Inflation has been incredibly strong the last few years and it’s one of the reasons why interest rates have been so high – the Fed has been combating it for quite some time. And with the latest inflation figures showing that inflation, while slowing down, is still higher than we’d like, it’s a signal that the Fed may keep rates higher for a little bit longer.

Higher rates are bad if you’re a borrower, but they’re great if you’re a saver.

With the latest inflation rates, we can now calculate what we think Series I bond rates will be when they reset in May.

First, if you’re wondering how Series I bonds work, we explain it all after the rate calculation. We start with what the rate is expected to be when adjust in May followed by how Series I bonds work:

Table of Contents

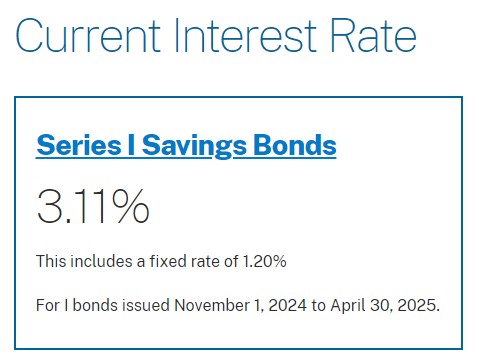

🔃 Updated November 1st 2024 with the official fixed and inflation rates for bonds issued NOvember 1, 2024 through April 30, 2025. In October, we updated this post with the latest inflation data released in October 2024, we can make a prediction for Series I bonds issued in the November 2024 to April 2024 time frame. We predicted that Series I bonds issued in this time frame will yield 1.90% – 3.21% for six months after purchase (this assumes a fixed rate of 1.00% – 1.30%). In reality, the new rate will be 3.11% with a fixed rate of 1.20%.

💸 November 2024 Interest Rate: 3.11%

💡This is no longer a guess, the Treasury has announced the fixed rate on Series I Bonds for the next period will be set to 1.20% so the rate for November 2024 bonds will be 3.11%.

In October, predicted a rate of 1.90% to 3.21% and the range reflects how we didn’t know what they would set as the fixed rate. It turns out that the fixed rate will be 1.20% (lowered by 0.10%) and so the rate for Series I bonds will be 3.11%.

Should you buy Series I bonds at 3.11%? That depends on your situation but with no penalty CD rates available in the 4% range, it’s not a slam dunk deal.

Much of it will depend on your federal tax rate. Series I bonds are taxed at the federal level but not at the state and local level. You also can’t redeem within a year and if you do within 5 years, you lose 3 months of interest. Personally, we won’t be getting any.

😀 November 2024 Interest Rate Prediction: 1.90% – 3.21%

When the U.S. Bureau of Labor Statistics has released the September 2024 CPI report, we knew the CPI-U rose 0.2% in September. This means that the 12 month inflation number was 3.7%.

For those who want to see our math, the March 2024 CPI-U was 312.332 and September 2024 CPI-U was 315.301, for an increase of 0.95% (this is the semi-annual inflate rate). We can use the equation below to guesstimate the interest rate for bonds issued in November 2024 if we assume the fixed rate is 0.00%. (though the bonds issued in May 2024 had a fixed rate of 1.30%).

This means our guess is that the Series I bond might yield 1.90% if the fixed rate were zero.

But, if they kept the same fixed rate (1.30%), the rate would be ~3.21%.

If the fixed rate were 1.00%, the new rate would be 2.90%.

We won’t know the official number for a couple of weeks but those rates are all lower than what you can get with a 12-month CD. In fact, you could go the safe route and pick a no-penalty CD that yields more and close it if you find a higher rate.

What can you do with this information? Series I bonds aren’t really as attractive as they once were. With the one year mandatory hold period and a five year hold to avoid paying a penalty, you’re better off going with a certificate of deposit or a money market fund.

