When I think of the name Goldman Sachs, I think of the famed investment bank.

I bet you do too.

During the Great Recession, you heard the name “Goldman Sachs” a lot.

That’s always going to happen whenever there is financial news because they’re one of the biggest investment banks. They have their hands in a lot of different pots.

But Marcus by Goldman Sachs isn’t that company. Technically, they’re part of the same family of companies (they all roll up into Goldman Sachs Group) but Marcus by Goldman Sachs is the banking division operating under Goldman Sachs Bank USA.

Table of Contents

About Goldman Sachs Bank USA

Goldman Sachs Bank USA was created on November 28th, 2008 and has the FDIC # 33124. It’s a Member of the Federal Reserve System and regulated by the Federal Reserve Board. They have six physical locations and are primarily an online bank.

Marcus by Goldman Sachs is named after the founder of Goldman Sachs, Marcus Goldmann. Marcus Goldmann was born in 1821 in Germany and immigrated to the United States in 1848, where he would go on to found Goldman Sachs along with Joseph Sachs.

If you wish to get in contact with them, you can call 1-855-730-7283 – they are open 24/7. There is also chat support if you are a customer, simply log in and you will have access.

Marcus Online Savings Account

You might be surprised to learn this but Marcus by Goldman Sachs only offers three types of accounts:

- An online savings account

- Certificates of deposit accounts, and,

- Unsecured personal loans

They don’t offer a checking account, which also means there is no debit card or ATM card. You can’t access your cash using any kind of card, which is worth noting because many online banks usually offer checking and savings.

The online savings account offers pretty standard stuff. You can earn a 3.90% APY with no minimum balance, no minimum deposit, and there is no monthly maintenance fee. There isn’t a single fee on the Marcus account (and most anything that would get assessed a fee is stopped) except if you close a CD early (early withdrawal fee).

If you’re keeping track at home, you might be wondering how you access your funds? You have to link up an external bank account and transfer your funds there. They let you link up to four external bank accounts, which is smaller than other banks but probably more than you need anyway. If you have more than four other accounts that you need to link up, it might be time to simplify your finances. (having four other external accounts isn’t a lot, but needing to link them up to operate your finances properly might be excessive)

Marcus Certificate of Deposit Accounts

The certificate of deposit accounts have a $500 minimum for each account and the minimum duration is six months. Their maximum length is six years (72 months).

The current APY on a 12-month CD is 4.25% APY. By comparison, Ally Bank’s 12-month CD offers 3.90% APY.

Each CD comes with a 10 Day Rate Guarantee. If you open your account, fund it within 10 days, and the rate increases within that 10-day window, you get the highest published rate on that term. If the rate falls, you still get the highest published rate within that 10-day window.

If you need access to your funds before the CD matures, the early withdrawal penalty is:

- On CD terms of less than 12 months: 90 days of simple interest

- On CD terms of 12 months to 5 years: 270 days of simple interest

- On CD terms of 5+ years: 365 days of simple interest

The early withdrawal penalties are about average for most banks.

As a comparison, the most favorable penalties on early withdrawal are from Ally Bank, which uses this schedule:

- On CD terms of less than 24 months: 60 days of simple interest

- On CD terms of 25 months to 36 months: 90 days of simple interest

- On CD terms of 36 months to 48 months: 120 days of simple interest

- On CD terms of 49+ months: 150 days of simple interest

When the interest rates are similar (and they usually are), I tend to go with the one with the lower withdrawal penalty even though I anticipate never needing it.

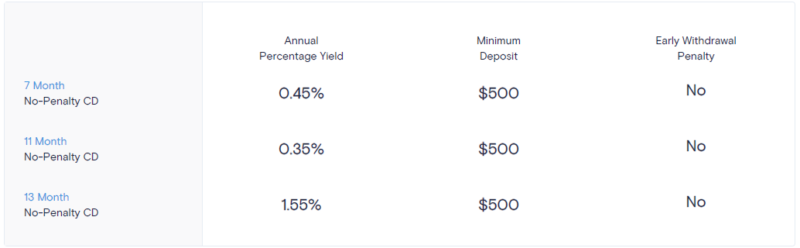

Marcus by Goldman Sachs also offers a No-Penalty CD with a term of 7-months, 11-months, and 13-months. It has the same minimum deposit and typically a slightly lower interest rate.

This screenshot taken on August 8th, 2022 shows you the progression of those rates (use it as a reference as rates change often):

Finally, they recently added Rate Bump CDs. These are CDs that allow you to increase your rate if they offer a higher rate for that term CD during your term. So if you open a 20-month CD and the rate goes up in the next 20 months, you can bump up your rate one time. It has a $500 minimum.

Unsecured Personal Loans

Marcus by Goldman Sachs also offers unsecured personal loans. You can apply for them online and there are no sign-up fees and no prepayment fees.

They offer fixed-rate loans from $3,500 to $40,000 with an APR that currently ranges from 6.99% APR to 28.99% APR, depending on your credit score. The terms of the loans are 36 to 72 months with higher rates for longer-term loans (this is typical).

They offer an on-time payment reward after you make 12 or more consecutive monthly payments in full and on-time. They let you defer one payment without accruing interest or fees. This will extend the term of your loan by one month since you will have not made a monthly payment. Then your payments resume as normal. IF you ever miss a payment or pay late, you’ll never be eligible for the on-time payment reward even if you make 12+ consecutive monthly payments after a miss.

They also do not charge a late fee if you pay late or pay less than your amount due. Your loan just accumulates more interest and your final payment will be larger. If you miss too many payments, you may default on your loan which is a different matter. The loan acts like every other loan except they don’t ding you with a late fee, they just charge you the interest you would’ve owed. This is not typical.

How Does Marcus Compare?

Marcus by Goldman Sachs is as pure an online savings account as you can get.

With no minimums and no fees, it’s on par with many other online banks. It doesn’t have a checking account, which means you can only access your funds by transferring them elsewhere, which makes it difficult to recommend.

I don’t fully understand why Marcus doesn’t offer a checking account.

The rates they offer are about average. The only positive is that they won’t ding you with fees because there aren’t any fees to charge. Here’s how it compares to the American Express Savings account.

Their personal loan offering is a bit more special. With no fees when you pay late and an on-time payment reward (deferring a payment), it comes down to where the interest rate stacks up against some of their competitors. The only way to know that is to make sure you get a rate from them if you need a personal loan.

Overall, I think it’s a fairly light offering from the banking side but an appealing one if you need a personal loan.

I’ve heard that they’re working on adding a checking account, partnering with Marqeta, but you shouldn’t expect a checking account product until later in 2021.