Did you know you may be required to pay tax on part of your child’s unearned income? It’s a provision in the federal tax law commonly referred to as the “kiddie tax.”

But how does the kiddie tax work, and are there ways you can avoid paying it? One thing is certain — if you have children with unearned income, it’s a tax you’ll need to be aware of.

In this article, I’ll explain how the kiddie tax works and provide you with some strategies that may help you reduce the amount owing on your income taxes or help you avoid paying it altogether.

Table of Contents

- What Is the Kiddie Tax?

- How Does the Kiddie Tax Work?

- Who Pays the Kiddie Tax?

- How to Report Your Child’s Unearned Income

- Is There a Way to Avoid the Kiddie Tax?

- Open a Roth IRA for Your Child

- 529 College Savings Plans

- Transfer Money into Non-Income Generating Investments

- Kiddie Tax FAQs

- Final Thoughts on the Kiddie Tax

What Is the Kiddie Tax?

The kiddie tax prevents parents from shifting assets to their children’s names to avoid paying taxes at their own (higher) tax rates. The practice was once common, and it enabled wealthy parents to shift assets to their children and pay tax on the investment income they generated at the (much lower) child’s income tax rate.

The Tax Reform Act of 1986 largely put an end to that practice by requiring a child’s unearned income above a certain threshold to be taxed at the parent’s tax rate. That’s when the kiddie tax was born.

The provision limits the amount of annual unearned income a child can have before he or she will be subject to the parents’ marginal tax rate. The current unearned income threshold for the child for the kiddie tax is $2,600, but that amount is adjusted periodically to account for inflation.

How Does the Kiddie Tax Work?

The kiddie tax applies only to unearned income. That includes income earned from interest, dividends, capital gains, other investment sources, and taxable scholarship income.

The investment income threshold of $2,600 is broken down into two categories. The first $1,300 of unearned income is tax-free to both the child and the parents. The next $1,300 is taxable at the child’s rate.

The parents must report anything above $2,600 and will be subject to their tax rate.

When Does the Kiddie Tax Apply?

The tax may apply if the child meets any of the following qualifications (in addition to the $2,500 income threshold):

- The child was under 18 at the end of the tax year,

- The child was 18 at the end of the tax year and didn’t have earned income that was more than one-half of the child support (in other words, the child qualifies as your dependent for tax purposes), or

- The child was a full-time student, at least 19 years old but under 24 at the end of the tax year, and didn’t have earned income that was more than half of the child’s support.

In addition, at least one of the child’s parents must be alive at the end of the tax year. The child must also file a federal tax return for that year.

✨ Related: Why a 529 is Even Better in 2024

Who Pays the Kiddie Tax?

The tax on unearned income from the child must be reported on the parent’s tax return, subjecting the income to the parent’s federal income tax rate and making it the parent’s responsibility to pay the tax.

Parents can elect to claim the child’s unearned income on their own tax return if certain conditions are met. To do so, they’ll need to file IRS Form 8814 with their tax return to make this election and include the income.

Those conditions include the following:

- The child is under age 19 at the end of the tax year or under age 24 if a full-time student.

- His or her gross income was less than $12,500 for the year.

- The child’s income was derived entirely from interest and dividends.

- No estimated tax payments were made for the child for the tax year, and no tax overpayment from the previous year was applied to the current year under your child’s name and Social Security number.

- No federal income tax was withheld from the child’s income under the backup withholding rules.

- The child must file a return absent this election by the parents.

- The child does not file a joint return for the tax year.

- You are the parent qualified to make the election or file a joint return with your child’s other parent.

If all the above apply, and you choose to include your child’s unearned income on your own tax return, you’ll have that option.