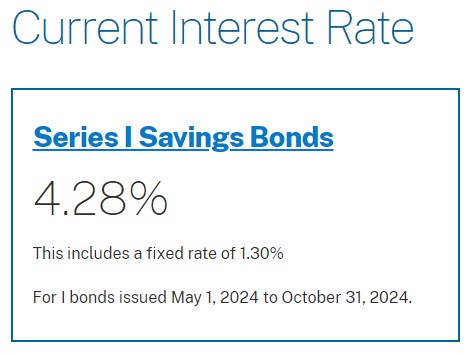

What should you do if you want bonds? If you’re choosing between buying I Bonds in October or buying them in November, with the new (currently unknown) fixed rate, it’s likely better to buy in October. You get six months of a 4.28% rate plus a 1.30% fixed rate on the bond for the life of the bond.

💸 May 2024 Interest Rate: 4.28%

💡This is no longer a guess, the Treasury has announced the fixed rate on Series I Bonds for the next period will be set to 1.30% so the rate for May 2024 bonds will be 4.28%.

The U.S. Bureau of Labor Statistics has released the March 2024 CPI report. CPI-U rose 0.4% in March so the 12 month inflation number is 3.5%.

The September 2023 CPI-U was 307.789 and March 2023 CPI-U was 312.332, for an increase of 1.48% – which is the semiannual inflation rate.

We don’t know what the Treasury department will set as the fixed rate of the bond but experts always look to the yield on short-term TIPS as a guide. Many experts believe that the Treasury will set the fixed portion at 1.30% (same as last time) or slightly higher. If we want to be safe, we can just expand our range on the the yield to be between 1.00% – 1.50%.

Given that range, and the semiannual inflation rate of 1.48%, the new composite rate range would be 3.97% – 4.48%.

If you already hold bonds, you now know what the rates will be whenever your bond’s inflation rate changes.

What can you do with this information? If you’re reading this in March and haven’t yet hit your $10,000 annual limit on Series I bonds, you can buy bonds in May and get the current fixed rate of 1.30% for the next six months. This would put your yield at 5.27% for six months and then drops to 4.27% for the next six months. If you buy them in April, then the rate will depend on the announced fixed rate but we expect it to be 3.97% – 4.48%.

Should you buy them? That depends on your situation but with no penalty CD rates in the same range, it’s iffy. Much of it will depend on your federal tax rate. Series I bonds are taxed at the federal level but not at the state and local level. You also can’t redeem within a year and if you do within 5 years, you lose 3 months of interest. Personally, we won’t be getting any.

Now that we’re past the numbers update – are you wondering how Series I bonds work? Let’s dive in.

What Are Series I Bonds?

Series I Bonds are bonds issued by the United States Treasury that accrue interest for thirty years. That interest income is taxable at the federal level but they are tax free at the state and local level.

The interest rate is adjusted twice a year and is based, in part, on inflation (more that later).

Each person is allowed to buy up to $10,000 in Series I bonds each year, electronically through TreasuryDirect.gov. If you have a tax refund, you’re also allowed to buy an additional $5,000 of bonds using Form 8888. (though this is going away after this year)

Here are step by step instructions on how to buy any Treasury bond or bill.

Tax Considerations

The best part about Series I bonds is that the interest is only taxable at the federal level. Interest is tax free at the state and local level.

While your interest continues to accrue every month, it is only added to the principal every six months. You can elect to report the interest every month but most people, and TreasuryDirect.gov advises that you do this, report it at the end when you decide to cash in the bond. When you cash in your bond, you’ll get a Form 1099-INT.

If you use the interest to pay for higher education expenses, that interest may be excluded from your taxes too.

Finally, you cannot cash in the bond within a year of purchasing it. If you cash it within five years of purchasing it, you lose the previous three months of interest.

How Are Interest Rates Calculated?

The interest rate of the Series I bond has two components – a fixed rate and an inflated adjusted rate.

The fixed rate is set for the life of the bond when you buy it. The fixed rate is announced in May and November.

The inflation adjusted rate depends on the CPI-U, which is an inflation figure released every month by the U.S. Bureau of Labor Statistics. This is the number every refers to when talking about inflation, it’s the Consumer Price Index for all Urban Consumers (hence the -U).

The inflation adjusted rate is set twice a year, in May and November, based on CPI-U data released in April and October. In April, you get inflation from the prior October through March. With that information, you can determine the inflation adjusted rate.

