Your effective tax rate is not your tax bracket but is probably best described as an “average” tax rate pertaining to the federal income taxes you pay.

You are probably already somewhat familiar with the federal tax bracket the IRS uses to determine how much individuals must pay in taxes. The IRS has brackets of income they use to determine how much a filer will pay in taxes. These brackets are based on your income after any deductions.

Your income is not all taxed at the same rate. Instead, different levels of income are taxed at different rates. Taking the average of these rates is your effective tax rate.

Table of Contents

Taxable Income – AGI

First things first, you need to understand what taxable income is. In tax terms, this is called your Adjusted Gross Income, or AGI.

You don’t actually pay income taxes on every dollar you earn. For single filers in 2025, you get a “standard deduction” of $14,600. This means that the first $14,600 you earn is not subject to income tax. (This is for income earned in 2024 and returns filed in 2025.)

For instance, if a non-married person earns $70,000 in 2024 and takes the standard deduction of $14,600, their taxes would be calculated based on $55,400 of income.

There are a lot of other deductions a person could qualify for, but to keep things simple, we’ll assume this taxpayer only qualifies for the standard deduction.

Progressive Tax System

After understanding what your taxable income is, the next piece to understanding “effective tax rate” is the progressive tax system.

This means that different levels of income are taxed at different rates.

Have you ever heard someone complain that if they make more money they will actually get less because they’ll be in a higher tax bracket? That’s simply not true. It’s a common misconception that all your income is taxed at the highest rate.

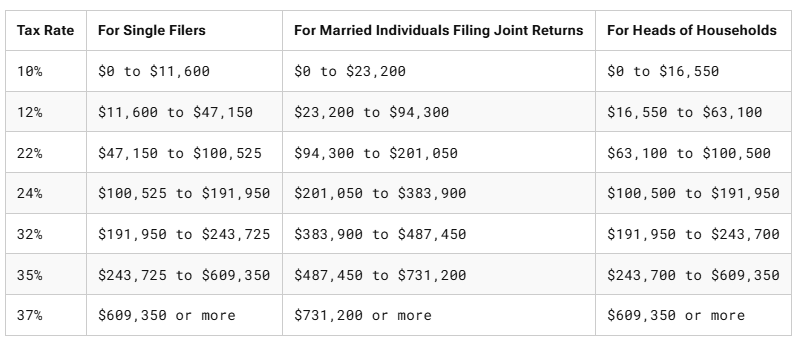

Here are the tax brackets for income earned in 2024.

What this means is that the first $11,600 is taxed at 10%, then from $11,600 to $47,150 is taxed at 12%, and so on.

Let’s use our single filing $70,000 income earner as an example. First, this taxpayer gets their standard deduction of $14,600 bringing their taxable income to $55,400.

Then they would pay federal income taxes as follows:

- $1,160 on the first $11,600 (10% on up to $11,600)

- $4,266 on the next $30,250 (12% for income between $11,600 and $47,150)

- $1,815 on the remaining $8,250 (22% for the income above $47,150)

That would bring this taxpayer’s total federal tax bill down to $7,241. This gives them an “effective tax rate” of 13%. ($7,241/$55,400)

When people talk about their effective tax rate, they’re talking about the average tax rate they pay based on the table above. How would you go about calculating your average (i.e. effective) tax rate?

How to Calculate Your Effective Tax Rate

If you’re interested in calculating your effective tax rate there are a couple of ways to go about it.

First, you can use your latest tax return to calculate your effective tax rate. Just divide the total amount paid by your adjusted gross income. That will give you your effective tax rate. (taxes/AGI = effective tax rate)

Another way to calculate your effective tax rate is by using your current taxable income amount and the current year’s tax table. Start by calculating how much tax you’ll pay for each segment of your income.

For example:

- $1,160 on the first $11,600

- $4,266 on the next $30,250

- $1,815 on the remaining $8,250

Then add up all of those tax amounts and divide them by your adjusted gross income. This will also give you your effective tax rate. Doing it by hand is less accurate than using your actual tax return since doing your taxes will ensure you are taking into account any deductions you would qualify for.

In this example, the total tax due is $7,241. Divide that by the adjusted gross income of $55,400 and you’ve got an effective tax rate of 13.07%.

Effective Tax Rate Applies Only to Income Taxes

It’s important to note that your effective tax rate only takes the federal income taxes you pay into consideration. It doesn’t include state and local taxes, FICA taxes, property taxes, etc.

You could calculate your effective tax rate to include these numbers by adding them into the total taxes paid number and dividing the total by your adjusted gross income. However, they’re not usually included when people refer to the term “effective tax rate.”

How to Calculate a Corporation’s Effective Tax Rate

When it comes to effective tax rates and corporations, the numbers are calculated a bit differently. Corporations calculate their effective corporate tax rate by dividing their pre-tax profit number by the amount of tax they paid.

A corporation’s pre-tax profit is the sum of its total revenue minus operating expenses, depreciation, and paid interest.

Conclusion

Understanding how deductions, progressive taxes, and effective tax rates work will take you a long way towards understanding our tax system.

Now that you know what an effective tax rate is, you can calculate your own effective tax rate. Or you can compare it to previous years’ rates as you use one of the best online tax filing software programs to file your taxes.

Have you ever calculated your effective tax rate?