diversify your holdings. Rather than a handful of stocks, you get hundreds. It’s also often cheaper (one commission) or even free (mutual funds) on the transaction, though you do pay an expense ratio that you wouldn’t on individual holdings.

One downside is that you also get short term and long term capital gains. A fund adjusts its holdings in response to inflows and outflows of funds, which creates taxable events. With individual stocks, you’re in full control but you lose the instant diversity. The capital gains can be mitigated, somewhat, if you go with an ETF instead of a mutual fund.

If you were to invest in the Vanguard High Dividend Yield ETF (VYM), you would get dividend distributions in March, June, September, and December with an expense ratio of just 0.06%. VYM has a 30-day SEC yield of 2.82% as of this writing.

The Vanguard S&P 500 ETF (VOO) pays out on the same schedule, has a 0.03% expense ratio, and yielded 1.30% as of this writing.

Here are the dividend distribution schedules of a few S&P 500 index funds:

- Vanguard 500 Index Fund (VFINX) – March, June, September, December

- Fidelity 500 Index Fund (FXAIX) – April, July, October, December

- Schwab S&P 500 Index Fund (SWPPX) – December (they make it really hard to find information!)

- T. Rowe Price Equity Index 500 Fund (PREIX) – March, June, September, December

Consider Business Development Companies

As you do your research, you may run into high dividend paying companies that seem a little too good to be true. If they are business development companies, then they are legitimate but they have some caveats.

A business development company, or BDC, is a special type of company that must pay out at least 90% of their income to their shareholders. They will invest in assets that are typically too big for ordinary investors but too small for private equity – these are things like loans to small businesses.

BDCs are closer to REITs than they are your typical dividend payer. When you invest in a publicly traded US company that pays dividends, much of the dividend will be classified as qualified. When Coca-Cola pays you a dividend, it’s qualified as long as you follow your holding rules.

With BDCs, they’re not going to be qualified so you have to take the tax rates into consideration as these are not apples to apples comparisons.

Which Broker Should You Use?

For stocks, I use Ally Invest because they offer commission-free trades and are connected to my bank, which is Ally Bank. This allows me to transfer funds back and forth quickly from one interface, which is convenient.

And, most importantly, there are no maintenance fees. You should not have an account with a brokerage that charges you any kind of maintenance fee.

Fortunately, there are a lot of brokers that offer commission free trades and no maintenance fees. Find one you like and go with it.

For funds, pick the family of funds you like (Vanguard, Fidelity, etc.) and open an account with that brokerage. I have a Vanguard account because I prefer Vanguard funds. They also have no maintenance fee. You can buy and sell shares of their mutual funds and ETFs for free. They also offer many other ETFs for free too.

Enjoy your monthly dividend paycheck!

What are the benefits of letting stock dividends be passive income versus just letting get reinvested into the company?

Well, the main benefit is the cash flow. THe idea behind this approach is that you’re looking to build a monthly paycheck so you want the actual payment. Now, when you say reinvested, there are two different ways the money could be “reinvested.” 1. The company, rather than pay out the dividend, reinvests that month back into the business. If your goal is cash flow, you would prefer the dividend. If your goal is equity growth, it’s better if the company reinvests it if it can find projects that have a return greater than their metrics require, usually determined by… Read more »

Another great column, Jim. If only I weren’t 65 years old already!

Thanks John!

You can still invest in a dividend paycheck! 🙂

I like this strategy a lot. It’s not for everyone, but definitely works in certain situations. I think it’s great for older families, close or in distribution stages, low to medium income, who are risk averse. It’s more about consistent cash flow (esp. with established REITs, Dividend kings/aristocrats and good ole Vanguard dividend funds) and less impacted for market downturns (as dividends will keep getting paid generally even if the stock value drops with the market). Obviously, would highly depend on which stocks/funds to invest in. With this strategy you get a pretty good return 4-6%, relatively low risk, and… Read more »

Jim, great article! I have a vanguard fund, which I receive dividends. But they get reinvested back to the fund, because the fund does not have a significant amount of shares, therefore the dividends paycheck would be relatively small. But I like the idea of getting a dividends paycheck. But my question is, isn’t it tedious when you have to pay tax on the dividends?

You still pay taxes if you reinvest it, you also need to keep track of the cost basis of each of those reinvestments… which I imagine would be far more tedious. 🙂

Hi Jim,

I am looking to create a monthly dividend portfolio that generates like 1K a month with $125K to start. I want to achieve 1200 – 1500 a month in five years. Do you have a portfolio that meets this criterion? I have been trying to build one and have not been successful. Well at least with $125K.

$1,000 a month on a portfolio of $125,000 is unreasonably high – that’s $12,000 a year or close to 10% of your portfolio. That’s impossible to sustain.