The well-known equation is:

Composite interest rate = Fixed rate + (2 * Semiannual inflation rate) + (Semiannual inflation rate * Fixed rate)

When you buy a bond, you get the inflation adjusted rate at the time of purchase for six months. Then it adjusts to the new rate.

If you purchase a bond in April 2023, you get the rate that was set in November 2022 for six months. Then, you get the rate announced in May 2023 for six months.

One final note on the rate, the inflation rate can be negative but the interest rate on the bonds will be negative. It just gets set to zero.

Interest Compounds Semiannually

The interest on the Series I Bond compounds semiannually, or every six months, based on the issue date of the bond.

So if you buy a bond today, you will earn the interest rate based on how much you purchased. Then, in six months, all that accrued interest is added to the principal of the bond. For the next six months, you earn interest based on the higher amount. And so on.

How To Predict Series I Bond Interest Rates

How are all these experts able to predict the interest rates of future bonds? It’s because the rates are based on inflation and inflation figures are released every month.

You can use the equation above to calculate exactly what the bond will be if you make assumptions about the fixed rate. The fixed rate is announced at the same time and the only part of the equation that is a “guess.” You can simply guess it’s 0% and smile at the bonus if it’s higher.

Historic Series I Bond Interest Rates

TreasuryDirect.gov has been kind enough to share a list of historic Series I bond interest rates dating back to 1998!

| Date the rate was set | Fixed rate | Inflation rate |

|---|---|---|

| May 1, 2023 | 1.30% | 1.48% |

| November 1, 2023 | 1.30% | 1.97% |

| May 1, 2023 | 0.90% | 1.69% |

| November 1, 2022 | 0.40% | 3.24% |

| May 1, 2022 | 0.00% | 4.81% |

| November 1, 2021 | 0.00% | 3.56% |

| May 1, 2021 | 0.00% | 1.77% |

| November 1, 2020 | 0.00% | 0.84% |

| May 1, 2020 | 0.00% | 0.53% |

| November 1, 2019 | 0.20% | 1.01% |

| May 1, 2019 | 0.50% | 0.70% |

| November 1, 2018 | 0.50% | 1.16% |

| May 1, 2018 | 0.30% | 1.11% |

| November 1, 2017 | 0.10% | 1.24% |

| May 1, 2017 | 0.00% | 0.98% |

| November 1, 2016 | 0.00% | 1.38% |

| May 1, 2016 | 0.10% | 0.08% |

| November 1, 2015 | 0.10% | 0.77% |

| May 1, 2015 | 0.00% | -0.80% |

| November 1, 2014 | 0.00% | 0.74% |

| May 1, 2014 | 0.10% | 0.92% |

| November 1, 2013 | 0.20% | 0.59% |

| May 1, 2013 | 0.00% | 0.59% |

| November 1, 2012 | 0.00% | 0.88% |

| May 1, 2012 | 0.00% | 1.10% |

| November 1, 2011 | 0.00% | 1.53% |

| May 1, 2011 | 0.00% | 2.30% |

| November 1, 2010 | 0.00% | 0.37% |

| May 1, 2010 | 0.20% | 0.77% |

As you can see, the inflation rate can sometimes be negative. In May 2015, it was -0.80% with a fixed rate of 0.00% – that just means bonds earned nothing for six months. You lost no money.

When Should You Buy Series I Bonds?

Whenever you want!

The best times to buy the bond is near the end of the month because you get “credit” for that entire month. If you buy it on April 20th, you get all the interest you would’ve accrued for the month of April. It’s a minor bit of optimization but worth noting.

If you plan to also and don’t yet have a TreasuryDirect account, get on it because it’s an old system and it can take a while!

Hello Jim,

Can I invest $10,000 in I bonds for my grandchildren?

If I can — show me how.

Thanks,

Mike Graffeo

Yes you can and Treasury Direct has instructions here – https://www.treasurydirect.gov/indiv/planning/plan_gifts.htm

Can you buy 10K for your kids. (Set up accounts in kid’s name and link to your own bank and purchase under their SSN.)?

I believe you can.