How to Report Your Child’s Unearned Income

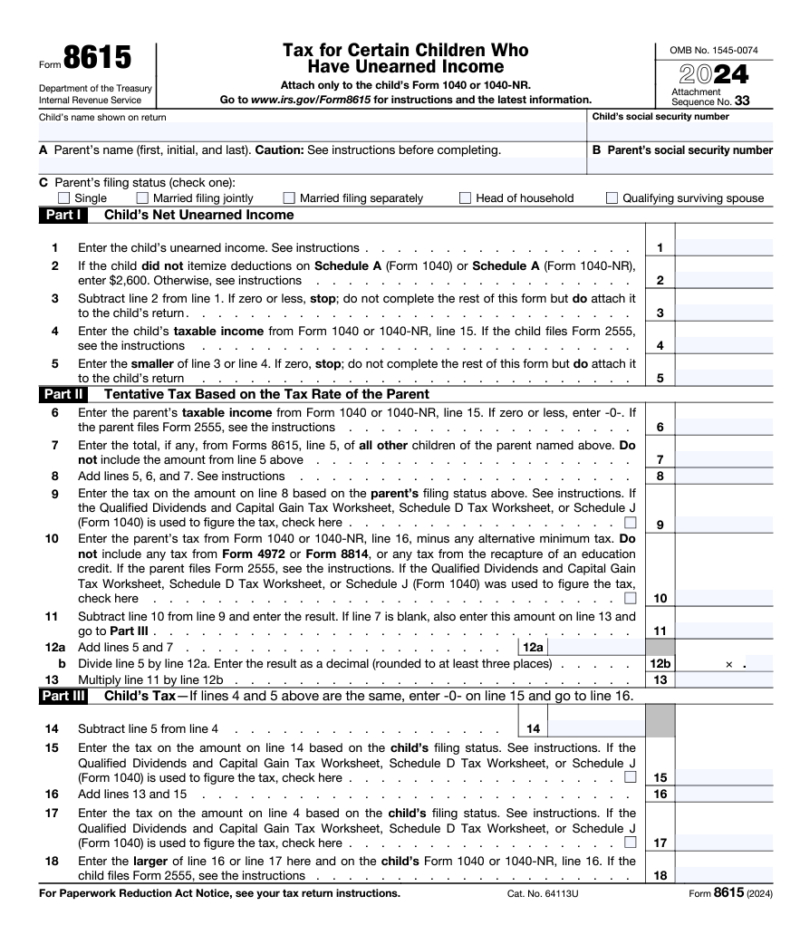

If the kiddie tax does apply to your child, the first $2,500 of his or her unearned income can be reported on the child’s own IRS Form 1040. You’ll then attach IRS Form 8615, Tax for Certain Children Who Have Unearned Income, to your child’s tax return.

Fortunately, you don’t need to know the specific reporting requirements — or the tax computation — if you are using either a professional tax preparer or tax prep software. It’s strongly recommended you take advantage of either if the kiddie tax will apply in your situation.

If you prefer to prepare your taxes yourself, software like TurboTax or H&R Block can make handling the kiddie tax effortless.

Is There a Way to Avoid the Kiddie Tax?

There are ways you can avoid the kiddie tax, but you’ll need to use different strategies for transferring financial assets to your child’s name.

Open a Roth IRA for Your Child

If your child does have earned income, he or she can qualify for a Roth IRA account. (The child can also qualify for a traditional IRA but probably won’t need the tax break it will provide and other restrictions that come with it.)

Roth IRAs have many advantages. For the 2024 tax year, you can contribute up to $7,000 to a Roth IRA for your child. The contribution amount cannot exceed the amount of the child’s earned income. But this is an excellent way to transfer thousands of dollars in wealth to your child and to do it each and every year.

As is the case with a traditional IRA, the investment income earned within the Roth IRA is tax-deferred. In fact, the Roth IRA has the advantage that investment income accumulated within the plan will become tax-free when the account holder reaches age 59 ½ and has had a Roth plan in place for at least five years.

Yet another advantage of a Roth IRA, particularly in the case of a child, is that contributions to the plan can be withdrawn at any time without tax consequences. The IRS even prioritizes withdrawals of contributions over accumulated investment earnings, which makes the process even easier. This can make a Roth IRA a source of additional cash when needed throughout the child’s life.

529 College Savings Plans

529 plans provide a way to transfer money to your child and avoid the kiddie tax, even if your child has no earned income. In fact, 529 college savings plans allow you to transfer the largest amount of funds to your child without tax consequences.

First and foremost, 529 plans are designed to enable parents and grandparents to fund a child’s education. There are no income restrictions for contributors, and contributions aren’t limited. However, most donors limit contributions to the amount of the federal gift tax threshold to avoid incurring the gift tax. But you can contribute up to $18,000 for 2024 without triggering the gift tax (other tax strategies are available if you want to make larger contributions).

Once funds are in a 529 plan, investment income is earned tax-free. And as long as funds are withdrawn to pay for the child’s qualified education expenses, there is also no tax on the distributions. (However, withdrawals made for purposes other than education will be subject to the child’s ordinary income tax rate.)

Transfer Money into Non-Income Generating Investments

If a Roth IRA or a 529 plan is not possible or preferred, you can also transfer money to investments that don’t generate regular income. The best example of this is either growth stocks or funds that invest in growth stocks.

Since growth stocks typically do not generate dividend income (or generate very little), money can be held in these stocks or funds for many years. Even as the stock continues to grow in value, no taxes are due until you sell the securities. And when you do, the income will be subject to more favorable long-term capital gains tax rates rather than ordinary income tax rates.

You can’t avoid an eventual tax liability. But it will prevent annual tax liabilities from developing that will affect either you or your child.

Kiddie Tax FAQs

The kiddie tax affects only a child’s unearned income. It doesn’t become a tax issue for the parents unless that unearned income exceeds $2,600. The first $1,300 is tax-free, and then the next $1,300 is taxed at the child’s tax rate. Anything above is taxed at the parent’s rate.

The kiddie tax loophole is actually what the kiddie tax was designed to prevent. It was implemented to prevent parents from shifting investments into their children’s names so that the income generated would be taxed at the child’s (lower) tax rate. The kiddie tax closed that loophole by subjecting a child’s investment earnings above $2,500 to the parent’s tax rate.

The best way to avoid the kiddie tax is by transferring assets into a tax-sheltered investment plan. This can include either a Roth IRA or a 529 plan. Alternatively, money can be invested in long-term growth stocks (the kind that doesn’t pay dividends but offers the prospect of future growth).

Final Thoughts on the Kiddie Tax

The kiddie tax is one of those “gotcha provisions” buried in the tax code. And many people are completely unaware that it exists until their child’s unearned income reaches $2,600. Thankfully, there are options available, like the Roth IRA or 529 college savings plan.

If you notice that your child’s unearned income is approaching the kiddie tax threshold, consider implementing strategies to avoid it entirely.